Gold Price Analysis: XAU/USD needs acceptance above $1870 to unleash further upside – Confluence Detector

Gold (XAU/USD) is poised to extend Monday’s advance, as markets cheer the renewed hopes of a likely US fiscal stimulus deal that has diminished the haven demand for the US dollar. US President Joe Biden said that he had a ‘substantive and productive discussion' with the Republican senators on covid relief.

Further, investors digest the recent retail-trading craze seen in both the commodities and equity markets. Gold’s upside, however, could be limited by growing optimism over the US economic recovery and coronavirus vaccine developments.

Let’s see how gold is positioned technically.

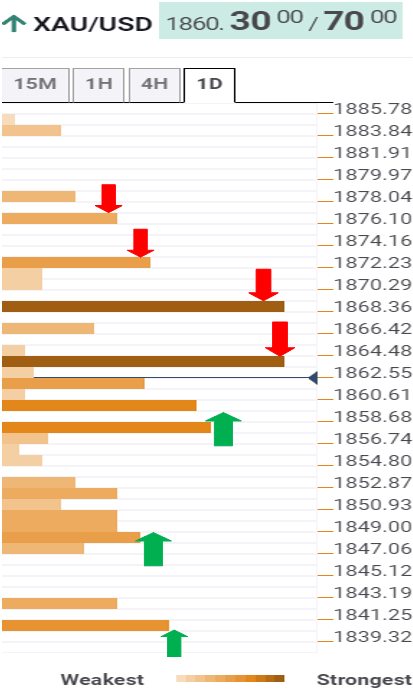

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold’s immediate moves higher are capped by the confluence of the previous high four-hour, Fibonacci 38.2% one-day and one-month at $1864.

The next stop was the bulls is seen at $1870, which is the pivot point one-week R1.

The XAU buyers need to crack the abovementioned barrier to testing the previous day high at $1872. At the level, the pivot point one-day R1 coincides.

Further up, the previous week high of $1875 would be in play. The SMA100 one-day resistance at $1877 could offer strong resistance to the metal.

On the flip side, the immediate downside is likely to be restricted by the Fibonacci 61.8% one-week at $1860, below which the critical resistance now support at $1857 could get tested.

That level is the convergence of the Fibonacci 61.8% one-day, SMA50 one-day and SMA10 four-hour.

The bears could then counter a dense cluster of support levels around $1850/ $1848, which is the intersection of the SMA5 one-day, previous day low, Fibonacci 38.2% one-week and SMA200 one-day.

The next relevant support for the XAU bulls awaits at $1840, the Fibonacci 23.6% one-week.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.