- Spot gold prices are consolidating in the low $1740s, close the 21DMA which currently resides just above $1740.

- Next week, gold’s key drivers will be a bombardment of Fed speak, preliminary Markit PMIs and Core CPE inflation.

Spot gold prices (XAU/USD) are consolidating in the low $1740s, close the 21-day moving average which currently resides just above $1740. Prices have been generally well supported above the $1730 level, amid a lack of any real fundamental drivers throughout the day, as well as relatively subdued price action in FX markets (USD is flat) and bond markets (US 10-year bond yields are flat). On the day, it looks as though gold will close with gains of around a quarter of a percent or roughly $5, which translated into modest gains on the week of around 0.8% or just under $15.

Next week, the key fundamental drivers of gold will be a bombardment of Fed speak, including from Fed Chair Jerome Powell who speaks on three separate occasions, as well as comments from Fed Vice Chairman Richard Clarida and NY Fed President John Williams. US data in the form of the timely preliminary Markit PMI report for the month of March (out on Wednesday) and February Core PCE inflation data (the Fed’s favoured gauge of inflation will also be worth watching. Ultimately, what happens with USD and real yields is likely to determine where gold goes; if both continue to rise, that could spell pain for gold, though if inflation expectations keep surging, this could be supportive.

Technical observations

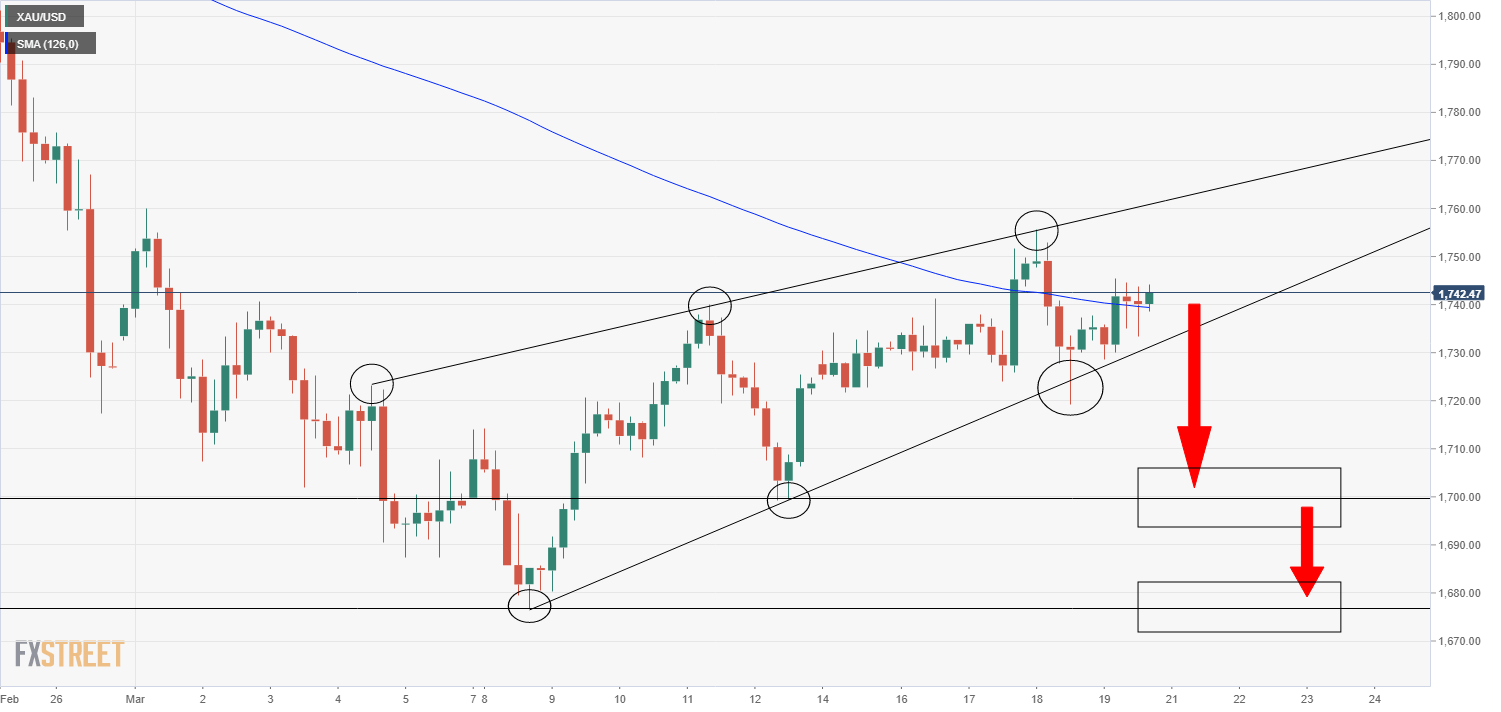

This week’s price action has confirmed that spot gold is consolidating within a bearish flag; to the upside, an uptrend linking the 4, 11 and 18 March highs has been constraining the price action, whilst to the downside, an uptrend linking the 5, 12 and 18 March lows has been supporting the price action. Typically, such structures occur when an asset is consolidating following recent losses, with a break to the downside of the flag acting as the sell signal for further downside – such a sell signal could be triggered by a break below the $1720-$1730 area and could open the door to a drop all the way back towards the psychologically important $1700 level and an eventual drop back to monthly lows around $1680.

XAU/USD four hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stays defensive near 1.1350 as US Dollar looks to stabilize

EUR/USD remains on the back foot for the second consecutive session, trading near 1.1350 in the European trading hours on Tuesday. The pair weakens as the US Dollar attempts to regain stability amid the US-China trade war and growing concerns over US recession. German/ EU data are awaited.

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

Gold price retains its positive bias above $3,200 amid US-China trade war, bearish USD

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair.

XRP resilient amid looming ETF deadlines

Ripple (XRP) flaunted a bullish outlook, trading at $2.1505 at the time of writing on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move, eyeing $3.0000 psychological level.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.