- Gold bulls have stepped in at the lows of the day pushing gold back to $1,860s.

- All eyes will turn to the Fed as the US dollar stays firm.

- US dollar in focus ahead of the FOMC.

- Gold Weekly Forecast: XAU/USD tests key trend line ahead of FOMC meeting

Update June 15: After dropping to its lowest level since mid-May at $1,844 on Monday, the XAU/USD pair staged a modest rebound during the American trading hours but ended up closing the day in the negative territory. In the absence of significant fundamental developments ahead of key data releases and events, gold seems to have gone into a consolidation phase and was last seen trading little changed on the day at $1,865. Later in the session, the US Census Bureau will release the Retail Sales data for May, which is expected to show a 0.8% decline on a monthly basis.

Read: US May Retail Sales Preview: Analyzing major pairs' reaction to previous releases

Gold has been quite a show on Monday falling from a high of $1,878.08 to a low of $1,844.63, or by 1.8%, or by over 33 dollars.

Relatively speaking, the greenback has hardly moved. As measured by the DXY, the index is flat and has stuck to a 90.4120 and 90.6010 range.

The dollar is in consolidation following Friday's move that was showing its strongest weekly gain since early May as investors likely positioned for the Federal Reserve meeting this week.

Investors have been covering short positions and searching for carry in a low volatility forex environment.

All eyes on the Fed

The Federal Reserve's assertion that high inflation would be temporary has been weighing on the greenback for many weeks as US stocks reached record highs and US yields chugged along the bottom of their sideways range since April.

The Fed meets for its 2-day June meeting tomorrow, with the policy decision and updated projections due on Wednesday.

The markets are on the lookout for the Fed to eventually announce a strategy for reducing its massive bond-buying program.

In turn, this has been supporting the greenback to some extent.

However, while the magnitude of price rises in both April and May has been unsettling, caution should prevail this week because there is little chance of there being new taper hints so soon.

The members at the Fed believe that the current inflation reflects the historically exceptional circumstances only.

With that being said, the risk on Wednesday is if inflation expectations are higher, ultimately feeding through to a more sustained rise in inflation over the medium term.

This would be more hawkish than what the markets are priced for and would most probably be marginally positive for the US dollar.

''We expect that this week’s FOMC meeting is likely to bring upward revisions for PCE inflation in 2021,'' analysts at Rabobank said.

''As long as further out inflation forecasts remain anchored the market should absorb this well.''

On the other hand, ABN Amro wrote in a note, ''the most likely course is that inflation decelerates over the coming months, settling back at more normal levels later this year. It is even possible we could get one or two weak readings in the months ahead, as some price rises look unsustainable and vulnerable to payback (particularly in used cars, a category driving 1/3 of the overshoot in April/May).''

''As such, although we expect a significant upward revision to the Fed’s current 2.4% forecast for PCE inflation in 2021 – perhaps a rise of more than a percentage point – we expect the FOMC statement to continue to describe the current inflation overshoot as transitory, and Chair Powell is likely to mount a vigorous defence of this thinking in the press conference.''

Bill Diviney at ABN Amro further explained, ''at the same time, while Chair Powell might acknowledge that the Committee is now ‘talking about talking about' a tapering of its asset purchases, we do not expect any concrete hints on this at the press conference. We continue to think a formal taper announcement could come by the September meeting – perhaps telegraphed at the Jackson Hole Symposium. This would pave the way for tapering to start in Q4.''

Implications for gold

Meanwhile, analysts at TD Securities explained that considering that gold was set-up for a pullback like a speed bump on the racetrack, they see risks for further weakness in prices as the talk of taper talk saps interest in the yellow metal at a time when flows are not particularly supportive.

''Golds failure to break $1900/oz despite the surprise non-farm payrolls and CPI inflation prints highlights a lack of speculative interest for the yellow metal, at a time when the technical break in inflation breakevens signals slowing inflation-hedging appetite.''

