Gold Price Analysis: Gold bears seeking a correction to test bullish commitments

- Gold has broken above the $1,800 mark, hitting the highest levels since February.

- The Confluence Detector is showing that XAU/USD has very few barriers through $1,850.

- Bears are lurking at resistance structure, eyeing a correction ahead of NFPs.

Update: As per the prior gold analysis from the start of the week, Gold Price Analysis: Bulls and bears battle it out at critical resistance, and Gold Price Analysis: Bulls back in town through critical resistance, where targets of a '-272% Fibo' that came in 'at 1,810' and 'a -61.8% Fibo' that 'is located at 1,820' were noted, the bulls have indeed taken up the discount from the daily correction and gone on to score a pre Nonfarm payrolls high on Thursday of 1,817.97.

Prior analysis

'The price has dropped further than anticipated, which is a bonus for the bulls, clearing out stale stops in what will be presumed to be the foundations for an extension to the upside.'

Live market, daily chart

The gold price has now reached a resistance structure.

Gold would now be expected to correct back to test the prior resistance which has a confluence with a 38.2% Fibonacci retracement of the latest bullish impulse.

With that being said, on the hourly time frame, there is a compelling case for demand higher up at the confluence of the daily 23.6% Fibo that meets the hourly 38.2% Fibo and the 10 EMA.

Should there be a steady correcting drift and deceleration into the key Nonfarm Payrolls that somehow disappoints, then the US dollar could find its self in more trouble which would be expected to support the gold price and potentially lead to another bullish impulse.

Update: Gold Price Analysis: XAU/USD bulls eye $1,850 after surging above $1,800 – Confluence Detector

It has finally happened – Gold has staged a convincing break above the $1,800, hitting a high of $1,813.63 at the time of writing. Falling US Treasury yields have prompted investors to buy gold, and cascading stop-losses have also been attributed to the upswing in the price of the precious metal.

How is gold positioned on the technical charts? Examining clusters of support and resistance lines can help provide answers.

The Technical Confluences Detector is pointing to showing that the next resistance line is at around $1,822, which is where the Pivot Point one-week Resistance 3 hits the gold price chart.

The next substantial hurdle for XAU/USD awaits at $1,850, which is the convergence of the 200-day Simple Moving Average and the Pivot Point one-month Resistance 2.

Initial support is at around $1,810, which is where the PP one-month R1, the PP one-day R3 and the Fibonacci 161.8% one-week all meet up on the gold price chart.

Update: Gold (XAU/USD) is easing from two-day highs of $1796, as sellers continue to lurk near the 100-DMA barrier of $1797. Despite the pullback, the price of gold remains buoyed by notable US dollar supply, as the risk sentiment rebounded on strong German factories data and conciliatory Fedspeak, suggesting that tapering is not on the table anytime soon. Earlier in the Asian session, gold fell to near $1785 levels after China escalated the row with Australia, which spooked markets and boosted the dollar’s haven demand. The focus now shifts towards the US weekly Jobless Claims and Fedspeak for fresh impulse.

Update: Gold price reverses the pullback from intraday high while picking up the bids to $1,790, up 0.15% intraday, ahead of Thursday’s European session. In doing so, the price of gold rises for the second consecutive day as US Treasury yields and the USD are yet to respond to the latest challenges to the risk sentiment.

Among them, Beijing's dumping of the China-Australia strategic economic dialogue mechanism and pressure on the Japanese government to extend the third state of emergency beyond the May 11 deadline are the key factors that recently weigh on market sentiment. Also, India’s fresh record infections above 400K roil the mood and should have challenged gold buyers. Even so, the stock futures are mildly offered ahead of an important day with full markets and crucial events in the UK as well as Eurozone.

Given the gold trader’s rejection of the risk-off mood, buyers are hopeful to attack the $1,800 threshold one more time.

Gold is extending its range play within a $50 band below $1800 into the fifteenth straight session on Thursday, set to end this week with moderate gains. The bulls are eagerly awaiting the US NFP report for a fresh direction.

The price of gold looks to build onto Wednesday’s rebound, as the US Treasury yields remain subdued amid dovish Fed expectations. Markets seem to have shrugged off Treasury Secretary Janet Yellen’s comments on inflation and a likely rate hike, as they believe that the Fed is unlikely to embark upon the tightening or tapering path anytime soon.

The Fed continues to maintain that they are still distant from achieving their employment goal, with about 8 million Americans still out of job since the pre-pandemic levels.

Yellen said Tuesday, ‘it may be that interest rates will have to rise somewhat to make sure our economy doesn't overheat.” Her comments spooked markets that led to a global sell-off, lifting the haven demand for the dollar at gold’s expense.

