Gold (XAU/USD) is nursing losses after three consecutive days of declines, although remains in a familiar range above $1850. The renewed concerns about a $900 billion COVID-19 relief package could likely keep gold on the back foot. US President Donald Trump asked for an amendment to the pandemic relief package.

However, broad-based US dollar retreat cushions the downside in gold. Brexit deal optimism and disappointing US Consumer Confidence data weigh negatively on the greenback. Pre-Christmas thin trading conditions will continue to play out ahead of the US economic releases.

How is gold positioned on the charts?

Gold Price Chart: Key resistances and supports

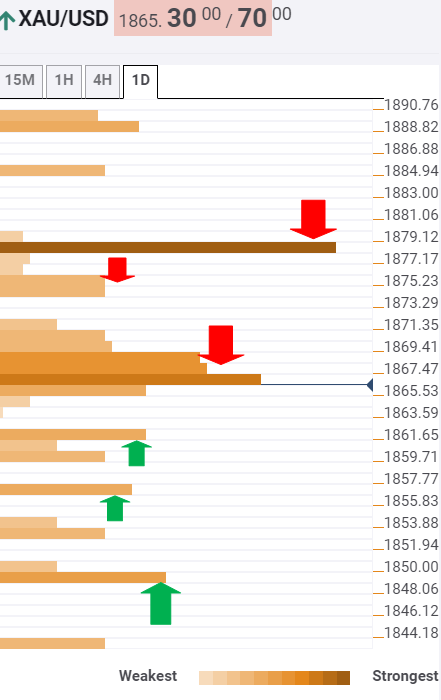

The Technical Confluences Indicator shows that the XAU/USD pair is struggling to overcome a dense cluster of resistance levels stacked up around the $1867-69 region.

That area is the confluence of the Fibonacci 38.2% one-week, SMA5 four-hour and the previous high four-hour.

A firm break above the latter could expose a minor cap at $1874, which is the convergence of the SMA5 one-day and Fibonacci 61.8% one-day.

Up next, the bulls are likely to challenge the critical barrier at $1880, the intersection of the Pivot Point one-day R1, Fibonacci 23.6% one-week and Bollinger Band four-hour Middle.

To the downside, minor support awaits at $1861, where the SMA200 one-hour coincides with SMA50 four-hour and the previous low four-hour.

The SMA10 one-day at $1856 is the next relevant downside target, below which the Pivot Point one-day S1 of $1852 could be probed.

The bears need a break below the $1850 barrier to reviving the bearish bias. The Fibonacci 61.8% one-week is aligned at that level.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD breaks below 1.1300, fresh two-daily lows

The selling pressure on EUR/USD has intensified, prompting the pair to move back below the critical support level at 1.1300 as the US Dollar gains traction on Tuesday. Mixed data from the domestic docket are not helping the Euro either.

GBP/USD trims gains, approaches 1.3200

After reaching fresh six-month peaks near 1.3250, GBP/USD is now coming under renewed selling pressure in response to a decent rebound in the US Dollar and is slipping back toward the 1.3200 support area. Next on tap on the UK docket will be the inflation figures, expected on Wednesday.

Gold stays bid above $3,200

Gold remains on a positive footing on Tuesday, trading slightly above $3,200 per troy ounce and recovering the ground lost at the start of the week. Easing concerns over a deepening global trade rift and a generally improved risk appetite have kept XAU/USD’s gains in check thus far.

XRP, Dogecoin and Mantra traders punished for bullish bets, will altcoins recover?

Altcoins are recovering on Tuesday as the dust settles on US President Donald Trump’s tariff announcements last week. The President has repeatedly changed his mind on several tariff-related concerns, ushering volatility in Bitcoin and altcoin prices.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.