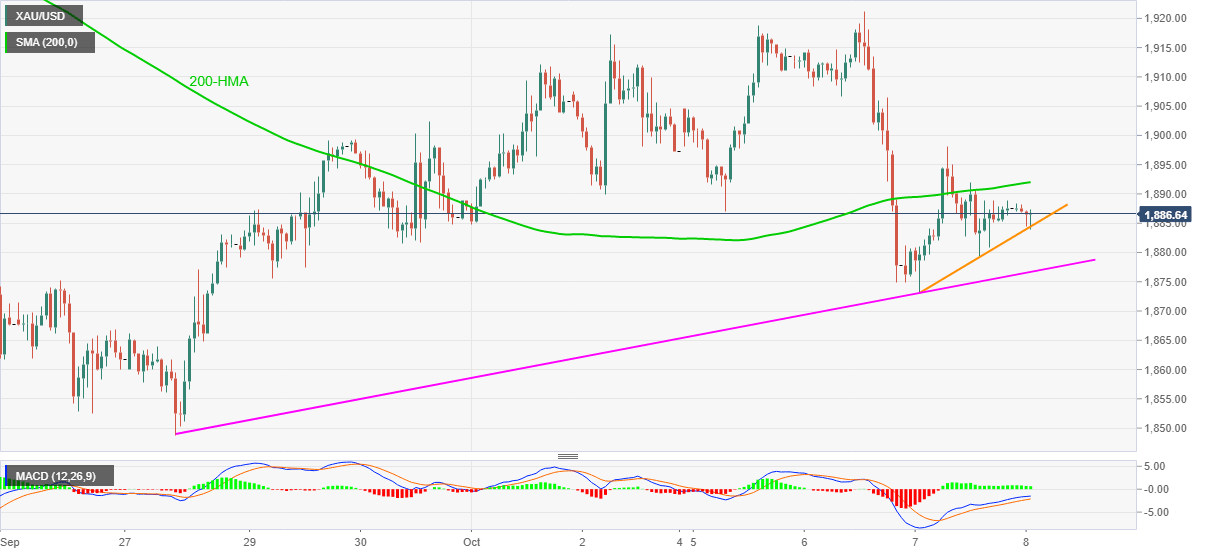

Gold Price Analysis: XAU/USD flirts with immediate support line around $1,885 amid Pence-Harris faceoff

- Gold prints mild losses following a U-turn from $1,887.56.

- Sustained trading below 200-HMA directs the bullion to an ascending trend line from September 28.

Gold prices drop to $1,886.46, down 0.06% intraday, amid the early Thursday’s trading. The bullion recently gained momentum as the US Vice Presidential Debate helped the US dollar while also defending the market’s risk-tone.

Follow updates here: VP debate could raise chances of a contested election and weigh on markets – Live coverage

In doing so, the yellow metal attacks an upward sloping trend line from Wednesday while staying below 200-HMA. As a result, sellers are likely to eye an eight-day-old support line, at $1,876 now, during the further declines.

In a case where the sellers dominate past-$1,876, the monthly bottom close to $1,873 will be a halt before challenging the late-September low near $1,848/49.

On the flip side, gold buyers need to cross the 200-HMA level of $1,892 with eyes on the $1,900 threshold.

Also acting as the key upside barrier is the monthly peak surrounding $1,921 that holds the gate for the metal’s run-up towards the mid-September high of $1,973.64.

Gold hourly chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.