- Gold remains pressured for third consecutive day as sellers attack weekly bottom.

- Treasury yields stays offered but King dollar stays firmer.

- G7, US-China and Brexit offer market jitters ahead of the key events.

- Top commodities to trade amid global reflation: Silver and copper to outshine gold price

Update: Gold quickly reversed the post-US CPI slide to the $1,870 area, or weekly lows and refreshed daily tops in the last hour, albeit lacked follow-through buying. The XAU/USD was last seen trading just below the $1,890 level, down nearly 0.15% for the day. Despite hotter-than-expected US consumer inflation figures, investors seem aligned with the Fed's transitory narrative and that pricing pressures will abate later in the year. This, in turn, prompted some fresh selling around the US dollar and provided a goodish lift to dollar-denominated commodities, including gold.

Meanwhile, the US fixed income market reacted to stronger data and pushed the yield on the benchmark 10-year US government bond back above the 1.50% threshold. This was seen as a key factor that kept a lid on any further gains for the non-yielding yellow metal. Apart from this, the underlying bullish sentiment in the financial markets – as depicted by a generally positive tone in the equity markets – acted as a headwind for traditional safe-haven assets and capped the upside for gold. This makes it prudent to wait for some follow-through selling before traders again start positioning for the resumption of the recent appreciating move.

Previous update: Gold price is attempting a minor bounce, having witnessed a steep drop following a break below the critical 21-DMA support at 1883. At the time of writing, gold price is trading 0.50% lower at $1880, looking to recapture the 21-DMA. The US dollar is gaining additional strength amid an uptick in the Treasury yields and anxiety ahead of the US inflation data. Investors resort to repositioning ahead of the ECB announcement and US CPI release. These key events will shed light on the pace of global recovery and policymakers’ thinking about paring back stimulus, which will have a significant impact on the dollar trades and eventually on gold price.

Read: US CPI May Preview: Inflation angst is coming

Gold (XAU/USD) prices remain pressured during a three-day downtrend of around $1,883, down 0.26% on a day, ahead of the Super Thursday’s European session. In doing so, the quote fades earlier bounce off the day’s bottom of $1,885.16 as traders await the key US Consumer Price Index (CPI) and the European Central Bank (ECB) outcomes.

Inflation is a severe concern than ECB…

A seven-week low of US inflation expectations keeps market players hopeful that the Fed can term the US CPI temporary risk should it matches the firmer forecasts. Though, early signals of the inflation, comprising the Retail Sales, Core PCE and GDP, not to forget buying spree due to the economic unlock, say another story for the next week’s FOMC meeting. As a result, a YoY CPI print near 3.4% and/or a 4.7% Core CPI shouldn’t make a strong bearish case for gold but anything beyond that will be crucial.

Read: US CPI May Preview: Inflation angst is coming

An otherwise market mover, the ECB meeting, is likely to step back to a second-tier unless Christine Lagarde and the company surprises markets with a change in either the benchmark rate of 0.0% or Deposit Rate of -0.5%, not forget any tapering announcement. It should, however, be noted that the regional central bank could probe the US dollar’s recent gains should the policymakers back their economic optimism with an upward revision to the macro forecasts.

Read: European Central Bank Preview: Why June's decision presents a buy the dip opportunity

It’s worth noting that US President Joe Biden’s visit to UK PM Boris Johnson, to break the Brexit deadlock over the Northern Ireland (NI) protocol, also becomes a second-tier event to watch. While the EU has been cheering Biden’s readiness to meddle, there prevails a doubt over whether America will risk its ties with Britain for the issue which has multiple loopholes. The same could risk the continuation of the mixed sentiment and put a safe-haven bid under the US dollar.

Additionally, the Group of Seven’s (G7) indirect hints to battle China over foreign trade and covid origin joins the Sino-American relations, which recently turned promising, may also –play their part to confuse gold traders.

However, gold sellers should keep their eyes on the US dollar index (DXY), up for the third day near 90.15, to determine immediate moves. Behind the USD performance could be the US Treasury yields that stay heavy near three month low.

Hence, gold has multiple catalysts to track for near-term direction but nothing more important appears than the US CPI for now.

