Gold (XAU/USD) consolidates the latest two-day downtrend amid a quiet Asian session on Monday. That said, the yellow metal picks up bids towards refreshing the intraday high around $1,774 while flashing 0.30% gains on a day by the press time.

While the US dollar strength and risk-off mood could be traced for the yellow metal’s earlier south-run, the recent gains seem to take clues from S&P 500 Futures, up 0.40% intraday.

The hopes of US stimulus and economic recovery in Asia, despite the looming coronavirus (COVID-19) in Japan and India, back the risk barometer. However, off in China and Japan, coupled with a light calendar elsewhere, seem to restrict the market moves.

Moving on, US activity numbers for April will be the key as traders will wait for confirmation of the recently strong economics published from the world’s largest economy to extend the market optimism.

Read: US Purchasing Managers’ Index April Manufacturing Preview: Let the good times roll

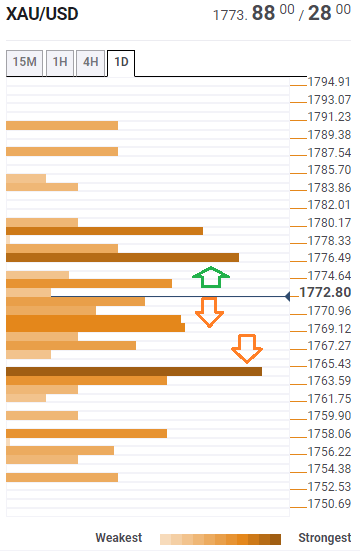

Gold: Key levels to watch

The Technical Confluences Indicator suggests the bulls are tightening the grips above the $1,765-64 support convergence including first support of Pivot Point on the Daily (1D) chart, 23.6% Fibonacci retracement on the weekly (W1) play and previous low of 1D.

While the upward trajectory has legs, backed by the recent risk-on mood, SMA 5 and 23.6% Fibonacci Retracement of monthly 1M chart intersect, around $1,777 becomes a tough nut to crack for the gold bulls.

Even if the bullion buyers manage to cross $1,777, a joint area comprising SMA 10 on daily, SMA 50 on four-hour (4H) and SMA 200 on the hourly chart (1H), not to forget second resistance on the daily Pivot Point, offer an additional filter to the north.

It should, however, be noted that the clear run-up beyond $1,780 will give a free hand to the gold buyers targeting the $1,800 threshold.

Meanwhile, multiple Simple Moving Averages (SMAs) on the short timeframes join Bollinger to highlight the $1,770 as immediate support ahead of the $1,765-64 key levels.

In a case where the bright metal drops below $1,764, an area comprising mid-March tops and late April lows near $1,755-56 will be the key to watch.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. The holiday mood kicked in, keeping action limited across the FX board, while a cautious risk mood helped the US Dollar hold its ground and forced the pair to stretch lower.

GBP/USD approaches 1.2500 on renewed USD strength

GBP/USD loses its traction and trades near 1.2500 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold drops to $2,620 area as US bond yields edge higher

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.