Gold Price Analysis: Corrective downside likely while below $1937 – Confluence Detector

Gold (XAU/USD) trades with sizeable gains so far this Monday, having recorded fresh life-time highs at $1944.76 earlier in the Asian session.

The unprecedented level of monetary and fiscal stimulus adopted by the global central banks and governments have weighed heavily on the inflation-adjusted US yields, benefiting the non-yielding gold at the expense of the US dollar.

Meanwhile, the US-China escalation has been the latest catalyst behind the latest rally in the bright metal to fresh records highs. The souring ties between the world’s two largest economies have dented the investors’ sentiment, as they seek safety in the traditional haven, gold.

Attention now turns towards the US Durable Goods Order data and performance on the global stocks for the next move in the prices. Let’s see how it is positioned technically, as indicated by the Technical Confluences Indicator.

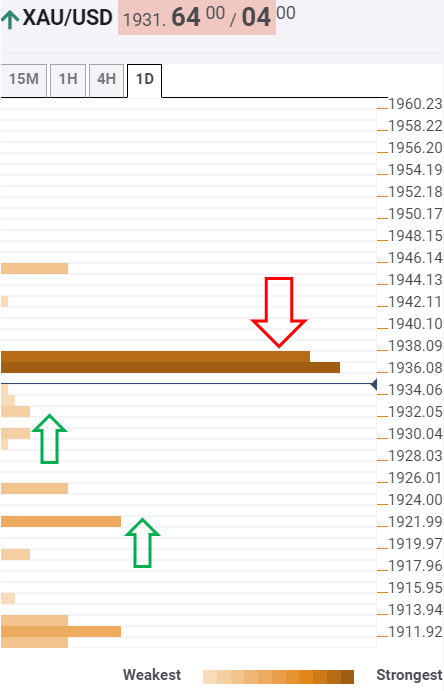

Key resistances and supports

The tool shows that a cluster of minor support levels around $1931 limits gold’s quick retracement from the record highs. That zone is the confluence of the SMA5 one-hour, previous low one-hour and Bollinger Band 15-minutes Middle.

A failure to resist above the aforesaid support area could expose the next support at $1924, the Bollinger Band four-hour Upper.

The bears eye the downside target at $1921.14, the previous record high. A break below the latter could accelerate the corrective downside.

To the upside, the immediate hurdle is around $1937, this is a powerful one, as the pivot point one-month R3, pivot point one-day R3 and pivot point one-week R1 intersect there.

Acceptance above that level could put the latest all-time highs at $1944.76 back to test. The next barrier is aligned at the psychological $1950 level.

Here is how it looks on the tool

About the Confluence Detector

The Confluence Detector is an excellent handy tool to identify important resistance and support levels. Therefore, it helps to determine the path of least resistance for the asset under analysis.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.