Gold (XAU/USD) is holding onto the recent recovery gains at around $1730 on Easter Monday, with thin trades offering little incentives. Meanwhile, strong US NFP jobs reported-led spike in the shorter-duration Treasury yields weigh on the non-yielding bright metal.

The Fed is expected to increases rates sooner than previously anticipated after the US jobs blowout strengthened the prospects of faster economic recovery amidst higher vaccination rates.

Stepping into a fresh week, the investors remain on the edge ahead of US Services PMI and FOMC minutes. However, gold remains at risk of witnessing some wild moves amid holiday-thinned market conditions.

How is gold positioned technically?

Gold Price Chart: Key resistance and support levels

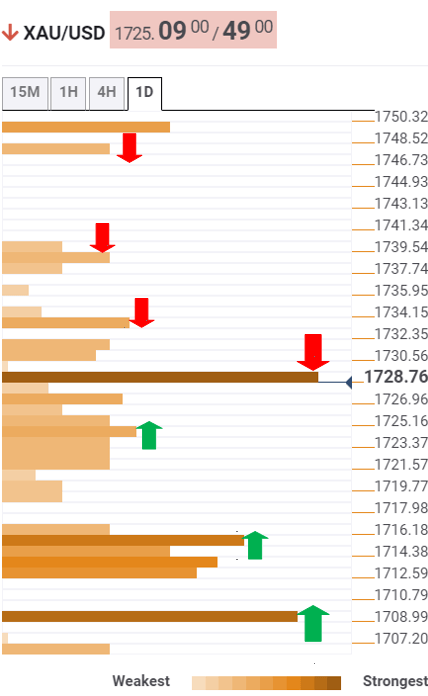

The Technical Confluences Detector shows that gold needs a firm break above $1729, the Fibonacci 61.8% one-month, to extending the two-day recovery momentum.

The previous week high at $1733 could challenge the bulls’ commitments. The next crucial hurdle awaits at $1738, the pivot point one-day R1.

Acceptance above the latter is likely to fuel a sharp rally towards $1747, the pivot point one-day R2.

Alternatively, the SMA5 four-hour at $1726 guards the immediate downside.

Further south, a stack of healthy support levels is seen around $1724, where the SMA10 one-day coincides with the Bollinger Band one-hour Middle.

The Fibonacci 61.8% one-day at $1715 could offer some respite to the XAU bulls.

A breach of the Fibonacci 38.2% one-month at $1709 could revive the bearish sentiment.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: A challenge of the 2025 peaks looms closer

AUD/USD rose further, coming closer to the key resistance zone around 0.6400 despite the strong rebound in the Greenback and the mixed performance in the risk-associated universe. The pair’s solid price action was also propped up by a firm jobs report in Oz.

EUR/USD gathers strength above 1.1350, ECB cuts interest rates by 25 bps

The EUR/USD pair attracts some buyers to near 1.1370 during the early Asian session on Friday. The concerns over the economic impact of tariffs continue to drag the US Dollar lower against the Euro.

Gold bounces off daily lows, back near $3,320

The prevailing risk-on mood among traders challenges the metal’s recent gains and prompts a modest knee-jerk in its prices on Thursday. After bottoming out near the $3,280 zone per troy ounce, Gold prices are now reclaiming the $3,320 area in spite of the stronger Greenback.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.