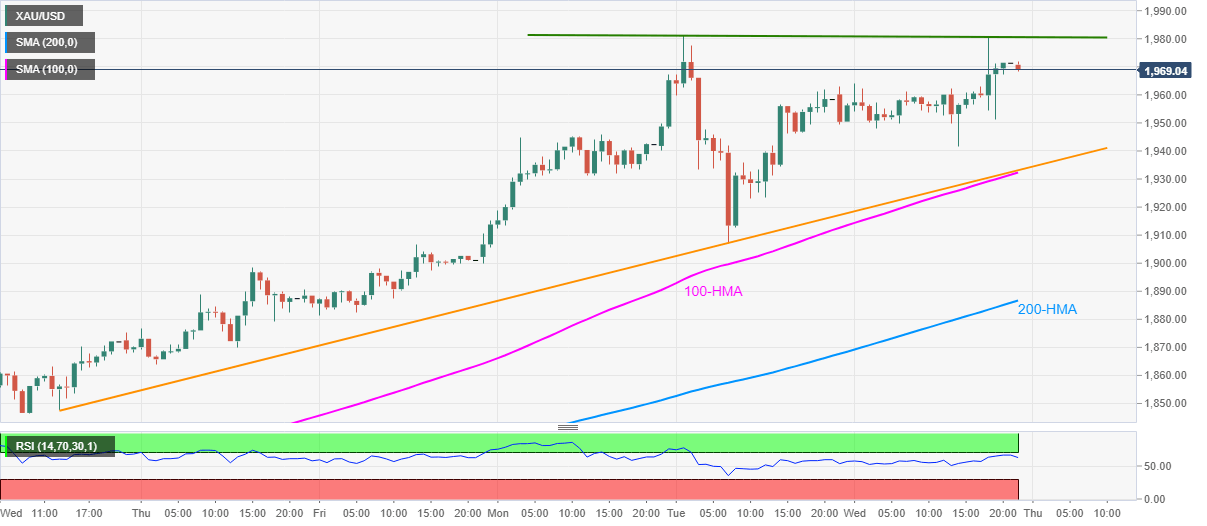

- Gold prices struggle to keep recoveries following second failure to cross $1,981.

- RSI conditions suggest cooling of the bull-run for a while.

- 100-HMA, weekly ascending trend line offers immediate strong support.

Gold prices recede to $1,968.60 amid the early Asian session on Thursday. The yellow metal recently surged to $1,980.89 but couldn’t refresh the record top of $1,981.34, making a ‘double-top’ around $1,981.

With the RSI conditions challenging further upside, coupled with the strong resistance near $1,981, sellers may sneak in for short-term gains. In doing so, a confluence of 100-HMA and an upward sloping trend line from July 22, close to $1,933/32, becomes important.

If the bears manage to snatch back the rein and dominate below $1,932, the $1,900 threshold and 200-HMA level of $1,886 will be on their radars.

Meanwhile, an upside clearance of $1,981 will quickly renew the north-run targeting $2,000 psychological magnet.

Further, 61.8% Fibonacci retracement of the precious metal’s rally from mid-2001 to late-2011, around $2,077, could lure the optimists afterward.

Gold hourly chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD declines toward 1.0450 on USD recovery

EUR/USD struggles to gain traction and declines toward 1.0450 on Tuesday despite the upbeat ZEW Survey - Economic Sentiment data for Germany and the Eurozone. Rising US Treasury bond yields support the US Dollar and weigh on the pair.

GBP/USD struggles to hold above1.2600

GBP/USD stays under modest bearish pressure and trades below 1.2600 on Tuesday. Earlier in the day, the pair edged higher with the initial reaction to the UK labor market data, which showed that the Unemployment Rate held steady at 4.4% in the three months to December.

Gold approaches record highs

Gold prices advance to two-day highs around $2,930 per ounce troy amid the resumption of tariff concerns and despite the tepid rebound in the Geenback and an acceptable move higher in US yields across the curve.

Why Solana, XRP, Dogecoin and BNB are crashing?

Solana (SOL), XRP, Dogecoin (DOGE) and Binance Coin (BNB) decline on Tuesday. Top altcoins ranked by market capitalization are in a downward trend, even though Bitcoin (BTC) continues to consolidate around the $95,000 level.

Rates down under

Today all Australian eyes were on the Reserve Bank of Australia, and rates were cut as expected. RBA Michele Bullock said higher interest rates had been working as expected, slowing economic activity and curbing inflation, but warned that Tuesday’s first rate cut since 2020 was not the start of a series of reductions.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.