- Gold had been making headway to the downside ahead of the NFP event.

- Bulls are stepping in below the prior week's low in $1,802, a break of which opens $1,830 target.

Gold is under pressure as the US dollar catches a bid in a risk-on environment ahead of this week's Nonfarm Payrolls even on Friday.

However, there is scope for an upside correction and the following illustrates where the next trading opportunity could arise leading into the event.

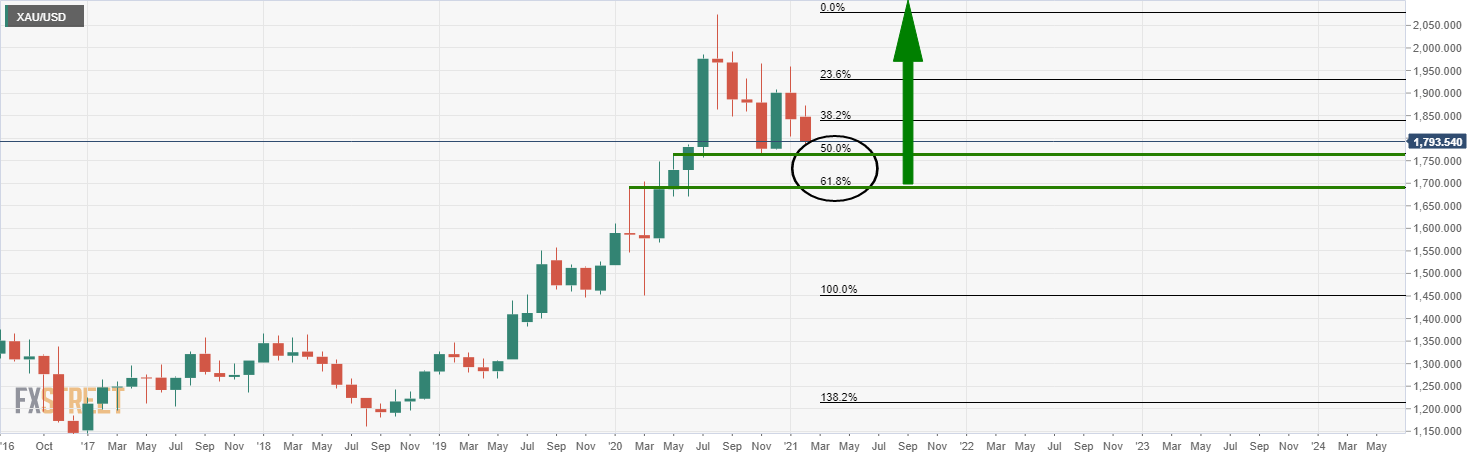

Gold Monthly chart

Gold is on the way to test the bull's commitments at monthly support.

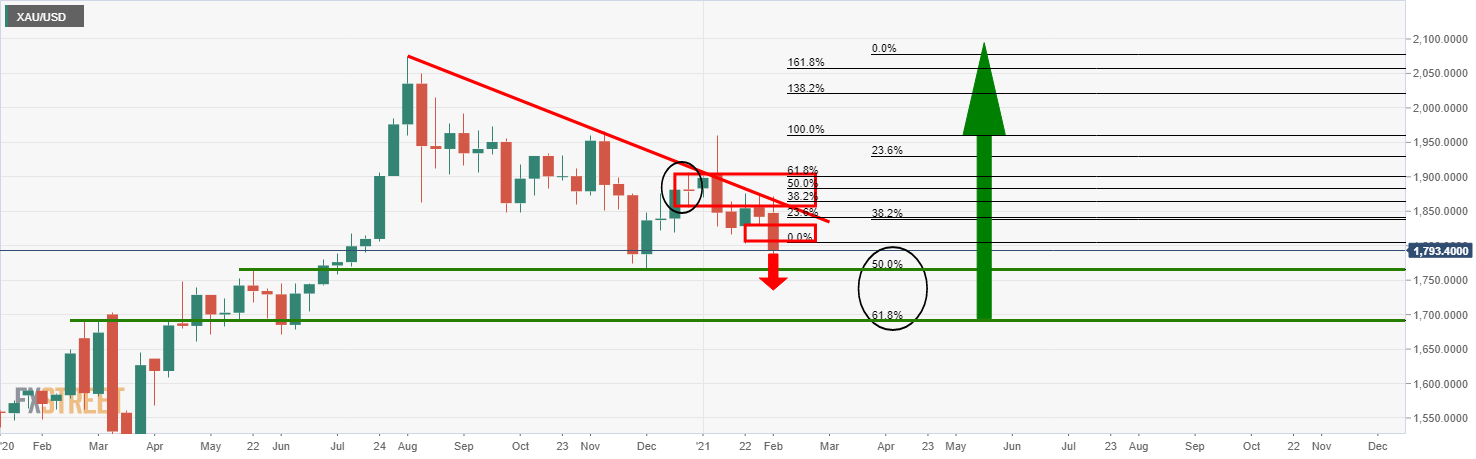

Gold Weekly chart

The price has made a lower low on the weekly chart, (1,802 prior low), which is encouraging for the bears so close to the close this week.

