Gold Price Analysis: XAU/USD fails to hold $2,080, slips back on US data concerns

- Spot Gold bids eased back to near-term median prices after US data missed the mark.

- Equities and commodities shed weight after US PMI figures flubbed expectations.

- Money markets are beginning to walk back rate cut expectations.

XAU/USD fell short of the $2,080 price level, reversing course and slipping back towards $2,050 as risk appetite soured on continuing misses in US economic data.

The US S&P Global Manufacturing Purchasing Managers’ Index (PMI) for December fell below investor expectations on Tuesday, slipping to a four-month low of 47.9 versus the forecast steady print of 48.2 from November.

Market appetite twisted on the data misprint, and investors are beginning to soften expectations of rate cuts from the US Federal Reserve (Fed), with median market expectations pricing in around 150 basis points in rate cuts through the end of the year. This stands in sharp contrast to the Fed’s own dot plot of rate expectations, which currently see at most 75 basis points in rate cuts through 2024.

Market sentiment is set to roil this week as 2024’s first US Nonfarm Payroll (NFP) print is slated for Friday. December’s NFP is expected to show US jobs additions easing back slightly from 199K to 168K.

NFP watchers will have to survive the midweek hump, with ISM Manufacturing and the Fed’s latest Meeting Minutes releasing on Wednesday, followed by Thursday’s ADP Employment Change and Initial Jobless Claims for the week ending December 29.

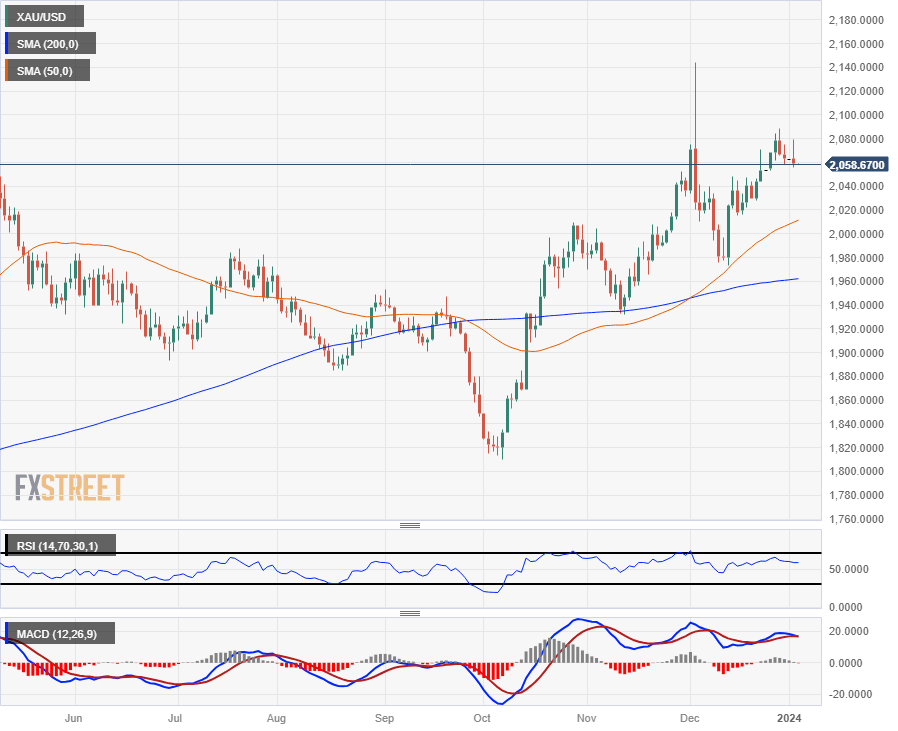

XAU/USD Technical Outlook

Intraday action in Spot Gold has the XAU/USD dipping into the 200-hour Simple Moving Average (SMA) near $2,060, with near-term bids capped off by the 50-hour SMA descending below $2,070.

On the daily candlesticks, XAU/USD remains on the high side, but the bottom is opening up as Gold bugs continue to struggle to hoist Spot Gold back into early December’s rally into all-time-highs near $2,140.

Prices remain well-bid above the 200-day SMA near $1,960, and the near-term price floor sits at the 50-day SMA just north of the $2,000 major price handle.

XAU/USD Hourly Chart

XAU/USD Daily Chart

XAU/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.