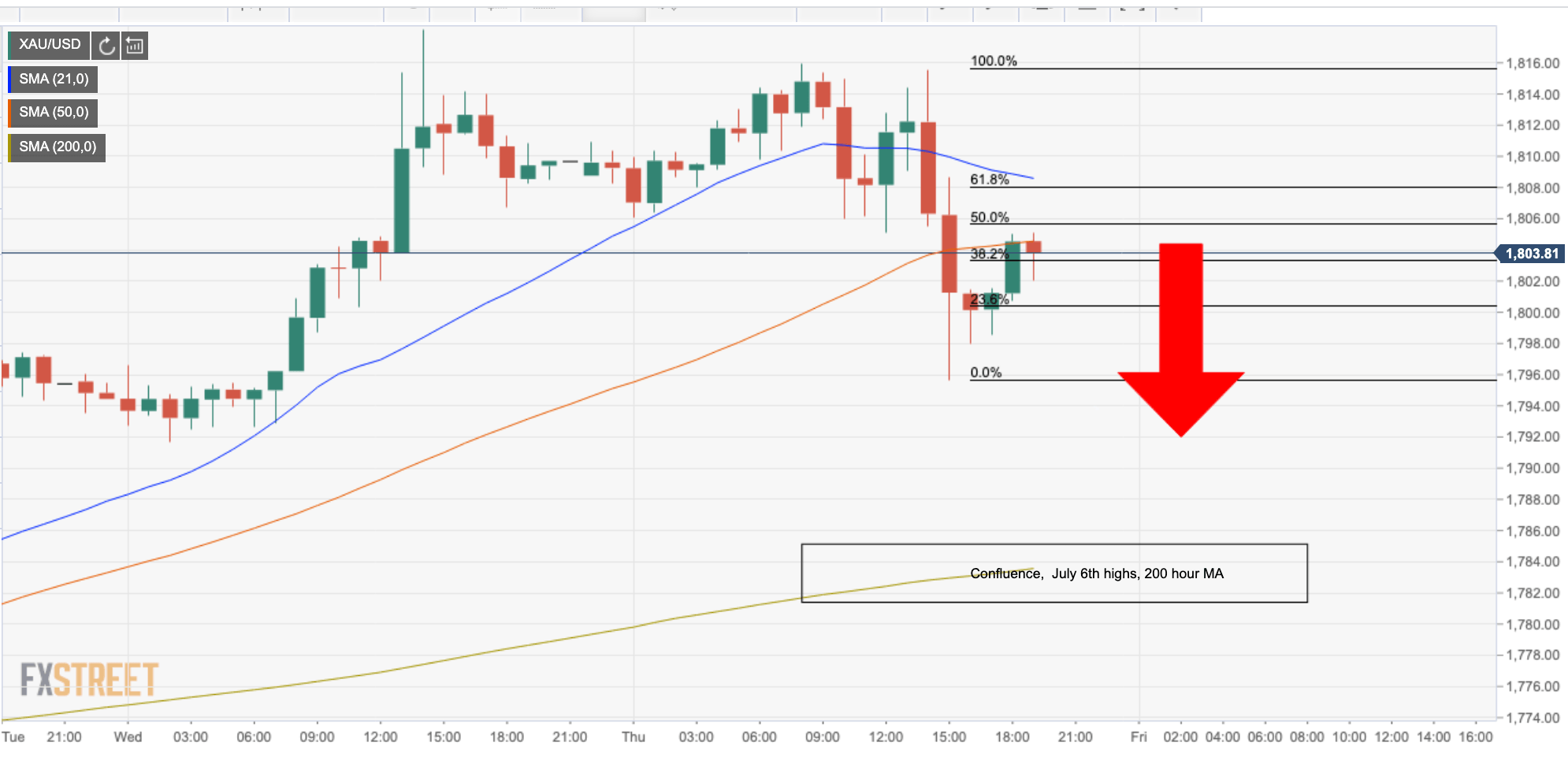

- Gold on the verge of a break below 1800 and bears eye run to 200-hour moving average.

- On the flipside, fundamentals play out and the normalizing inflation expectations underpin the bullish case longer-term.

The price of gold has been on the move on Thursday, taking on bullish commitments just below the psychological $1,800 level.

We have seen a bearish spike from the resistance area between $1,816 and $1,818/16 and a test below the level for a low of $1,795 so far.