However, there is scope for a retracement which will likely be determined in Friday's US Nonfarm Payrolls event and flows in the US dollar.

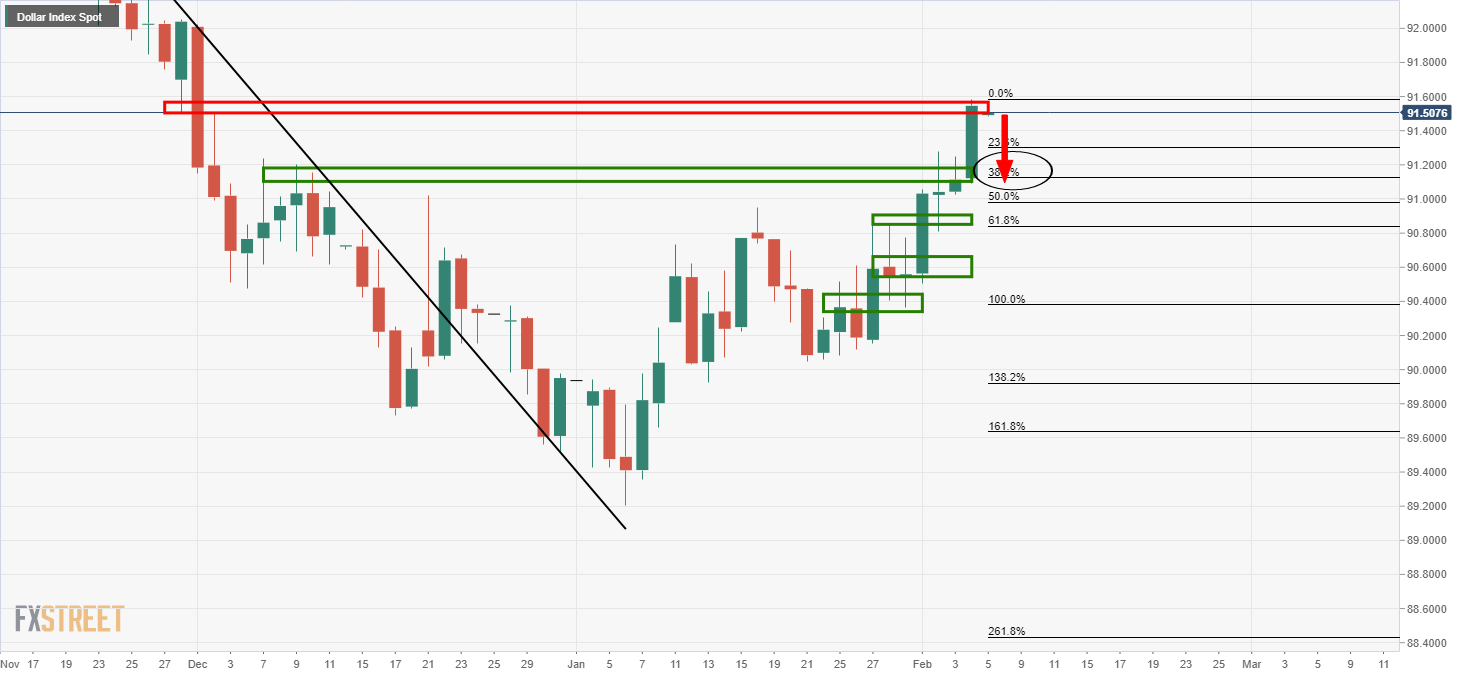

Gold DXY daily chart

If there is a miss in expectations in the NFP's report, the dollar could come under pressure at the resistance and a 38.2% Fibonacci retracement has a confluence with prior structure.

Consequently, the price of gold would be expected to rise.

