Gold Price Analysis: XAU/USD is lacking direction into the FOMC minutes

- Spot gold found good support in the $1850 area and has advanced on Wednesday in the run-up to Fed minutes.

- Geopolitical angst regarding Russia/Ukraine remains elevated, underpinning gold, which is also being supported by technical factors.

Update: The price of the yellow metal is going and froing between the day's range of $1,850 and $1,870 but threatens a breakout to the top side ahead of the Federal Open Market Committee minutes. However, gold bulls are unlikely to find any fuel from those if they are as hawkish as the markets expected them to be. Bets on front-loaded Fed tightening should help to limit any further losses in the greenback that has otherwise suffered a bout of risk-on in financial markets. This is down to the market's perception that there is less of an imminent threat of a Russian invasion of Ukraine that had been touted in the media to happen today.

On the contrary, Russia had said it had pulled troops away from the border of Ukraine, but there is no Western or Ukrainian intelligence on this. This leaves markets on edge. The White House press secretary Psaki has said that there is still in window where an attack could come at any time by Russia and one that could be preceded by a false flag, and misinformation as a pretext.

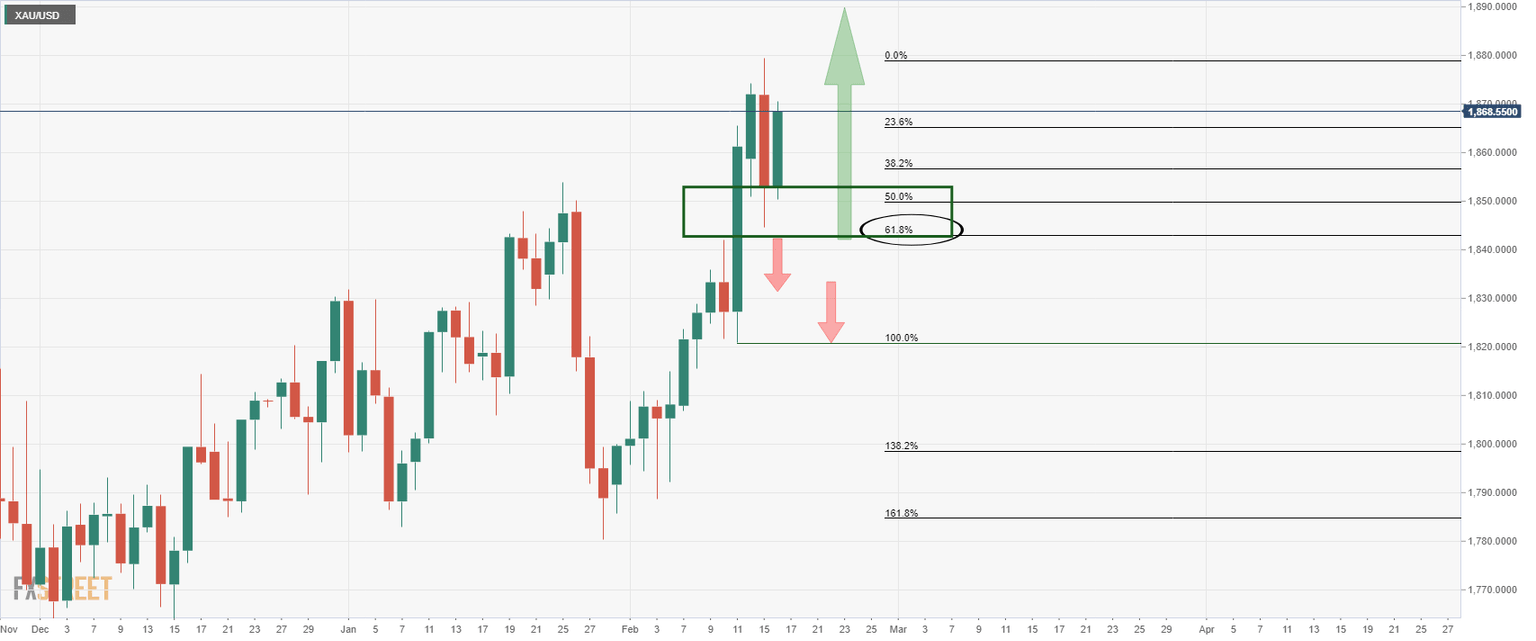

XAU/USD daily chart

The markets will now scan the minutes of the January FOMC meeting looking for evidence of support for an aggressive start in the tightening cycle. As such, the US dollar could derive ongoing support for the rest of the week on such an outcome, potentially capping progress of gold prices towards these daily highs and resistance near $1,880.

End of update

World stocks edged lower while oil and gold rose on Wednesday with markets seeking signs of de-escalation after NATO and the United States said they have not seen Russia pull back troops from Ukraine's borders.

Stronger-than-expected U.S. retail sales data and higher inflation readings from Canada and the UK provided the Federal Reserve with more reasons to tighten policy, but geopolitical tensions kept markets focused on the Ukraine crisis.

NATO questioned Moscow's stated willingness to negotiate a solution to the crisis, one of the deepest in East-West relations in decades and accused Russia of increasing its massive military build-up surrounding Ukraine.

U.S. Secretary of State Antony Blinken backed the assessment, an outlook that lifted the price of safe-haven gold and boosted crude oil, supply of which would be further constrained by an invasion.

As US/NATO officials continue to question the veracity of Russian claims that the country is now withdrawing troops from its border with Ukraine, markets remain nervous about the prospect of a flare-up in military tensions in the region. This is helping to keep spot gold (XAU/USD) prices supported above key support at the $1850 level. At current levels in the mid-$1860s, XAU/USD is trading with on-the-day gains of about 0.5%, unfazed by the latest US Retail Sales figures, which were much stronger than expected for January, though also saw hefty negative revisions to the December numbers.

As gold traders keep one eye on geopolitical developments in Eastern Europe, focus is increasingly shifting towards Wednesday’s release of the minutes from the January Fed policy meeting. Fed Chair Jerome Powell refused to rule out the possibility of a larger 25bps rate hike in March. In wake of recent Consumer and Producer Price Inflation data surprises as well as hawkish comments from some Fed policymakers (like James Bullard), US money markets have been increasingly leaning towards a 50bps move next month. The minutes will thus be scrutinised for any indications as to FOMC support for a larger 50bps rate hike.

The fact XAU/USD found solid support at the $1850 level on Wednesday is positive from a technical perspective. The precious metal recently broke to the north of a long-term pennant structure and in finding support at $1850, XAU/USD found support at the retest of the pennant. Technicians might thus now view a move back to multi-month highs in the $1880 area as highly likely and perhaps even a push on towards mid-2021 highs in the $1920 area. Should the geopolitical situation in Eastern Europe further soar, that would lend fundamental impetus to such a move.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset

-637806206434059826.png&w=1536&q=95)