Gold Price Analysis: XAU/USD needs to crack $1784 resistance to revive the upside – Confluence Detector

Gold (XAU/USD) is back in the red this Tuesday, having failed to sustain at higher levels amid a recovery in the US against its major peers. Markets are turning risk-averse as the Fed begins its two-day monetary policy meeting later today while surging covid cases in emerging economies also underpin the safe-haven US dollar. Meanwhile, the renewed uptick in the US Treasury yields exerts additional downside pressure on the yieldless gold.

Markets look forward to the US CB Consumer Confidence data and corporate earnings report for fresh trading incentives. In the meantime, let’s see how gold’s outlook appears on the technical graphs.

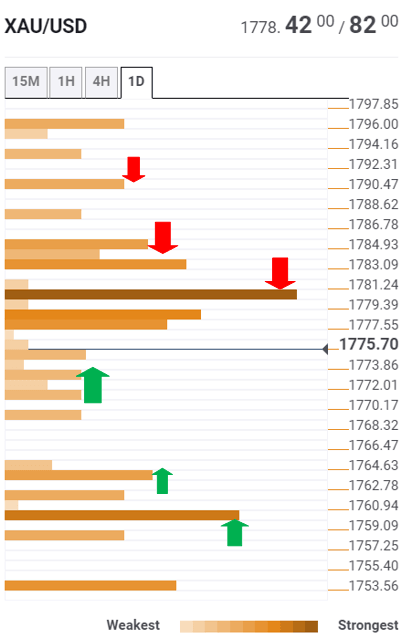

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold holds below a bunch of minor resistance levels around $1777, which caps the immediate upside.

That level is the convergence of the Fibonacci 38.2% one-day and Fibonacci 61.8% one-week.

If the selling pressure intensifies, the spot could meet the demand placed at levels between $1774-$1770, which the confluence zone of the pivot point one-day S1, SMa10 one-day and Fibonacci 61.8% one-day.

The intersection of the previous week low and pivot point one-day S2 at $1764 could emerge as the next relevant downside target.

Alternatively, a break above a dense cluster of upside barrier around $1777 could expose the critical resistance at $1781. At that point, the Fibonacci 23.6% one-day meets with the SMA10 one-hour.

Recapturing that barrier is critical for the bulls to extend their control towards the $1785 region, where the Fibonacci 38.2% one-week, previous day high and SMA5 one-day coincide.

The Fibonacci 23.6% one-week at $1790 could likely challenge the bullish commitments.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.