Will Democrats enjoy a dual victory in Georgia? That is the question for gold traders. If President-elect Joe Biden's party gains effective control of the Senate, he could push for an ambitious stimulus deal that would benefit the precious metal.

The latest opinion polls show a minor lead for Democrats, but anything can happen. How is XAU/USD positioned on the charts?

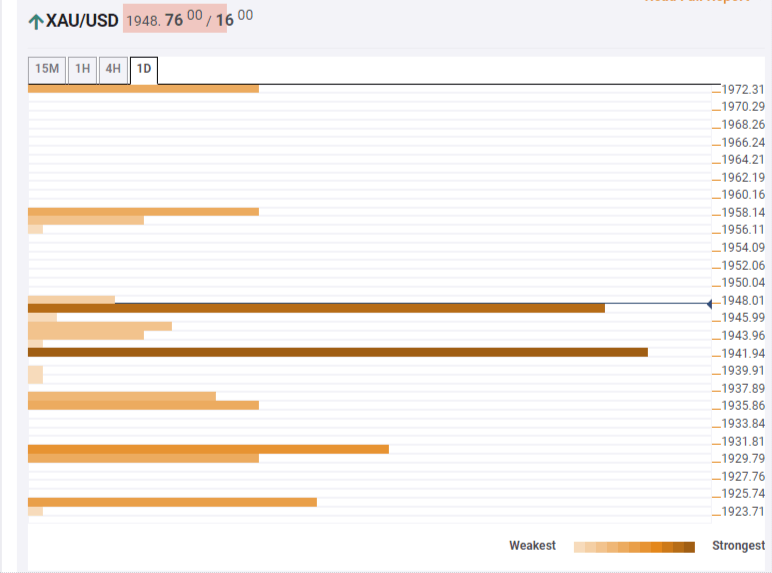

The Technical Confluences Indicator is showing that gold is still battling the $1,947 level, which is the convergence of the Pivot Point one-month Resistance 1 and the Bollinger Band 1h-Upper.

Looking up, some resistance awaits at $1,959, which is the meeting point of the PP one-day R1 and the BB 4h-Upper.

Further above, the upside target is $1,972, which is where the Pivot Point one-day Resistance 2 hits the price.

Strong support awaits at $1,941, which is a dense cluster of lines including the Simple Moving Average 50-15m, the SMA 10-1h, the BB 1h-Middle, the PP one-week R3 and more.

Further down, another line worth watching is $1,930, which is the confluence of the Fibonacci 38.2% one-day and the SMA 10-4h.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD keeps bullish vibe, first upside target emerges near 1.1400

EUR/USD holds steady near 1.1360 in Monday’s Asian session. The positive view of the pair prevails above the key 100-day EMA with the bullish RSI indicator. The Greenback steadies as traders are confused by mixed signals on US-China trade relations.

GBP/USD consolidates around 1.3300 mark; downside potential seems limited

GBP/USD lacks any firm intraday direction and oscillates in a range at the start of a new week. The USD preserves last week’s recovery gains from a multi-year low and acts as a headwind. Bets for a less dovish BoE and hopes for a UK-US trade deal to limit the downside for the major.

Gold price languishes below $3,300; last week’s swing low holds the key for bulls

Gold price meets with a fresh supply on Monday amid the US-China trade deal optimism. A fall in China’s gold consumption and a modest USD uptick also weigh on the commodity. Trade-related uncertainties and Fed rate cut bets warrant caution for the XAU/USD bears.

Bitcoin and Ethereum stabilize while Ripple shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.