Gold futures have remained trading within previous ranges on Tuesday, trapped between $1,900 and $1,915, with the market awaiting the outcome of the US stimulus negotiations.

US House Representative, Nancy Pelosi, who set Tuesday as the deadline to reach an agreement, said she was optimistic about a stimulus deal, although senate republicans have shown their opposition to the spending figures proposed by the democrats, which cast serious doubts about the chances for the legislation to be passed before the Election Day.

How is XAU/USD positioned on the charts?

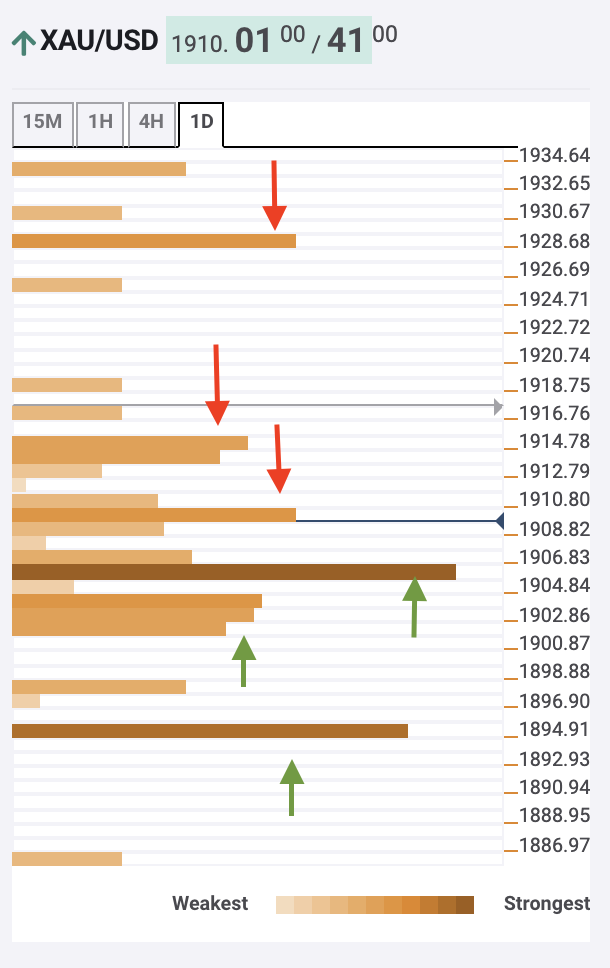

The Technical Confluences Indicator shows the yellow metal trading below a cluster of lines at $1,910, that include previous lows at 15 min and hour charts, 38,2% Fibonacci retracement one day and 5 SMA in 15 min and one-hour charts.

Beyond that level, the precious metal will find $1,9013 with the confluence of the 200-SMA on 4h charts, the Bollinger Band 4h-Upper, and the Fibonacci 38.2% one-day.

Finally, at $1,928 the pair will find pivot point 1-day R2 and pivot point 1-week R1.

On the downside, initial support lies at $1,905, where the 50-SMA in 1-hour charts converges with the 200 SMA in 15M and 5 SMA in 4H plus the Bollinger Band 4H middle and 61.8 Fibonacci 1H.

Below here at $1,901 we find the confluence of 5-SMA on 1D, 100-SMA on 4H and Fibonacci 38,2% 1W.

Finally, at $1,895 gold futures might find support at the 23,6% Fibonacci 1W confluence with pivot point 1 Day S1 and Bollinger Band 1D Middle.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0500 as US Dollar wilts ahead of data

EUR/USD holds its ground and trades in positive territory above 1.0500 on Wednesday. Traders cash in on the US Dollar long positions ahead of a series of top-tier US data, lifting the pair. The USD/JPY sell-off also adds to the US Dollar downside.

GBP/USD holds gains near 1.2600, US PCE data eyed

GBP/USD extends the bullish momentum to trade near 1.2600 in the second half of the day on Wednesday. The pair benefits from a sustained US Dollar weakness but the risk-off sentiment limits the upside as traders turn cautious ahead of top-tier US data releases.

Gold rises toward $2,650 as traders “buy the fact” following news of Lebanon ceasefire

Gold (XAU/USD) recovers into the $2,650s on Wednesday as traders “buy the fact” of the ceasefire deal brokered between Israel and Hezbollah after “the rumor” led to heavy selling on Monday. Market focus shifts to US data releases.

US core PCE inflation set to hold steady, raising doubts on further Federal Reserve rate cut

The United States Bureau of Economic Analysis (BEA) is set to release the Personal Consumption Expenditures (PCE) Price Index data for October on Wednesday at 15:00 GMT.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.