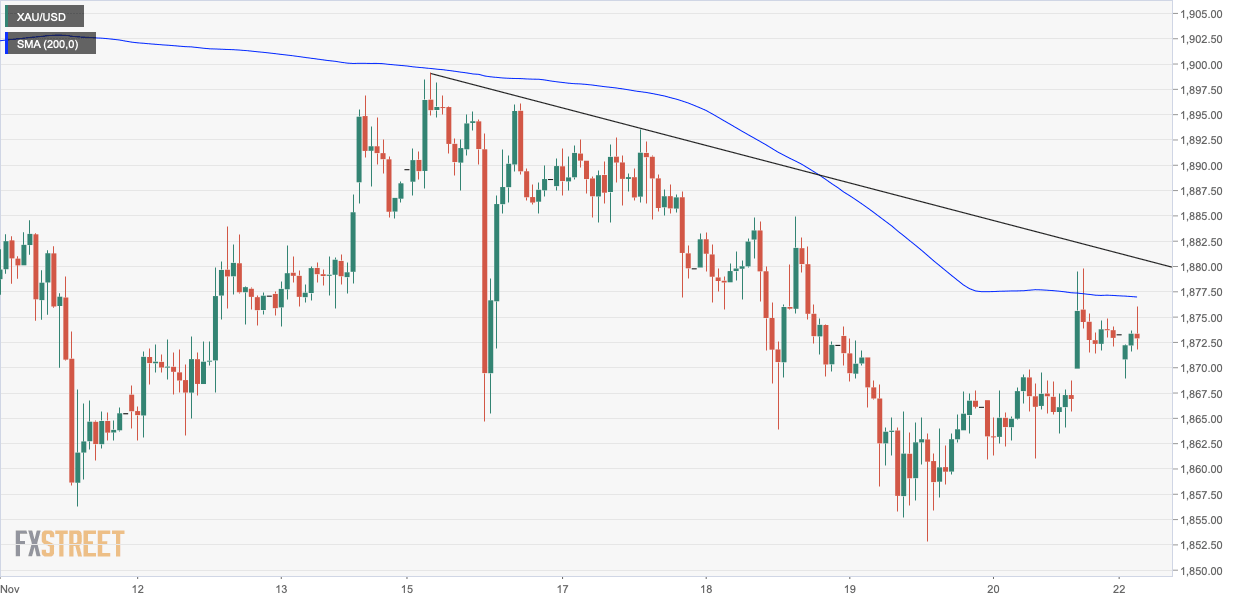

Gold Price Analysis: XAU/USD nears 200-hour SMA

- Gold struggles to cross above the 200-hour SMA hurdle.

- Vaccine optimism keeps haven demand for gold under check.

Gold is currently trading near $1,872 per ounce, having nearly tested the 200-hour Simple Moving Average (SMA) of $1,876 a few minutes before press time. The buyers failed to establish a foothold above that average on Friday.

Despite the latest bounce from the long-held support of $1,850, the immediate bias remains neutral. That's because the hourly chart descending trendline is still intact. A break above that diagonal resistance would open the doors to $1,900.

The odds of a bullish breakout look bleak as prospects of an early rollout of coronavirus vaccines are currently offsetting fears of economic restrictions to control the second wave of the virus, as evidenced by the uptick in the U.S. stock futures. As such, the metal is unlikely to draw strong haven demand.

On the downside, the Asian session low of $1,868 is the level to beat for the bears. A violation there would shift the focus back to the key support at $1,850.

Hourly chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.