Gold (XAU/USD) remains on the backfoot following the rejection above the $1950 level for the second straight day. The yellow metal failed to sustain the rally fuelled by the ECB’s optimism on the economy, as the US dollar demand returned on the sell-off in Wall Street stocks.

The greenback is likely to hold the reigns amid negative tone on the global markets, as the US-China tensions, Brexit woes and US fiscal deadlock continue to weigh. Let’s look at how gold is positioned in the lead up to the US CPI release.

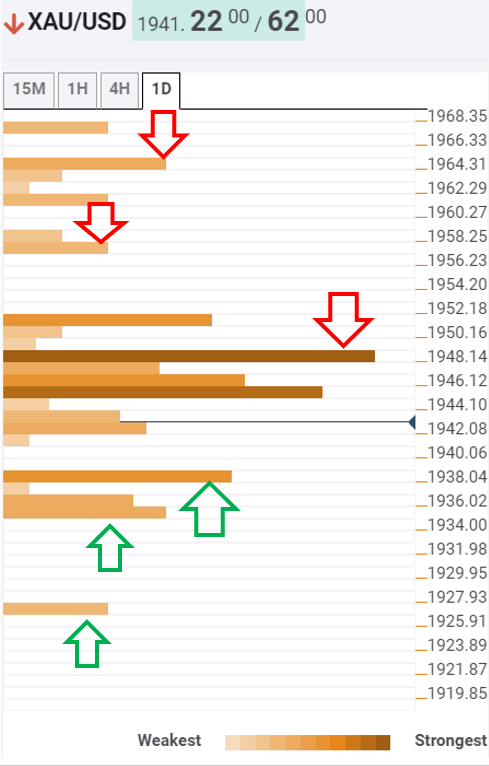

Gold: Key resistances and supports

The Technical Confluence tool shows that gold continues to face stiff resistance around $1945-1950 region, which is the convergence of the Fibonacci 23.6% one-day, Fibonacci 38.2% one-week and one-month.

A firm break above the latter is critical for the further upside, as buyers aim at the soft cap at $1952, the Fibonacci 38.2% one-day.

A sharp rally is likely to follow towards the next significant resistance at $1964-1966, the confluence of the Fibonacci 61.8% one-week and previous day high.

To the downside, immediate cushion awaits at $1938, where the SMA5 one-day, previous low four-hour and Bollinger Band four-hour Middle coincide.

The bears will then test minor support at $1934, the Fibonacci 23..6% one-week, below which the pivot point one-day S2 at $1926 will be put at risk.

Here is how it looks on the tool

About the Confluence Detector

With the TCI (Technical Confluences Indicator) tool, you can easily locate areas where the price can find a support zone or resistance zone and make trading decisions. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points each time. If you are a medium- and long-term trader, this tool will allow you to know in advance the price levels in which a medium / long-term trend can stop your travel and rest, where to undo positions or where to increase your position.

Learn more about Technical Confluence

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains beyond 1.1400 amid renewed USD weakness Premium

EUR/USD extended gains beyond 1.1400 as the US Dollar (USD) fell alongside Wall Street. Business confidence continues to deteriorate amid mounting concerns about a global economic setback. First-tier data later scheduled for later this week could be a make it or break it.

GBP/USD gathers bullish momentum, advances beyond 1.3400

GBP/USD extends its daily climb above the 1.3400 mark in the second half of the day on Monday. Renewed US Dollar weakness amid a lack of fresh developments hinting at a further de-escalation of the US-China trade conflict support the pair ahead of this week's critical data releases.

Gold rebounds above $3,300 as mood sours Premium

Following a bearish opening to the week, Gold gains traction and trades above $3,300 in the American session. Mixed headlines on the ongoing US-China trade war cause markets to remain risk-averse on Monday, allowing XAU/USD to turn north.

XRP extends gains ahead of futures ETFs launch this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.