The bullish correction is meeting a 38.2% hourly Fibonacci level with the confluence of hourly swing lows/support, More on the technicals outlook below, but the prospects are favouring the bears at this juncture.

From a fundamental standpoint, however, "the yellow metal is torn between its safe-haven bona fides, which are prompting money managers to sell on risk-on behaviour in markets, and its inflation-hedge characteristics, which are driving a swarm of capital to seek refuge in the yellow metal," analysts at TD Securities argued.

Fauci says states with major outbreaks should ‘seriously look at shutting down’ again

Meanwhile, gold is always going to flourish so long as the risks of lockdown persist.

Anthony S. Fauci, the nation’s top infectious-disease official, is advising that some states seriously consider “shutting down” again if they are facing major resurgences of the virus — a warning that conflicts with President Trump’s push to reopen the country as quickly as possible, The Washington Post reported.

Fauci added Thursday that he hopes there’s not a need for new shutdowns, saying it “would not be viewed very, very favourably,” and urged states to pause their reopening process to slow the spread of the virus so that renewed shutdowns are not necessary.

Real rates will continue to drive gold prices higher

Ultimately we anticipate that real rates will continue to drive gold prices higher as normalizing inflation expectations and suppressed rates vol provide fuel for the trade. Meanwhile, the industrial-precious silver could outperform — benefiting from both the positive precious metals environment and its industrial characteristics, at a time when its supply may remain constrained,

the analysts at TD Securities explained.

Gold levels

As per the introduction to technical mentioned above, the price is on the verge of another bearish impulse to the downside.

If the hourly 21 and 50 moving averages can hold the price down, then the path of least resistance is likely a break to the downside towards the 200-hour moving average and the previous month's high.

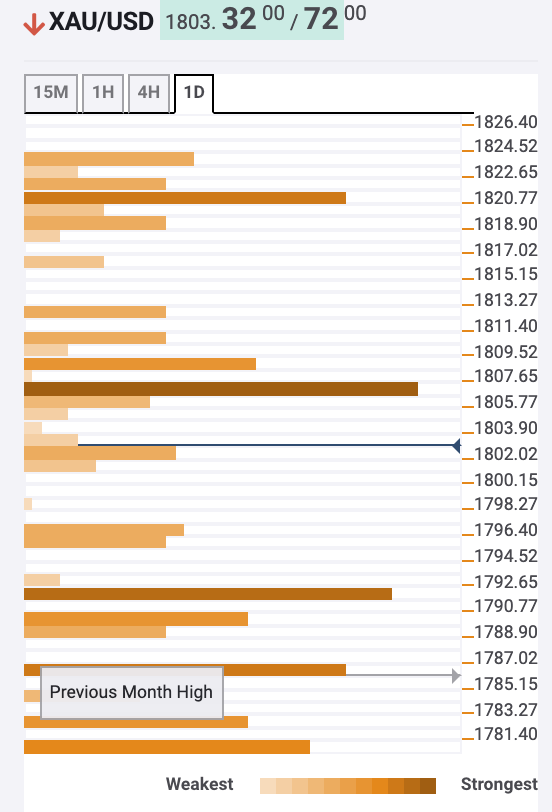

FXStreet Technical Confluences Indicator

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds steady above 0.6300, awaits fresh impetus

AUD/USD is holding steady above 0.6300 in the Asian session on Thursday. The pair draws support from a broadly subdued US Dollar even as markets remain wary of escalating trade war, assessing its implications on global economic prospects. US PPI inflation eyed for fresh impetus.

Gold price targets record highs amid cooling inflation, trade war

Gold price is building on the recent upswing early Thursday, looking to retest lifetime highs of $2,956. Gold buyers cheer a bullish technical setup as markets assess the implications of Trump-induced global trade war.

USD/JPY turns lower to near 148.00 amid divergent BoJ-Fed expectations

USD/JPY turns south to test 148.00 in Thursday's Asian session. A cautious risk tone and concerns over a global trade war keep the Japanese Yen underpinned, dragging the pair lower. The pair also faces headwinds from the divergent BoJ-Fed policy expectations.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally.

Brexit revisited: Why closer UK-EU ties won’t lessen Britain’s squeezed public finances

The UK government desperately needs higher economic growth as it grapples with spending cuts and potential tax rises later this year. A reset of UK-EU economic ties would help, and sweeping changes are becoming more likely.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.