- Gold bears moved in for the kill and swept up the bulls and stake stops.

- The market's focus will now turn to Fed chairman Jerome Powell.

Gold price dropped on Tuesdays to complete the week's opening balance between $1,933 and $1,910 round numbers. The yellow metal fell from a high of $1,930.73 to a low of $1,910.89. Essentially, the market went after the money on the downside following a narrow inside day on Monday ahead of key events for the days ahead.

US-manufactured capital goods today unexpectedly rose in May, but the prior month's data was revised down. On the Russian front, risks from the short-lived mutiny in the nation appear to have been digested and on the back burner. Meanwhile, traders are looking ahead to Federal Reserve Chair Jerome Powell's speech along with a trove of key economic data on Thursday that could offer clues on future interest rate hikes.

However, analysts at TD Securities say that they expect that this Friday's Personal Consumption Expenditure report won't corroborate the rates markets pricing of 17bp of hikes in July, particularly as the core PCE services ex-housing measure is likely to post its smallest increase since last July. ''Nonetheless, algos are unlikely to fuel additional upside until prices break above the $2,010/oz mark, suggesting that gold bulls may need discretionary traders to lose faith in the Fed's hawkish tone for prices to resume their upward trajectory.''

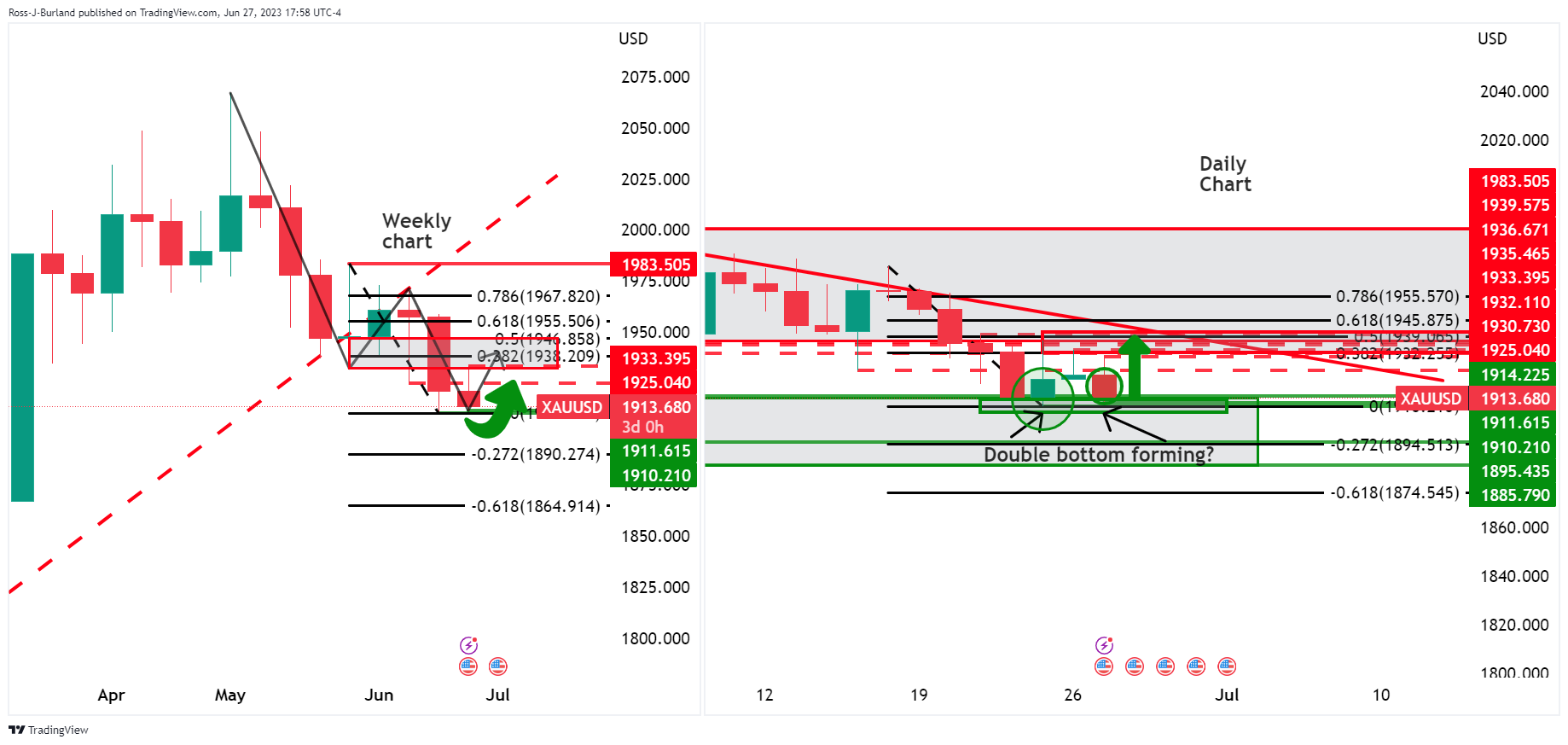

Gold technical analysis

Technically, the US Dollar is under pressure on the weekly and daily charts and this could be the fuel for the Gold bugs. On the Gold weekly chart, we have seen a downside extension that could have made a low and thus, the focus is on the upside. a 38.2% Fibonacci retracement of the latest downside impulse's range on the weekly chart marries up with a 50% mean reversion area on the daily chart into trendline resistance around $1,938/39. If the USD continues to deteriorate, this could lead to a double bottom on Gold's daily chart.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.