Gold Price Analysis: XAU/USD making its way towards daily support territory, $1,780

- Spot gold is struggling to make use of risk-averse market conditions on Monday and remains subdued under $1800.

- An on-the-day rise in real yields is the main reason why gold is struggling.

Update: The price of gold, XAU/USD, is down on the New York session by some 0.35% at the time of writing. The price has fallen from a high of $1,804.17 to a low of $1,791.78 so far. Spot trades at $1,792 as it move sin toward what would be expected to be a strong area of support as per the daily chart.'s structure below.

Meanwhile, US stocks are lower in midday trading as the spread of the omicron variant of COVID-19 amid peak holiday travel and a setback for US President Joe Biden's spending plans hit investor sentiment. The S&P 500 slumped 1.7% to 4,540.89, the Nasdaq Composite fell 1.8% to 14,891.14, and the Dow Jones Industrial Average declined 1.8% to 34,725.21.

The Netherlands entered a full lockdown Sunday in an effort to stem omicron's spread, while several other European countries, including the UK, were contemplating similar restrictions before Christmas.

Omicron is now present in 45 of 50 US states, according to data from the US Centers of Disease Control and Prevention.

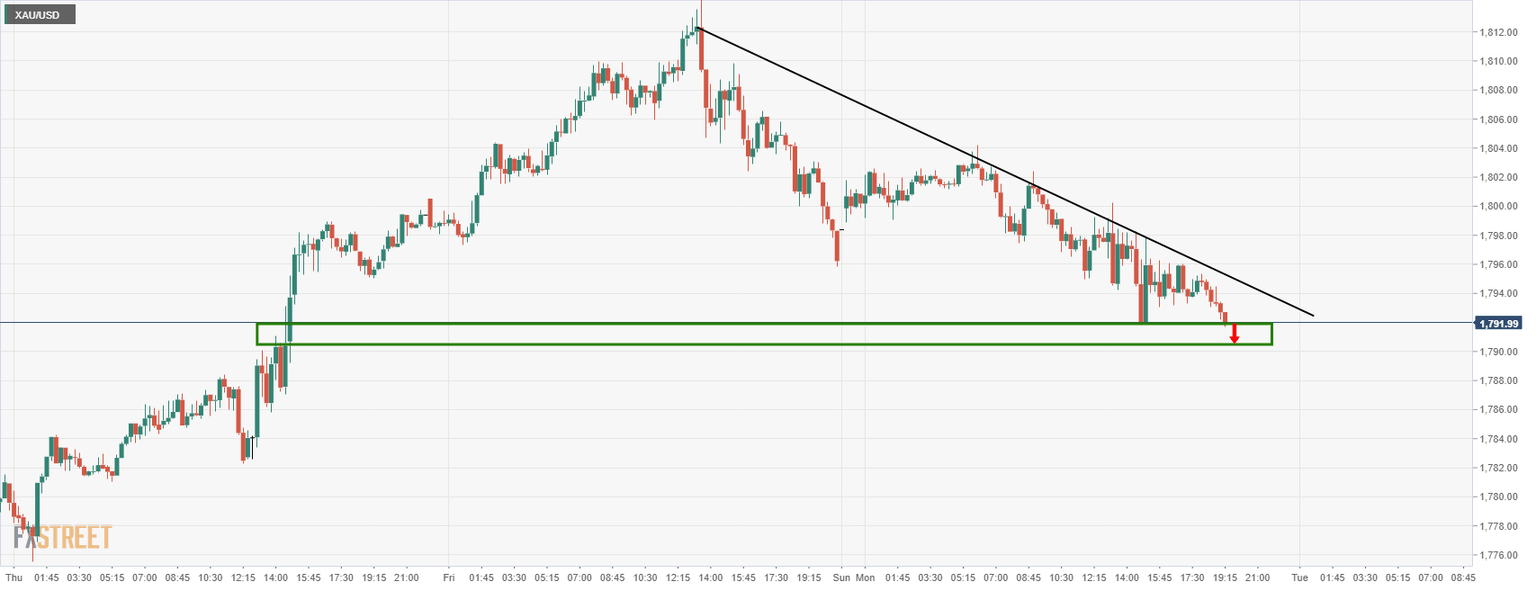

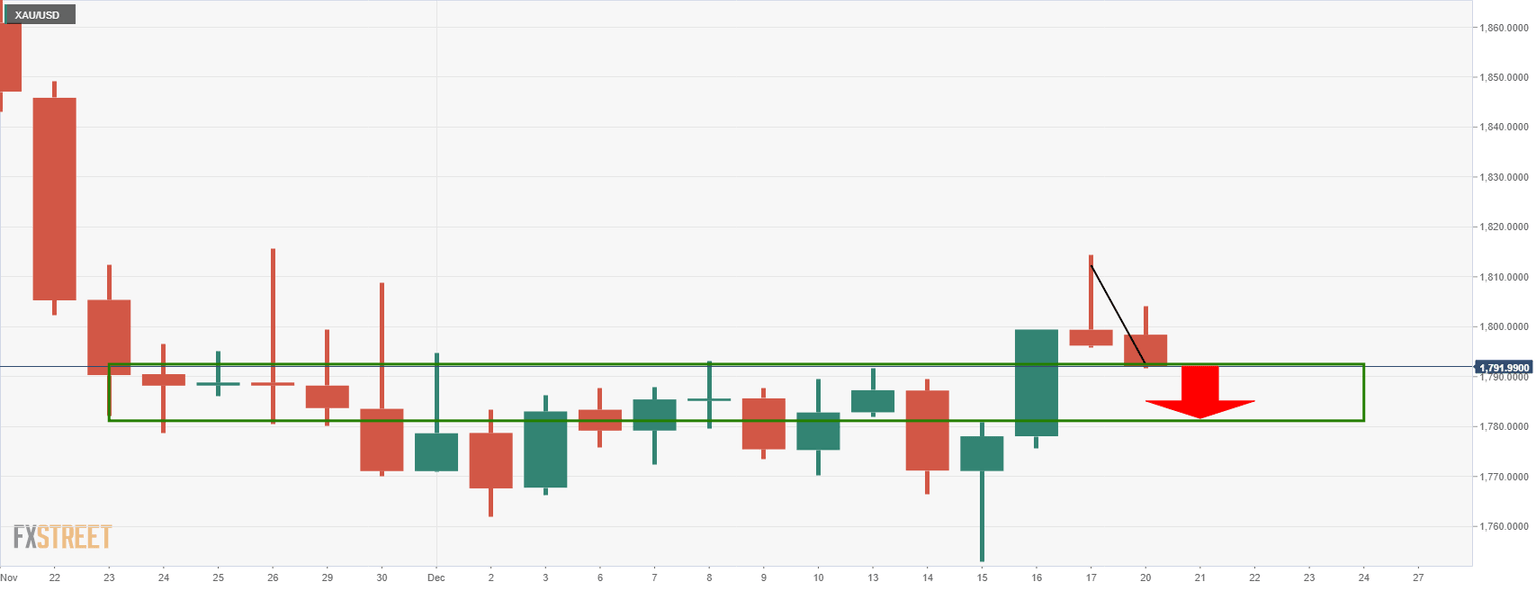

XAU/USD 15-min and daily charts

The price is embarking on the support are on the short term charts with $1,790 guarding the way to $1,780 as per the daily chart's support area:

End of update

