Gold Price Analysis: XAU/USD hits two-month highs above $1820 as real yields decline

- Spot gold continues to nudge higher as real yields fall and is now above $1820.

- The precious metal is being supported by lower real yields and a weaker US dollar on Monday.

- Remarks from influential Fed member Clarida may have triggered a dovish market reaction.

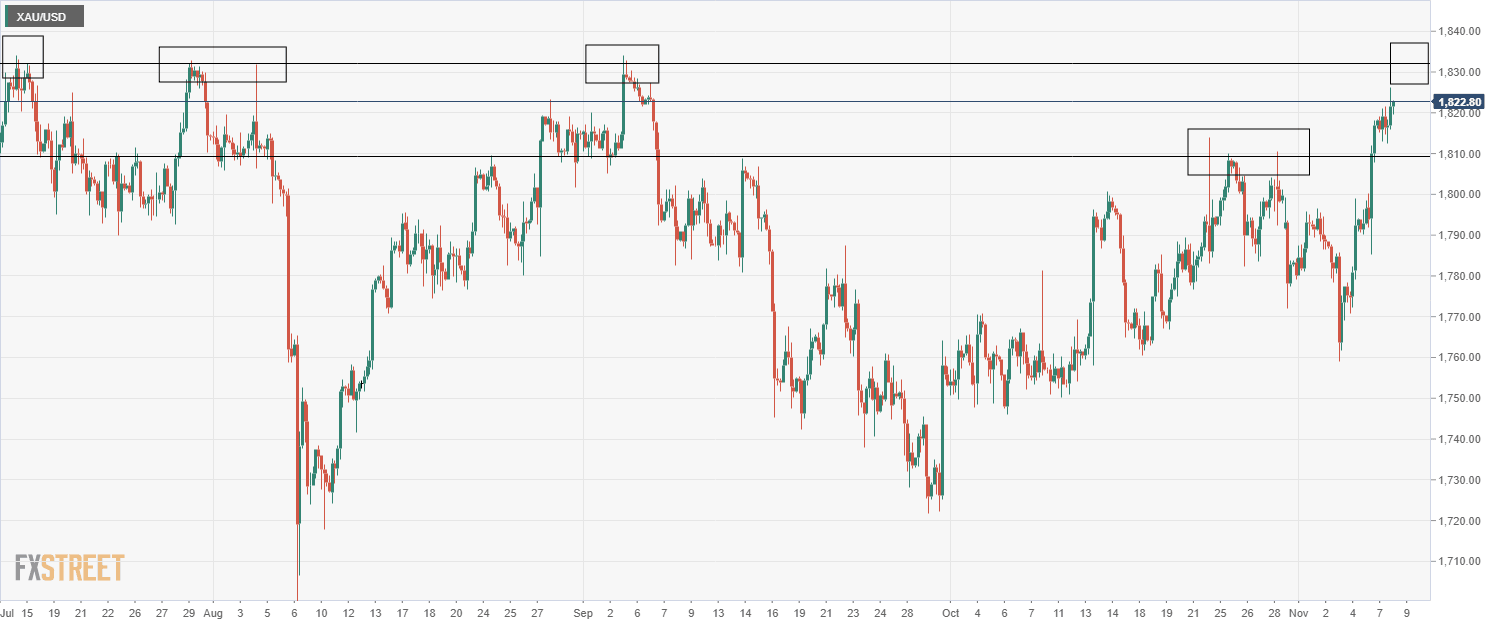

Spot gold (XAU/USD) continues to trade with an upside bias on Monday after breaking above key resistance last Friday in the $1814/oz area. Spot prices surpassed $1820 earlier in the session, the highest level in over two months. Gold bulls will now be eyeing a move back to test resistance in the $1830s, an area that spot prices tried and failed to break above on between July and early September. To the downside, there is support in the form of the October highs around $1810.

Falling Real Yields

US real yields, which saw a sharp fall last week, continue to head lower on Monday, with the 10-year TIPS yields down roughly 2bps on the session and back below -1.10%. Gold has a negative correlation to real yields; as real yields decline, this reduces the opportunity cost for investors in holding non-yielding precious metals, thus boosting their appeal. The fact that US inflation expectations are moving higher may also be helping gold given its reputation as an inflation hedge. 10-year break-evens are up about 6bps to 2.58% on Monday and showing signs that a move back towards recent multi-decade highs close to 2.7% could be on the table.

Weaker Dollar

A weakening US dollar is also giving dollar-denomination spot gold a helping hand on Monday. The Dollar Index has weakened by about 0.3% on the session and has fallen back to test the 94.00 level. A weaker USD makes spot gold cheaper for global buyers, thus increasing its demand.

Influential Fed member and Vice Chairman of the FOMC Richard Clarida spoke earlier in the session and his comments were more dovish than many might have expected; he said the conditions for a rate hike could be met by the end of 2022 and the Fed is still some way from considering rate lift-off. USD STIR markets currently price a hike by September 2022, thus Clarida’s remarks may be interpreted by some as dovish pushback against the market’s pricing. This may have contributed to USD underperformance on Monday and may, thus, be helping gold.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset