Gold Price Analysis: Bulls eye a correction, US PMIs will be key

- Gold price is meeting support and there is a focus on the upside ahead of key data.

- US PMIs are eyed for Friday as a potential catalyst.

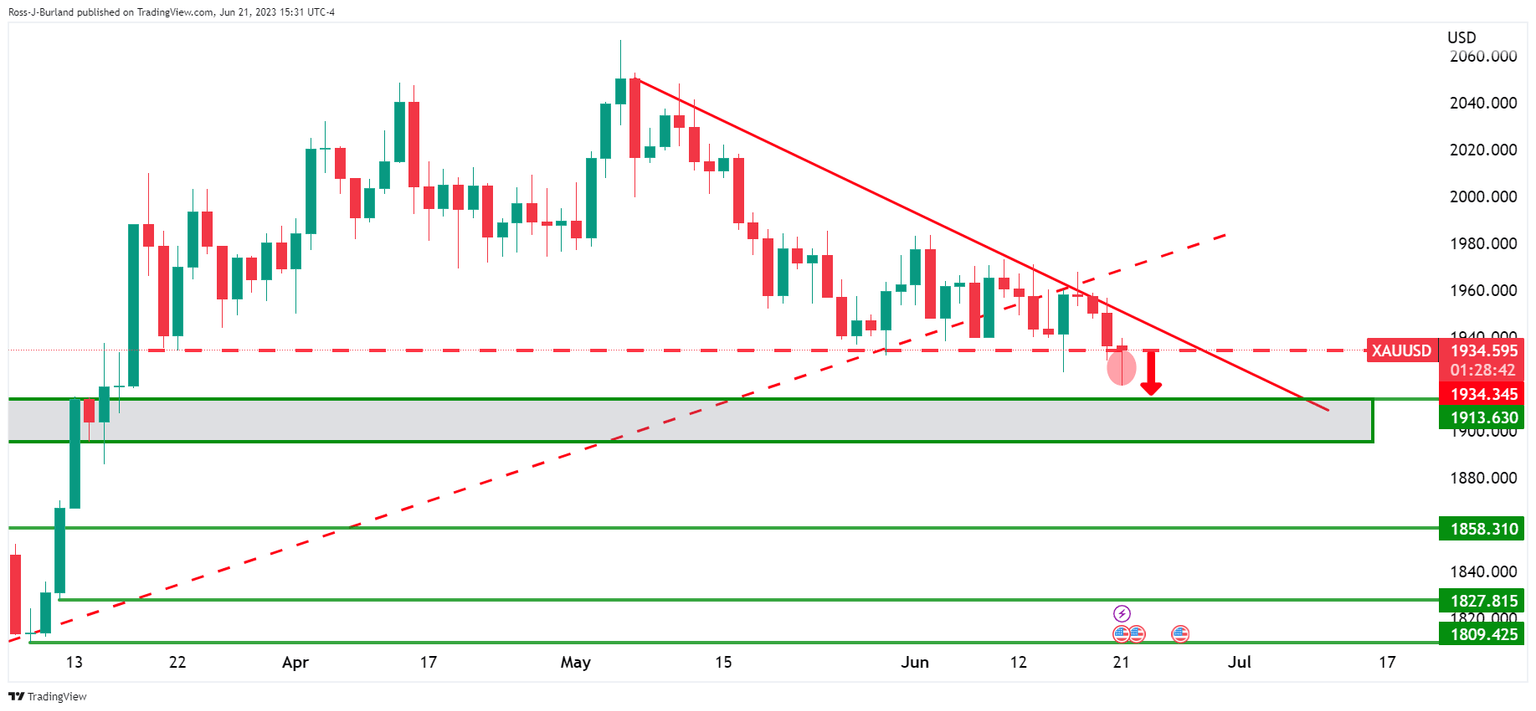

Gold price is down on the day after falling from a high of $1,935 to a low of $1,912.82 with the market getting behind the US Dollar and US yields.

Gold prices fell to the lowest in three months on Thursday as investors fear that US interest rates will rise as the central bank looks to slow the US economy to lower inflation. Fed's Chairman Jerome Powell addressed the Senate Banking Panel and repeated that interest rates are likely to continue on an upward path and that no cuts to rates are coming anytime soon.

The US Dollar, as measured by the DXY index, is currently higher by 0.33% and has travelled between a low of 101.921 and 102.467 so far, The move higher is making gold more expensive for international buyers. Bond yields also moved up which is bearish for gold since it offers no interest. The US 10-year note rallied to a high of 3.808% from a low of 3.711% while the two-year note was last seen paying 4.789%, up 1.42%.