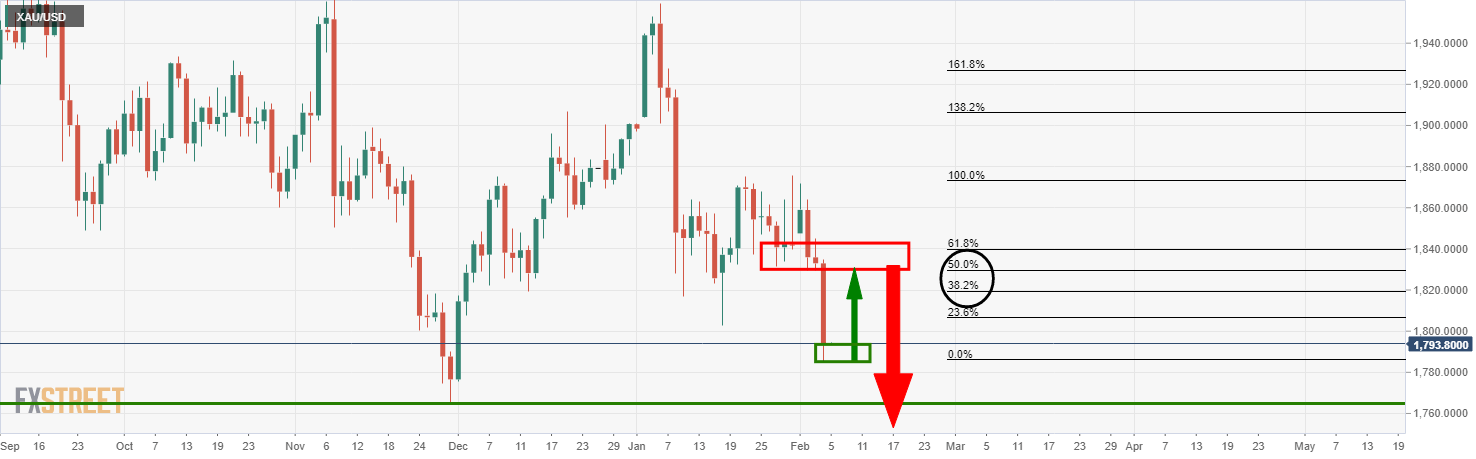

Gold Daily chart

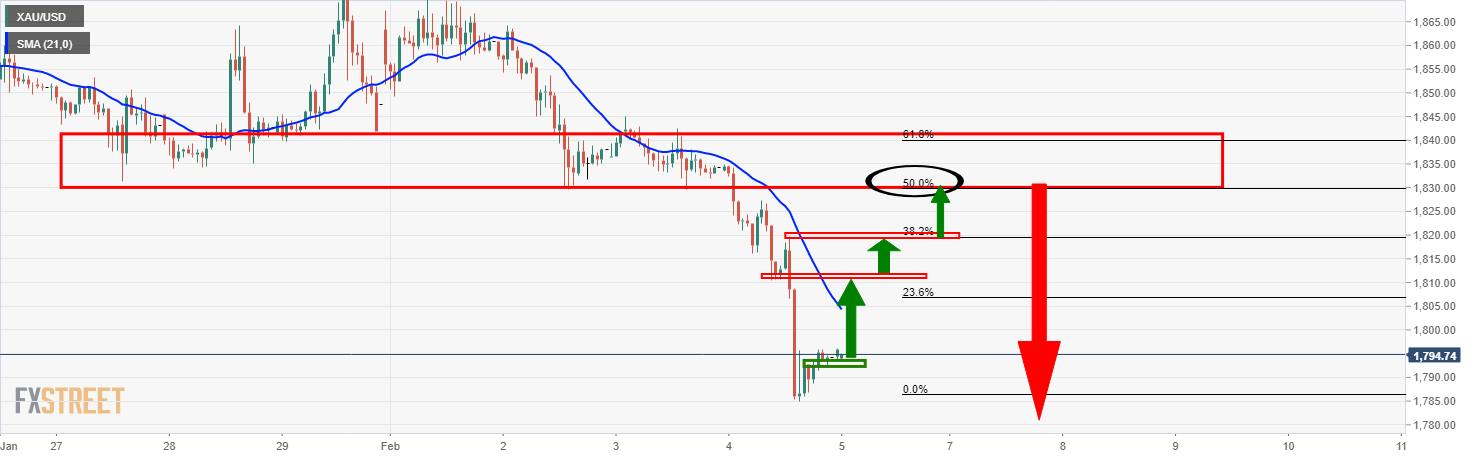

On a break above last week's low, bulls can then target either a 38.2% Fibonacci retracement or a deeper 50% mean reversion which aligns with the prior lows.

Gold 1-hour

The price remains bearish on the lower time frame in the 1-hour chart, but bulls can monitor the environment for a switch-up as the price continues to correct higher through $1,802.

An optimal entry, ideally within bullish conditions when the price breaks above the 21-hour moving average, for instance, would be achieved from a bullish structure, protected with a stop loss below it and targeting the confluence target of $1,830.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady above 1.1400 ahead of key US data

EUR/USD struggles to gather recovery momentum but holds steady above 1.1400 on Wednesday following the mixed PMI data releases for the Eurozone and Germany. Markets await comments from central bankers and US PMI data.

GBP/USD stays weak near 1.3300 after disappointing UK data

GBP/USD stays under bearish pressure near 1.3300 on Wednesday. Pound Sterling is having a tough time attracting buyers following the weaker-than-forecast April PMI data from the UK. BoE Governor Bailey will speak later in the day and the US economic calendar will feature PMI reports.

Gold stabilizes above $3,000 after sharp decline on Trump's softer tone on trade and Fed

Gold stabilizes above $3,300 after correcting sharply from the all-time high it set et $3,500 early Tuesday. US President Donald Trump's softer tone on Fed Chairman Jerome Powell's position and trade relations with China seems to be discouraging buyers.

US S&P Global PMIs set to highlight worsening services and manufacturing sectors in April

Investors are bracing for a modest pullback in April’s flash Manufacturing PMI, expected to slip from 50.2 to 49.4, while the Services PMI is forecast to ease from 54.4 to 52.8.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.