Technical analysis

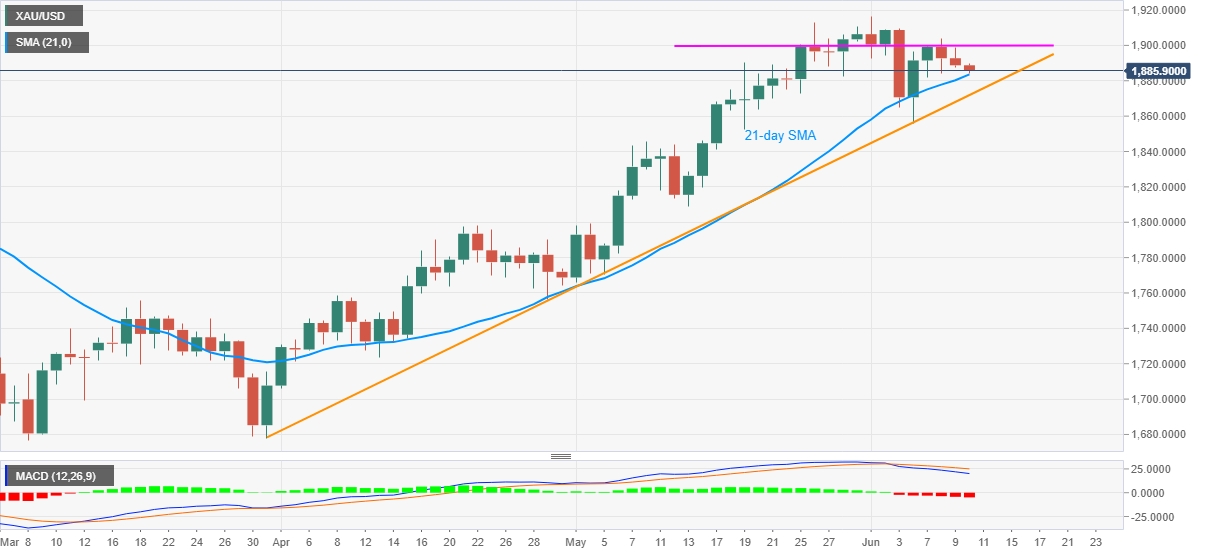

Failures to sustained the bounce off an ascending support line from March join the most bearish MACD signals in three months to keeps gold sellers hopeful.

However, a downside break of 21-day SMA near $1,883 won’t be enough for gold bears’ return as the stated trend line support, close to $1,871, could also restrict the commodity’s further declines.

In a case where the quote drops below $1,871, the early May’s top near $1,845 should return to the chart.

Alternatively, corrective pullback needs to cross a 12-day-long horizontal line near the $1,900 threshold to recall the gold buyers.

Also acting as an upside filter is the latest swing high $1,916.62, a break of which will aim for the yearly top near $1,960 with $1,935 likely acting as a buffer.

Gold daily chart

Trend: Further weakness expected

Additional important levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD reaches fresh weekly lows with ECB, dismal US data

EUR/USD trades near a fresh weekly low of 1.0468 after the European Central Bank trimmed interest rates as expected, and the United States published discouraging employment and inflation-related data. The US Dollar finds additional support in a dismal market mood.

GBP/USD nears 1.2700 on broad US Dollar demand

GBP/USD is pulling further back towards the 1.2700 level in the European session on Thursday as traders turn cautious. The pair reverses earlier gains as the US Dollar gathers strength following dismal United States data.

Gold pierces $2,700 as investors assess US news, ECB decision

XAU/USD pierced the $2,700 threshold and remains under pressure as investors diggest US figures and the European Central Bank monetary policy announcement. Inflation in the US at wholesale levels rose by more than anticipated in November, according to the latest Producer Price Index release.

-637336005550289133_Medium.jpg)

Chainlink surges amid World Liberty purchase, Emirates NBD partnership and CCIP launch on Ronin network

Chainlink price surges around 15% on Thursday, reaching levels not seen since mid-November 2021. The rally was fueled by the Donald Trump-backed World Liberty Financial purchase of 41,335 LINK tokens worth $1 million on Thursday.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.