- A combination of factors assisted gold to gain some traction on Wednesday.

- The uptick lacked follow-through and remained capped near 200-hour SMA.

- The set- favours bearish traders and supports prospects for further weakness.

Gold struggled to capitalize on the Asian session bounce from weekly lows and was last seen trading with only modest gains, around the $1730 region.

The prevalent risk-off mood extended some support to the safe-haven XAU/USD. This, along with some follow-through slide in the US Treasury bond yields, further benefitted the non-yielding yellow metal. However, the underlying bullish sentiment around the US dollar capped any meaningful upside for the dollar-denominated commodity.

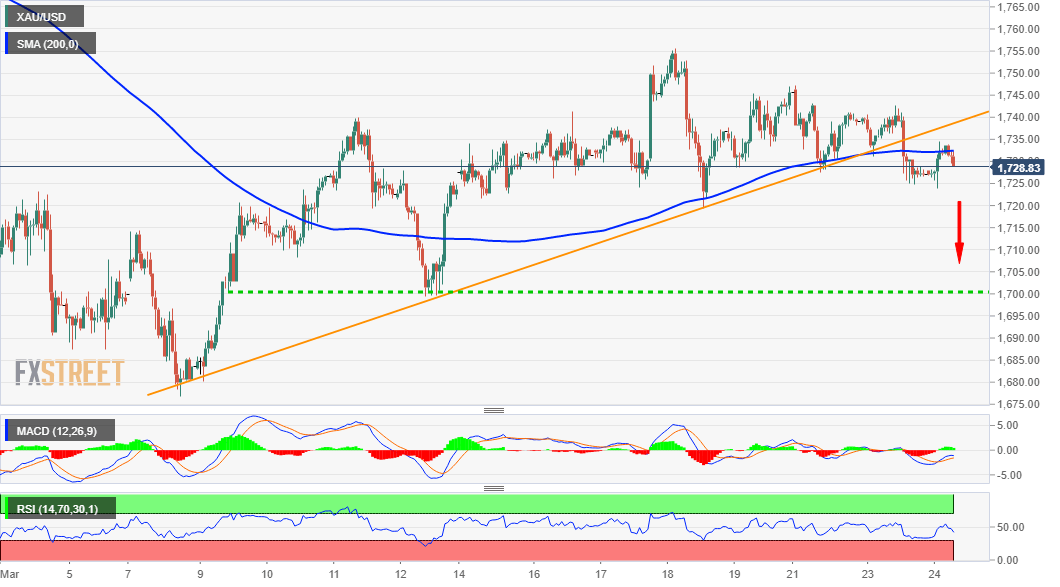

From a technical perspective, the intraday uptick faltered near the $1735 confluence breakpoint and supports prospects for the resumption of the prior downward trajectory. The mentioned region comprised of 200-hour SMA and short-term ascending trend-line extending from the $1677-76 region, or multi-month lows touched on March 8.

Meanwhile, technical indicators on the daily chart maintained their bearish bias and are yet to recover from the negative territory on hourly charts. This further adds credence to the near-term bearish outlook. Hence, a subsequent fall below the $1700 mark, towards retesting multi-month lows, looks a distinct possibility.

Some follow-through selling will be seen as a fresh trigger for bearish traders and set the stage for a slide towards the $1630-25 intermediate support. The XAU/USD could eventually drop to test sub-$16000 levels in the near-term.

On the flip side, the trend-line support breakpoint, now coinciding with the $1740-42 supply zone, should act as immediate resistance. A sustained move beyond might trigger a short-covering move and push the XAU/USD beyond the $1750 level. That said, the positive move might still be seen as a selling opportunity and remain capped near the $1765-60 area.

XAU/USD 1-hourly chart

Technical levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD recovers above 1.0300, markets await comments from Fed officials

EUR/USD gains traction and trades above 1.0300 on Thursday despite mixed German Industrial Production and Eurozone Retail Sales data. Retreating US bond yields limits the USD's gains and allows the pair to hold its ground as market focus shifts to Fedspeak.

GBP/USD rebounds from multi-month lows, trades above 1.2300

GBP/USD erases a portion of its daily gains and trades above 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep a close eye on comments from central bank officials.

Gold climbs to new multi-week high above $2,670

Gold extends its weekly recovery and trades at its highest level since mid-December above $2,670. The benchmark 10-year US Treasury bond yield corrects lower from the multi-month high it touched above 4.7% on Wednesday, helping XAU/USD stretch higher.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.