Despite a broadly risk-off market tone and an underperforming US dollar, spot gold (XAU/USD) prices are struggling to make headway on Monday. Prices are currently flat on the session but have slipped back from earlier session highs in the $1805 area to current levels around $1797 in recent trade. The 50-day moving average at $1795 provided support earlier in the session, but if this level goes, XAU/USD is likely to slip back to test early/mid-December highs and the 200DMA in the $1790 area.

Gold’s lackluster performance on Monday owes itself to the fact that real yields in the US have been advancing. 10-year TIPS yields, to which gold is very sensitive, are up about 2bps on the day and back to the north of the -1.0% level. But that still leaves the 10-year TIPS yield well within recent late-November/December ranges of about -1.1% to -0.9%. 5-year TIPS yields are current up about 4bps but are also within recent week’s ranges. Whether the most recent rally in real yields can build into a broader move higher is the key question – that of course would be bad for gold. Remember that as real yields rise, the opportunity cost of holding non-yielding gold also rises.

The recent hawkish shift on the Fed has some strategists betting on a move higher in real yields. Recall last week that the Fed doubled the pace of its QE taper, which Fed member Christopher Waller said indicated that the March meeting was live for a rate hike, and recall that the bank pointed to three rate hikes in 2022. Longer-term nominal yields have remained subdued in recent weeks despite this hawkish shift amid concerns for the longer-term outlook for growth. It only takes inflation expectations to fall at a greater rate than long-term growth expectations for this to cause real yields to rise (something a hawkish Fed could trigger). Gold traders should thus be on notice that market conditions could turn increasingly bearish for the precious metal in 2022.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset