Gold Price Analysis: XAU/USD hovers near $1,900, daily chart shows bearish pattern

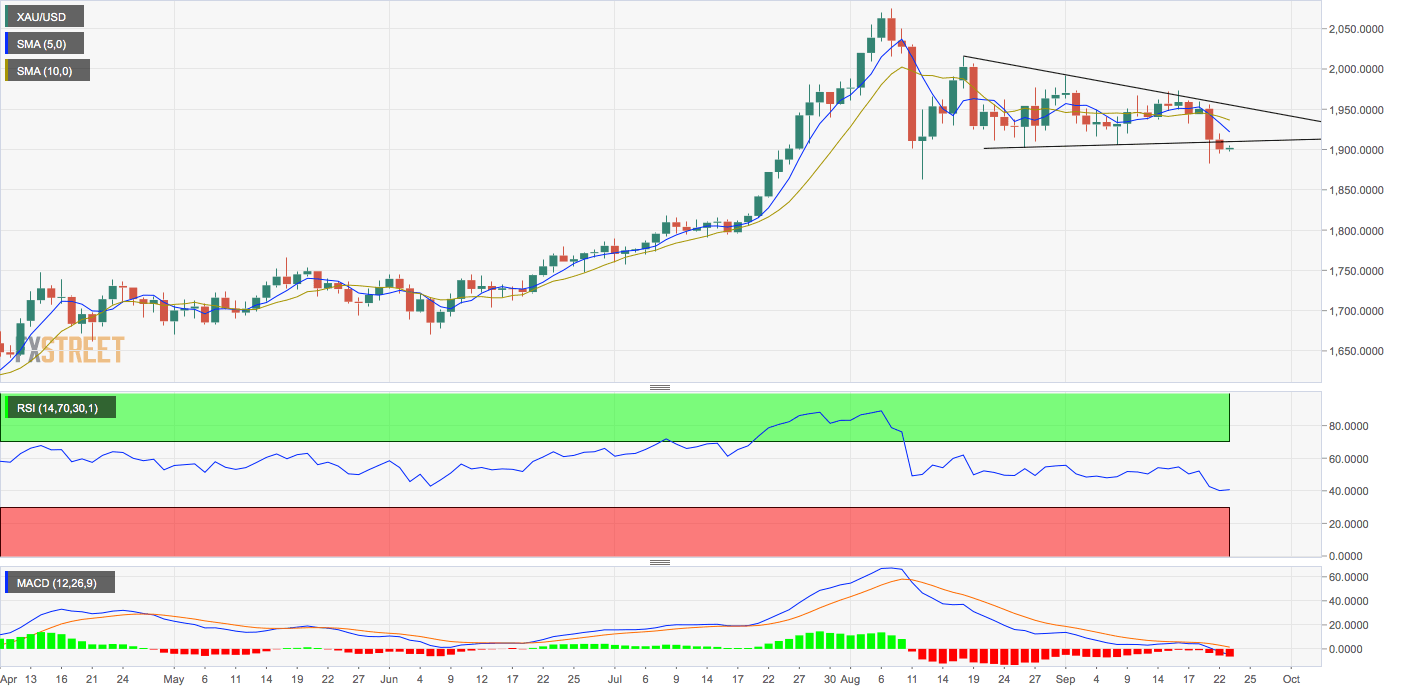

- Gold's daily chart shows a descending triangle breakdown.

- Key indicators have aligned in favor of the bears.

The path of least resistance for gold appears to be on the downside, as the yellow metal's daily chart shows a bearish pattern, and the US dollar is breaking higher from its multi-week trading range.

The metal closed Tuesday with a 0.66% loss at $1,899 per ounce, confirming a downside break of a descending triangle represented by trendline connecting Aug. 18 and Sept. 1 highs and Aug. 26 and Sept. 8 lows.

The triangle breakdown indicates the four-week price consolidation has ended, and the pullback from the Aug. 7 record high of $2,075 has resumed.

The breakdown is backed by a below-50 or bearish reading on the 14-day relative strength index and descending 5- and 10-day simple moving averages.

The MACD histogram is again printing deeper bars below the zero line – a sign of the strengthening of the bearish momentum.

As such, the metal risks falling to the Aug. 12 low of $1,863. A close above the descending 10-day SMA, currently at $1,936, is needed to invalidate the bearish view.

Daily chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.