Gold Price Analysis: XAU/USD extends daily slide, next support aligns at $1,818

- XAU/USD falls sharply during the American trading hours.

- Next near-term support for gold could be seen at $1,818.

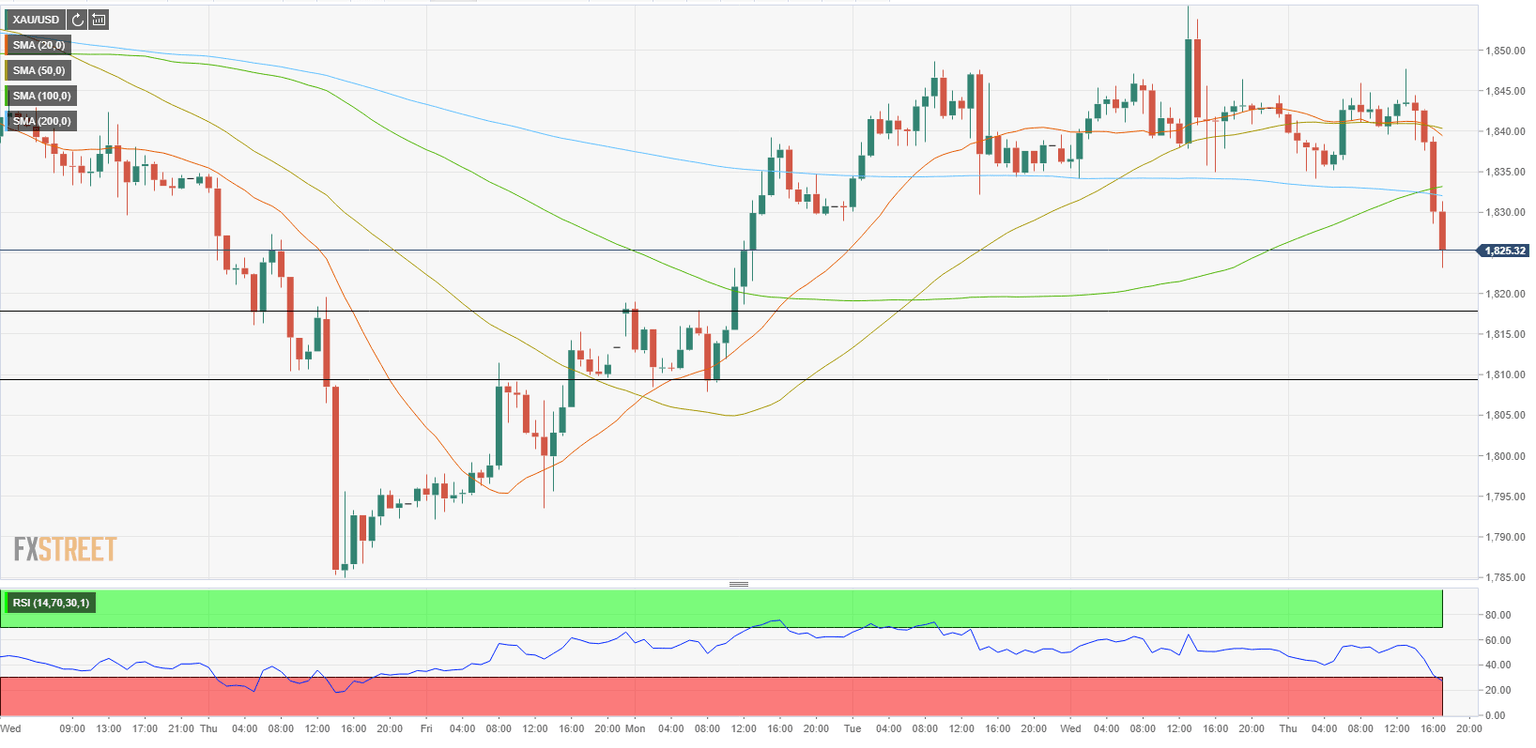

- RSI indicator on the one-hour chart dropped below 30.

The XAU/USD pair came under heavy selling pressure during the European trading hours and dropped to a daily low of $1,823. Renewed USD strength amid rising US Treasury bond yields seems to be weighing on XAU/USD, which was last seen losing 1% on the day at $1,825.

Gold technical outlook

With the latest decline, gold price fell below both the 100-hour and 200-hour SMAs and sellers could look to remain in control of XAU/USD's action unless the pair manages to reclaim those levels. Meanwhile, the Relative Strength Index (RSI) indicator on the same chart retreated below 30, suggesting that there could be a technical correction before the next leg down.

$1,830/33 (100-hour SMA/200-hour SMA) aligns as the initial resistance ahead of $1,840 (50-hour SMA) and $1,855 (daily high).

On the downside, $1,818 (static level) could be seen as the next target in case the bearish momentum remains intact. Below that level, next support is located at $1,810.

Additional levels to watch for

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.