However, later she walked back on her words, which did help to calm markets and cap the gains in the greenback. Gold, thus, attempted a bounce towards $1800 but failed once again near the previous week high of $1790.

Gold prices continue to find support from the recent surge in the precious metals complex, especially with the price of Palladium sitting at record highs above the $3,000 mark. Silver retreated from two-month highs but the undertone continued to remain bullish amid expectations of a faster global economic recovery, which would boost the industrial demand for silver and palladium.

Gold price and NFP: Key event risk ahead

After the US private sector employment rose only by 742K as against expectations of +800K in April, markets turn cautious ahead of the official NFP print. The ADP release is usually seen as a precursor to the US payrolls data. The US economy is likely to have added 978K last month vs. 916K seen previously.

An NFP disappointment could raise doubts on the strength of the US economic recovery, which could push back the Fed’s tapering expectations, rendering gold-supportive. However, the US dollar could see some resurgent haven demand if the broader market sentiment deteriorates on downbeat figures, which could limit gold’s upside attempts.

Gold: Technical outlook

As observed on gold’s daily chart, the price has been wavering in a familiar range below $1800 since April 16, lacking conviction on either side, as traders seemingly await a strong catalyst for the next directional move.

Gold Price Chart: Daily

The range is getting tighter each passing day, with the 100-daily moving average (DMA), now at $1798 continuing to test the bullish commitments.

Meanwhile, the mildly bullish 21-DMA at $1771 keeps protecting the downside.

The Relative Strength Index (RSI) remains flattish while trending above the central line, highlighting that the bullish potential still remains intact.

A daily closing above the 100-DMA barrier is needed to confirm an upside break from the range, which could bring the $1800 mark back into the picture.

Recapturing the latter is critical for the gold bulls to ride higher towards the February 24 high of $1813.

To the downside, if the 21-DMA support is taken out on a sustained basis, a drop towards the 50-DMA at $1744 cannot be ruled out.

All in all, gold’s fate hinges on the US NFP release. In the meantime, the dynamics in the yields and the dollar will continue to influence the prices.

Gold Futures: Still room for extra gains

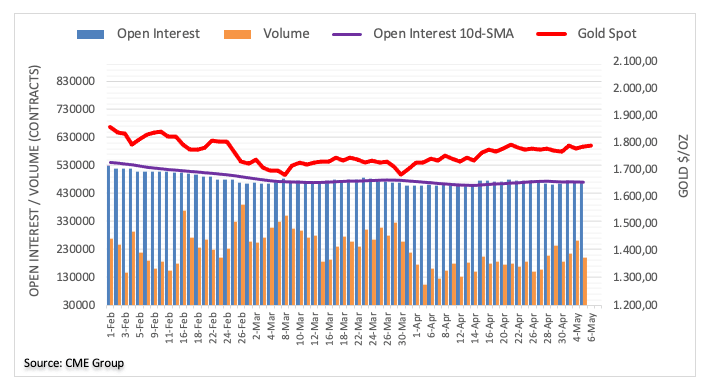

Open interest in Gold futures markets reversed the previous day drop and increased by nearly 1.1K contracts on Wednesday in light of preliminary figures from CME Group. On the opposite direction, volume shrunk by nearly 58.5K contracts after two consecutive daily builds.

Gold remains capped by $1,800

Gold prices edged higher on Wednesday and gradually approaches the key $1,800 level. The move was sustained by rising open interest, indicative that the continuation of the uptrend remains in place in the very near-term. That said, the $1,800 mark per ounce troy stays as the next key barrier for gold-bulls.

Will gold break back above $1800 before silver breaks $27? [Video]

Where are prices heading next? Watch The Commodity Report now, for my latest price forecasts and predictions:

Gold Price Analysis: Softer demand from central banks and jewellery to cap any upside – HSBC

Gold underperformed year-to-date as economic recovery and risk-on sentiment continue. Strategists at HSBC downgrade gold to neutral because they think it will be difficult for the precious metal to rally strongly from current prices amid now higher bond yields.

See – Gold Price Analysis: XAU/USD to suffer some near-term weakness – Commerzbank

XAU/USD has been weak as inflation expectations have pushed higher

“Inflation expectations remain elevated but appear to have peaked. We think inflation concerns will be temporary and mild with central banks still committed to keeping loose monetary policy.”

“The US 10 Year Treasury yield appears to have stabilised around 1.6% after hitting recent highs of 1.75% at end-March signaling that inflation concerns may be abating for the time being.”

“Short-term, we have downgraded gold to neutral as we don’t expect significant capital appreciation over the next 3-6 months, especially with bond yields still elevated.”

Gold: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.