Gold (XAU/USD) attempts a bounce after Wednesday’s 2% slide, fuelled by the rally in US Treasury yields and stocks. Prospects of additional US stimulus amid a likely Blue sweep in the Senate revived the reflationary trades and drove the US rates sharply higher while Wall Street to fresh record highs.

Despite the sell-off in gold, the risks remain tilted to the upside amid expectations of more stimulus and growing US political tensions after the attack on Capitol Hill late Wednesday.

How is gold positioned technically?

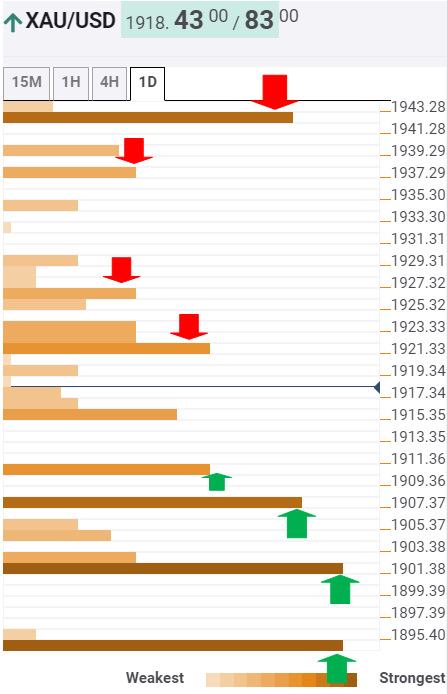

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold lacks healthy resistance levels, making it an easy path for the bulls to extend the recovery momentum.

$1923 is the next relevant upside cap, which is the confluence of the pivot point one-week R2 and SMA5 one-day.

The gold buyers will then look to clear the $1926 (SMA100 one-hour) resistance on its journey towards $1937, which is the Fibonacci 61.8% one-day.

Further north, the intersection of the pivot point one-week R3 and Bollinger Band one-day Upper at 1942 could likely offer strong resistance.

Alternatively, immediate support is seen at $1915, which the Fibonacci 23.6% one-day. A break below which the sellers could probe the pivot point one-week R1 at $1910.

The previous month high at $1908 could challenge the bears’ commitment, as the next powerful support awaits at $1902, the confluence of the previous week high and the previous day low.

The convergence of the Fibonacci 23.6% one-week and SMA100 one-day at $1895 is the last resort for the XAU bulls.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades at yearly lows below 1.0500 ahead of PMI data

EUR/USD stays on the back foot and trades at its lowest level since October 2023 below 1.0500 early Friday, pressured by persistent USD strength. Investors await Manufacturing and Services PMI surveys from the Eurozone, Germany and the US.

GBP/USD falls to six-month lows below 1.2600, eyes on key data releases

GBP/USD extends its losses for the third successive session and trades at a fresh fix-month low below 1.2600. This downside is attributed to the stronger US Dollar (USD) as traders continue to evaluate the Fed's policy outlook following latest data releases and Fedspeak.

Gold rises toward $2,700, hits two-week top

Gold continues to attract haven flows for the fifth consecutive day and rises toward $2,700. XAU/USD continues to benefit from risk-aversion amid intensifying Russia-Ukraine conflict. Investors keep a close eye on geopolitics while waiting for PMI data releases.

Ripple surges to a new yearly high; XRP bulls aim for three-year high of $1.96

Ripple extends its gains by around 10% on Friday, reaching a new year-to-date high of $1.43 and hitting levels not seen since mid-May 2021. The main reasons behind the rally are the announcement that the US SEC's Chair Gary Gensler will resign and the launch in Europe of an XRP ETP by asset management company WisdomTree.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.