Gold Price Analysis: XAU/USD eyes key $1831 support after benign Fed – Confluence Detector

Gold (XAU/USD) wavers below $1850, consolidating the Fed-led downside, as traders await the US Q4 advance GDP release for a fresh direction.

Gold lost ground once again on Wednesday after the Fed left its key rates unchanged while maintaining the current bond-buying at $120 billion per month. Benign Fed and mounting tensions over the covid surge knocked-of the stocks and boosted the safe-haven demand for the US dollar.

Let’s take a look at the key technical levels for trading gold in the day ahead.

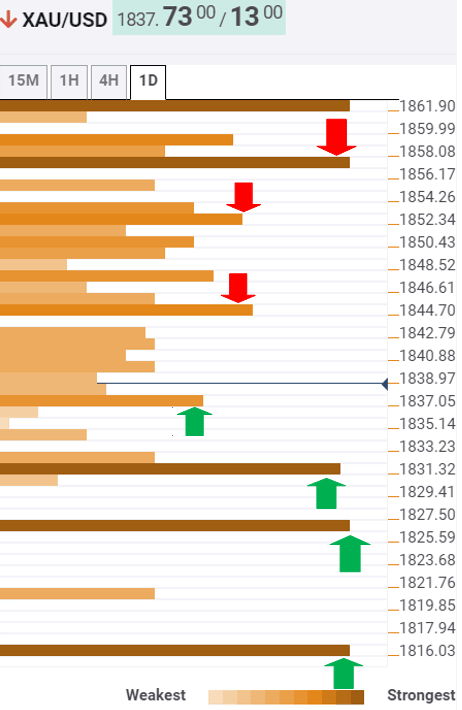

Gold Price Chart: Key resistances and supports

The Technical Confluences Indicator shows that gold is challenging immediate support at $1836, which is the confluence of the previous low one-hour and Fibonacci 23.6% one-day.

The bears need acceptance below the critical $1831 cushion, where the previous low one-day, Fibonacci 61.8% one-week and pivot point one-day S1.

The next downside target is seen at the Fibonacci 61.8% one-month at $1827. A sharp sell-off below the latter cannot be ruled out, exposing powerful support at $1817, the pivot point one-month S1.

Alternatively, the bulls face a dense cluster of resistance levels around $1842, above which the Fibonacci 61.8% one-day at $1845 guards the upside.

Further up, it is likely to be an uphill task for the XAU bulls until the Fibonacci 38.2% one-month at $1857 is scaled on a sustained basis.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.