Gold prices recover to $1,838, up 0.08% intraday, while heading into Monday’s European session. Although a lack of major catalysts weighs on the yellow metal, the latest chatters concerning the US-China tussle and Japan’s stimulus help the commodity buyers to remain optimistic despite Friday’s losses.

Early in Asia, Reuters came out with the news suggesting the Trump administration’s readiness for further sanctions on the policymakers from China’s Communist Party (CCP). The news precedes China’s weaker than expected imports of 4.1% YoY for November, which in turn suggests the brewing trade war.

Elsewhere, Japanese Prime Minister (PM) Yoshihide Suga recently showed readiness to decide further economic measures tomorrow. The national leader also said that the economic measures to include loans and more reserve funds.

On a different note, Brexit jitters continue whereas vaccine hopes gain momentum with Russia ready for distribution of its vaccine while China’s Sinovac announced that it aims to complete construction of second production facility by the end of 2020 to increase annual covid-19 production capacity to 600 million doses.

Against this backdrop, S&P 500 Futures print mild losses while the US 10-year Treasury yields also dwindle. Further, commodities remain mildly positive while the US dollar index (DXY) fails to keep late Friday’s gains while staying heavy near April 2018 lows, marked during the last week.

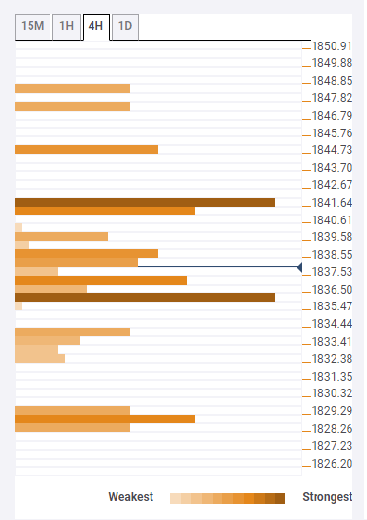

Gold: Key levels to watch

Having successfully cleared $1,836 resistance, now support, comprising the Simple Moving Average (SMA) 10 on hourly (1H), gold is up for confronting the $1842 resistance confluence including Fibonacci 38.2% one-month.

Though, a sustained break above $1,842 will open the path of least resistance towards $1,845, comprising the middle Bollinger on the daily chart and upper Bollinger on 1H.

It should, however, be noted that the yellow metal’s ability to cross $1,845 enables it to eye $1,850 round-figure with Pivot Point one-day (D1) Resistance 1 around $1,847 and the previous high on D1 around $1,848.

On the contrary, a downside break below $1,836 highlights Fibonacci 23.6% one-month, near $1,829 with $1,833 including the middle Bollinger on four-hour (4H) acting as intermediate halt.

Here is how it looks on the tool

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds losses below 1.1400 on modest US Dollar recovery

EUR/USD struggles to gain traction and trades in negative territory slightly below 1.1400 on Tuesday. The Euro weakens amid rising expectations of further ECB interest rate cuts, while the US Dollar draws support from some progress on US trade deals with its major global trading partners. US jobs data awaited.

GBP/USD retreats to 1.3400 area ahead of US data

GBP/USD reverses its direction and trades near 1.3400 after setting a multi-year high near 1.3450 earlier in the day. The US Dollar (USD) stays resilient against its rivals as markets remain optimistic about a de-escalation in the US-China trade conflict. Focus shifts to key macroeconomic data releases from the US.

Gold declines toward $3,300 on improving risk mood

Gold fails to build on Monday's modest gains and declines toward $3,300 on Tuesday amid mixed fundamental cues. Signs of easing US-China trade tensions continue to drive flows away from traditional safe-haven assets and undermine demand for the precious metal.

JOLTS job openings expected to dip slightly in March as markets eye April employment data

The Job Openings and Labor Turnover Survey (JOLTS) will be released on Tuesday by the United States Bureau of Labor Statistics. Markets expect job openings to retreat to 7.5 million on the last business day of March with the growing uncertainty surrounding the impact of Trump’s trade policy.

May flashlight for the FOMC blackout period – Waiting for the fog to lift

We expect the FOMC will leave its target range for the federal funds rate unchanged at 4.25-4.50% at its upcoming meeting on May 6-7, a view widely shared by financial markets and economists. Market pricing currently implies only a 9% probability of the FOMC cutting the fed funds rate by 25 bps.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.