Gold Price Analysis: XAU/USD bears eyeing $1,871 as downside target – Confluence Detector

Gold is falling alongside stocks as the market mood sours. Rising coronavirus cases in Europe and the US is weighing on the mood, as well as uncertainty about the elections. The chances of a "blue wave" – a massive Democratic victory – that would ensure massive stimulus seems less certain as investors get nervous ahead of the vote.

See Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

In the meantime, how are technicals looking for XAU/USD? Bears seem to have the upper hand.

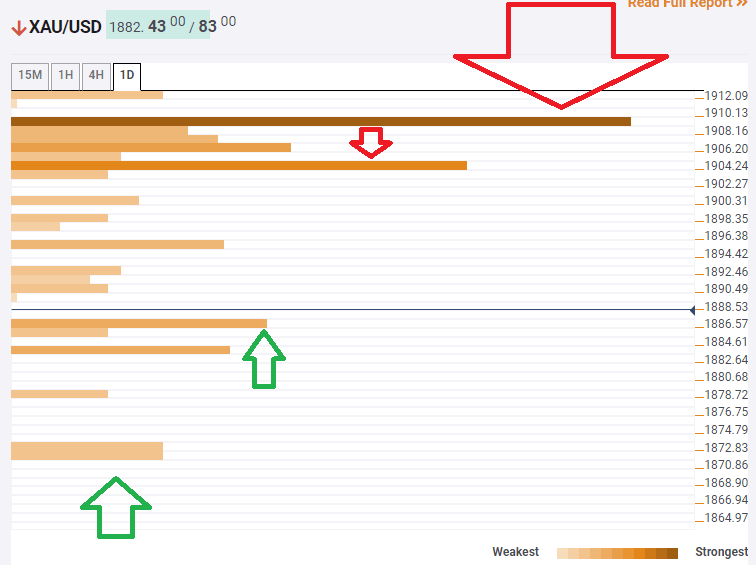

The Technical Confluences Indicator is showing that significant resistance awaits gold at $1,904, which is the convergence of the Bollinger Band 4h-Middle, the BB one-day Middle, the Simple Moving Average 10-1h, the SMA 5-4h, and the Fibonacci 38.2% one-month.

An even stronger cap awaits XAU/USD at $1,909, which is the meeting point of the Fibonacci 23.6% one-day and the Fibonacci 61.8% one-week.

Some support awaits at $1,886, which is the confluence of the Pivot Point one-week Support 1 and the PP one-day S3.

The downside target is $1,871, which is a juncture including the Fibonacci 161.8% one-week and the PP one-week S2.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.