Gold technical analysis

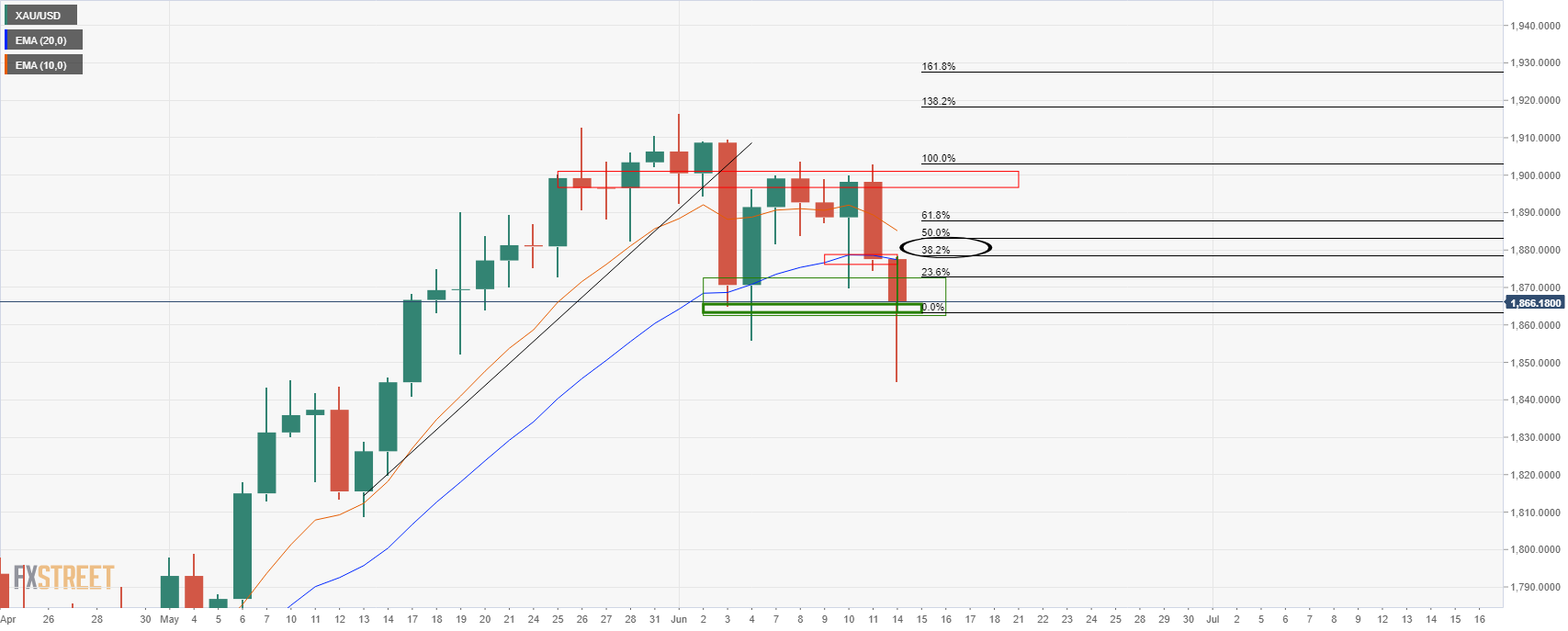

The daily chart has completed an M formation and a retest of the old lows would be expected at this juncture.

A 38.2% Fibonacci has a confluence with 4-hour structure as follows:

Previous updates

Update: Gold price remains in the red zone, on its way to mark the second straight down day, as the US dollar holds the higher ground ahead of the FOMC meeting. However, the decline in the US Treasury yields keeps gold’s downside in check.

On Monday, gold price almost tested the 200-Daily Moving Average (DMA) at $1840 before rebounding swiftly to near the $1870 supply zone. At the time of writing, gold price is down nearly 0.40%, flirting with the daily lows near $1860. Gold’s path of least resistance appears to the downside amid mixed market sentiment, which will underpin the haven demand for the US dollar. Attention now turns towards the US Retail Sales release for fresh impetus while the Fed begins its two-day monetary policy meeting later on Tuesday.

Update: Gold (XAU/USD) fades corrective pullback from a two-month low, around $1,867, during the early Asian session on Tuesday. Gold prices broke an ascending support line from March 31 on Friday and extended the south-run towards the lowest since mid-April the previous day. However, pick-up in the US dollar’s failures to track the pick-up in the US Treasury yields triggered the quote’s bounce off 200-day SMA (DMA) towards $1,870.

The recovery moves not only remain below the previous support line but also struggle with a horizontal area established during early June on the four-hour play amid a lack of fresh catalysts. Also contributing to gold’s lack of upside momentum could be the cautious market sentiment ahead of today’s US Retail Sales and Wednesday’s Federal Open Market Committee (FOMC) meeting.

Given the likely barriers to trading and the US dollar’s refrain from backing down, not to forget sustained trading below previous supports, gold prices may attack 200-DMA support on fresh declines.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637592968570039753.jpeg)

-637592971032099015.png)