- Gold price is back in the red amid the resurgent US dollar’s demand.

- Yellen’s optimism lifts the Treasury yields, rescues the greenback.

- Gold Price Forecast: XAU/USD’s upside appears capped below $1900, with all eyes on US CPI

Update: Gold struggled to capitalize on Friday's goodish rebound from the $1,855 region, or three-week lows and edged lower on the first day of a new trading week. The commodity remained depressed heading into the North American session and was last seen trading just above the $1,885 level, down nearly 0.20% for the day.

As investors looked past Friday's softer US jobs report, a goodish pickup in the US Treasury bond yields turned out to be a key factor that exerted some pressure on the non-yielding yellow metal. A disappointing headline NFP print tempered market expectations that the Fed could begin tapering its bond-purchase program. That said, concerns about rising inflationary pressure acted as a tailwind for the US bond yields.

Hence, the focus will remain on Thursday's release of the US consumer inflation figures, which will be another piece of important macro data that would set the tone for the FOMC meeting on June 15-16. In the meantime, investors seemed reluctant to place any aggressive bets amid absent relevant market moving economic releases. Apart from this, a subdued US dollar demand extended some support to dollar-denominated commodities and helped limit any further losses for gold.

Previous update: Gold price is falling from just below the $1900 area this Monday, kicking off the week on a bearish note. Resurgent US dollar demand amid a rebound in the Treasury yields, courtesy of US Secretary Janet Yellen’s optimism over the economy, weighs on gold’s appeal. Yellen said that higher interest rates would be a ‘plus’ for the Fed. Investors shrugged off dismal US NFP jobs data, as Yellen revived taper talks. Further, a tussle between the White House and Republicans over President Joe Biden’s $1.7 trillion infrastructure spending bill also adds to the downward pressure on gold price.

Looking ahead, the broader market sentiment and dynamics in the yields would continue to play out amid a lack of relevant US economic news. The US CPI report due on Thursday will be the main event to watch for fresh trading opportunities in gold price.

Read: Gold Weekly Forecast: XAU/USD snaps four-week winning streak, closes below $1,900

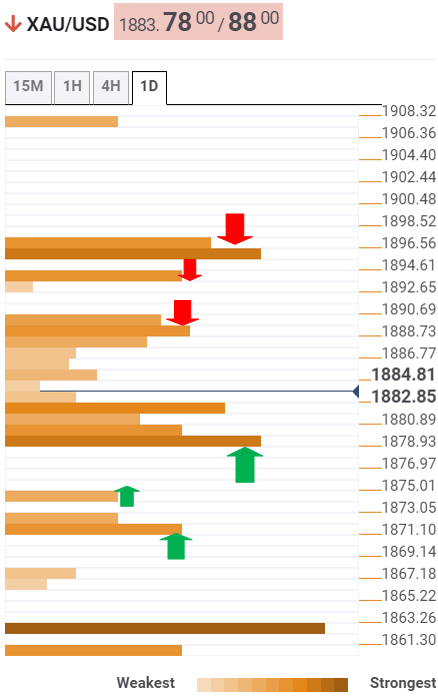

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price is approaching a dense cluster of support levels stacked up around $1880.

At that point, the Fibonacci 38.2% one-month, Fibonacci 23.6% one-week and Fibonacci 38.2% one-day coincide.

If that cap gives way, a drop towards the Bollinger Band one-day Middle at $1874 cannot be ruled out.

Further south, the sellers will then test the confluence of the Fibonacci 23.6% one-week and Fibonacci 61.8% one-day at $1871.

On the flip side, gold bulls need to scale the $1888-$1890 supply zone on a sustained basis. That area is the convergence of the SMA5 four-hour, SMA10 one-hour and previous four-hour.

The Fibonacci 61.8% one-week at $1893 could test the bullish commitments.

The next stop for gold bulls is seen at $1896, where the previous day high, SMA50 four-hour and SMA200 one-hour meet.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.