Gold Price Analysis: XAU/USD recovers from session lows, $2,015 is key support

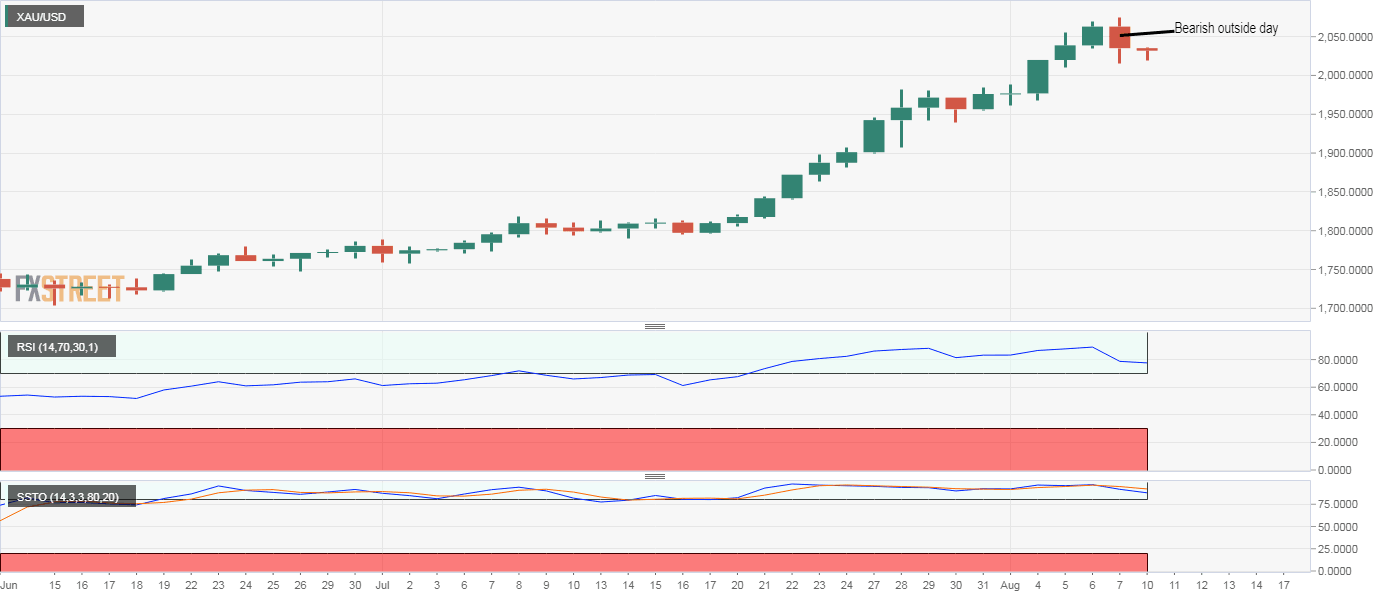

- Gold's daily chart shows early signs of bearish reversal.

- A move below Friday's low of $2,015 would confirm the trend change.

Gold is trading near $2,031 per ounce at press time, having put in a session low of $2,019 early Monday.

The yellow metal created a bearish outside day candle on Friday, as prices clocked a high and low of $2,075 and $2,015, respectively, and ended the day with a 1.39% drop, engulfing Thursday’s price gain.

The bearish outside day is widely taken to represent a bullish-to-bearish trend change when it appears after a notable rally. In this case, the candlestick has appeared at record highs and after a stellar 35% year-to-date gain.

The trend change would be confirmed if the bulls fail to defend Friday’s low of $2,015. As such, Friday’s low is a key support to watch out for this week.

Acceptance under $2,015 would imply an interim top has been made and open the doors for a stronger pullback to $,1981 (resistance-turned-support as per 4-hour chart).

Friday’s bearish candle would be invalidated if prices rise above $2,075. However, with the 14-day relative strength index and slow stochastic reporting overbought conditions, a move below $2,015 looks more likely.

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.