Gold Price Analysis: Downside more compelling for XAU/USD in the NFP week ahead – Confluence Detector

Gold (XAU/USD) shed about 4.5% in the past week, delivering a weekly closing below the August month low of $1863. The yellow metal booked the first weekly loss in three, with the risks skewed to the downside in the US Non-Farm Payrolls (NFP) week ahead.

The persistent haven demand for the US dollar, in the wake of fiscal stimulus wrangling and coronavirus resurgence in key economies, continues to exert the downward pressure on the metal. Further, central banks’ skepticism on providing additional monetary stimulus also undermines the sentiment around gold.

How is gold positioned technically, with all eyes on the critical US NFP release?

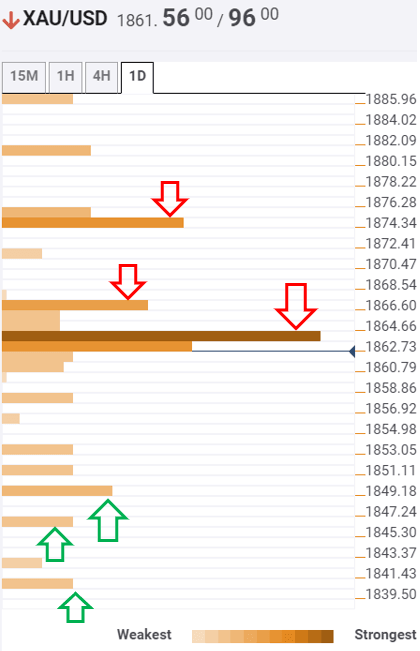

Gold: Key resistances and supports

Gold failed to hold onto the critical $1862 barrier on a daily closing basis. Therefore, the Technical Confluences Indicator suggests that the path of least resistance appears to the downside amid a lack of healthy support levels.

The bears are likely to meet minor hurdles before testing a significant support level at $1849, which is the previous week low.

The next downside targets are seen at $1846 and $1840, the SMA100 one-day and pivot point one-day S2 respectively.

To the upside, a sustained move above the $1862/64 barrier is critical to prompt a minor recovery towards a major cap at $1874, where the pivot point one-day R1 and Fibonacci 23.6% one-week coincide.

The bulls may, however, confront a soft cap at $1866 (Fibonacci 61.8% one-day) before it heads to the latter.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.