Gold prices have fallen off their highs, cooling down as fiscal stimulus talks have yet to reach the final line. While both Republicans and Democrats are reporting progress, time is running out toward the elections and it is unclear if lawmakers would opt to pass legislation during the "lame duck" period.

The precious metal was rising on hopes for a multi-trillion dollar injection of funds from the federal government. Moreover, the market mood dampened after US security authorities said that Iran and Russia obtained voter registration files and are threatening people ahead of Election Day. Concerns about foreign interference may contribute to a contested election and no new stimulus.

How is XAU/USD positioned after these developments?

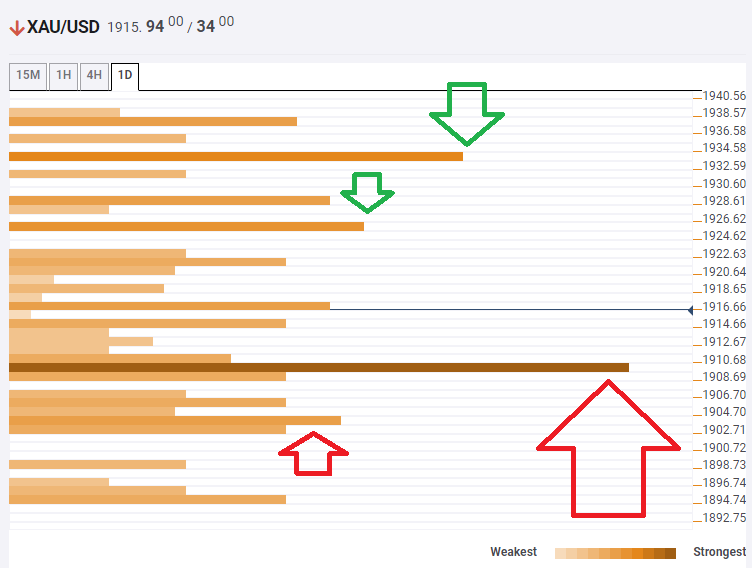

The Technical Confluences Indicator is showing that gold has robust support at $1,909, which is the convergence of the Simple Moving Average 200-1h and the SAM 5-one-day.

Below this critical line, an additional cushion awaits at $1,903, which is where the Fibonacci 38.2% one-month and the Fibonacci 38.2% one-week meet up.

Looking up, resistance is at $1,925, the confluence of the 50-day SMA, and the Fibonacci 23.6% one-day.

Further above, $1,923 serves as an upside target. It is where the Bollinger Band one-day Upper and the previous week's high converge.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD faces the next hurdle at 0.6400

AUD/USD rose markedly and approached the key 0.6400 hurdle at the beginning of the week, always in response to rising weakness in the US Dollar and hopes of fresh stimulus in China.

EUR/USD keeps the upside target at 1.1000

EUR/USD extended further Friday’s recovery and traded at shouting distance from the YTD peaks near 1.0950 in response to increased selling pressure in the Greenback and the improved political scenario in Germany.

Gold consolidates around $3,000 ahead of Fed

Gold prices has started the week on a positive tone and maintains their trade around the key $3,000 mark per troy ounce on the back of the modest pullback in the Greenback and mixed US yields across the curve,

Outflows in crypto funds reach $6.4 billion over five weeks amid long-term holder accumulation

Crypto exchange-traded funds extended their outflow streak last week, totaling $1.7 billion, bringing the total outflows in the past 5 weeks to $6.4 billion, per CoinShares weekly report on Monday.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Fed.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.