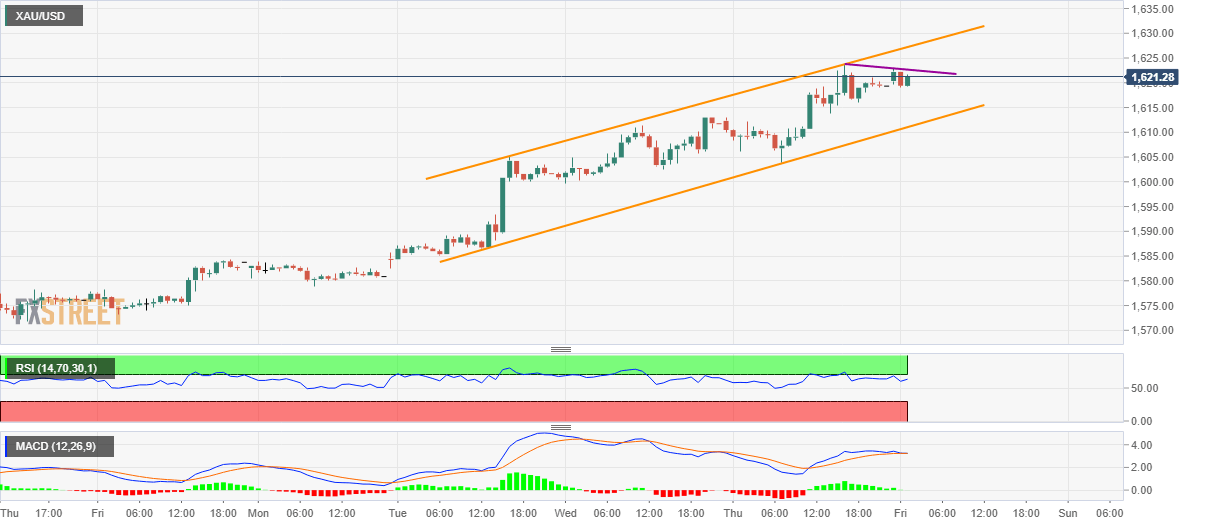

- Gold buyers catch a breath after rising heavily to the fresh 11-year top during the last two days.

- MACD and RSI both favor a pullback while the latest lower highs on the hourly chart support the argument.

- An upward sloping trend channel from Tuesday keeps pleasing the bulls.

Gold prices stay mildly positive around $1,621 during early Friday. The yellow metal has been flashing a lower high formation since its pullback from $1,623.80 while MACD is also likely turning negative. Further to support the odds of a pullback are RSI conditions that signal a halt to the additional upside.

As a result, the bullion may decline to Wednesday’s high of $1,613 while the support line of a short-term rising channel, at $1,611 can question extra downside.

If at all the quote dips below $1,611, $1,605 and $1,600 can entertain the bears ahead of recalling the early-week levels surrounding $1,584/83.

Meanwhile, an upside break of $1,623 can trigger fresh run-up towards the channel resistance of $1,627.

During the precious metal’s additional rise past-$1,627, the rising trendline connecting highs marked during September 20119 and January 2020, close to $1630/31, will be in the spotlight.

Read: Gold Price Analysis: Path of least resistance is up, $1,626 next target – Confluence Detector

Gold hourly chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD struggles to recover above 1.0900 as markets remain cautious

EUR/USD stays on the back foot and trades below 1.0900 following Thursday's sharp decline. Dovish comments from European Central Bank officials and the risk-averse market atmosphere make it difficult for the pair to stage a rebound on Friday.

GBP/USD falls toward 1.2900, looks to post weekly losses

GBP/USD continues to push lower toward 1.2900 in the American session on Friday. Disappointing Retail Sales data from the UK, combined with the US Dollar (USD) recovery amid souring mood, causes the pair to stay under bearish pressure ahead of the weekend.

Gold extends daily slide, trades near $2,400

Gold's correction from the record-high set earlier in the week deepens on Friday. With the US Dollar (USD) benefiting from safe-haven flows and the 10-year US yield holding steady above 4.2%, XAU/USD tests $2,400 and looks to post small weekly losses

Top 10 crypto market movers as Bitcoin and Ethereum hold steady ahead of $1.8 billion options expiry

Bitcoin and Ethereum hold steady above $64,000 and $3,400 as $1.8 billion in options expire on Friday. WazirX hack of $230 million potentially linked to Lazarus Group ushers correction in Shiba Inu, among other assets.

Week ahead – Flash PMIs, US GDP and BoC decision on tap

US data awaited amid overly dovish Fed rate cut bets. July PMIs to reveal how economies entered H2. BoC decides on monetary policy, may cut rates again.