'' While the yellow metal has remained locked in a tight range over the last weeks, the lackluster price action is revealing some implicit weakness as the metal fails to rally despite a slumping USD,'' analysts at TD Securities explained. ''Given our gauge of CTA positioning continues to suggest extremely limited outflows, it is possible that discretionary traders are growing their net short position following the latest FOMC meeting, suggesting traders aren't sceptical about the Fed's hawkish communication.''

The Fed is data-dependent. This makes Friday's data a key event and perhaps we will see a deceleration in the price ahead of the data. Manufacturing will be what will be key as the PMI registered its first decline this year in May, while the services PMI continued to improve, posting its fifth consecutive gain last month.

Gold technical analysis

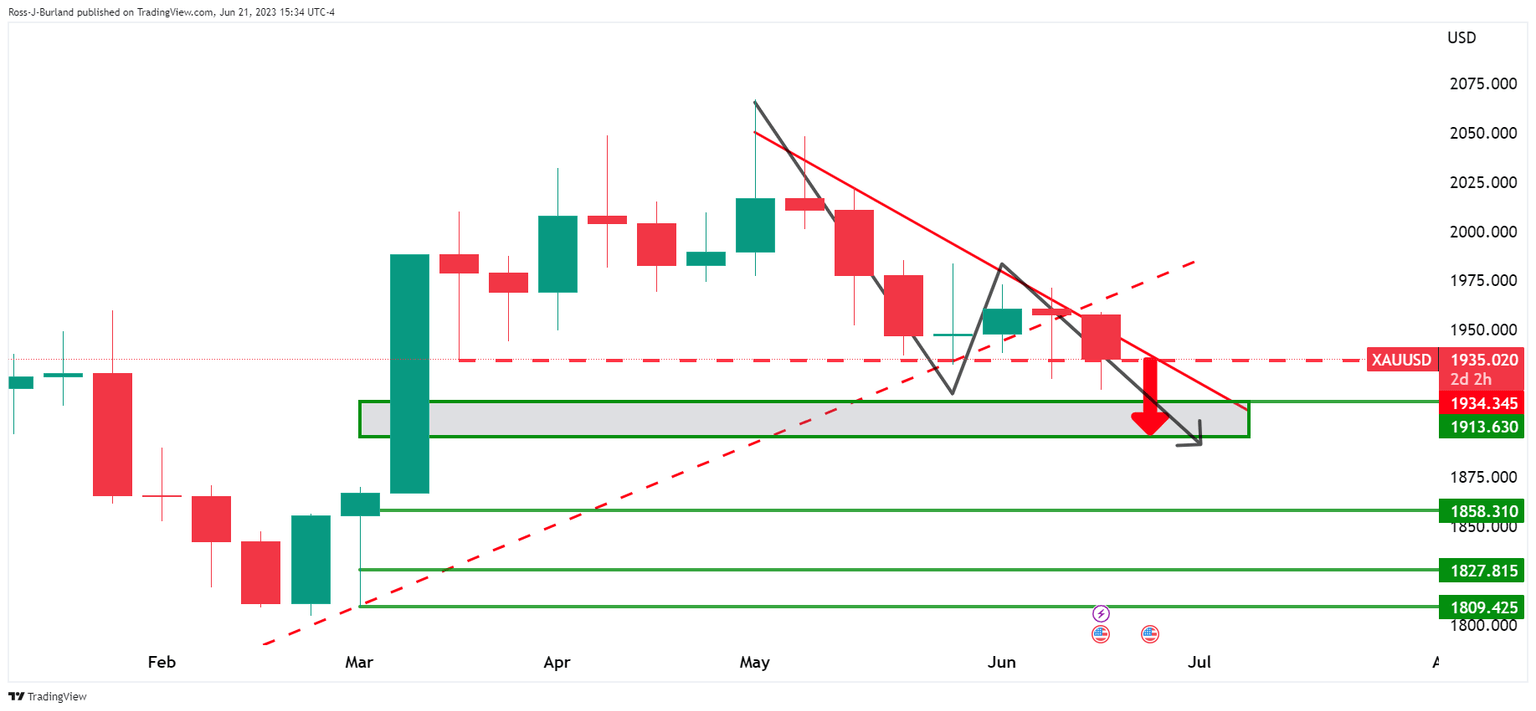

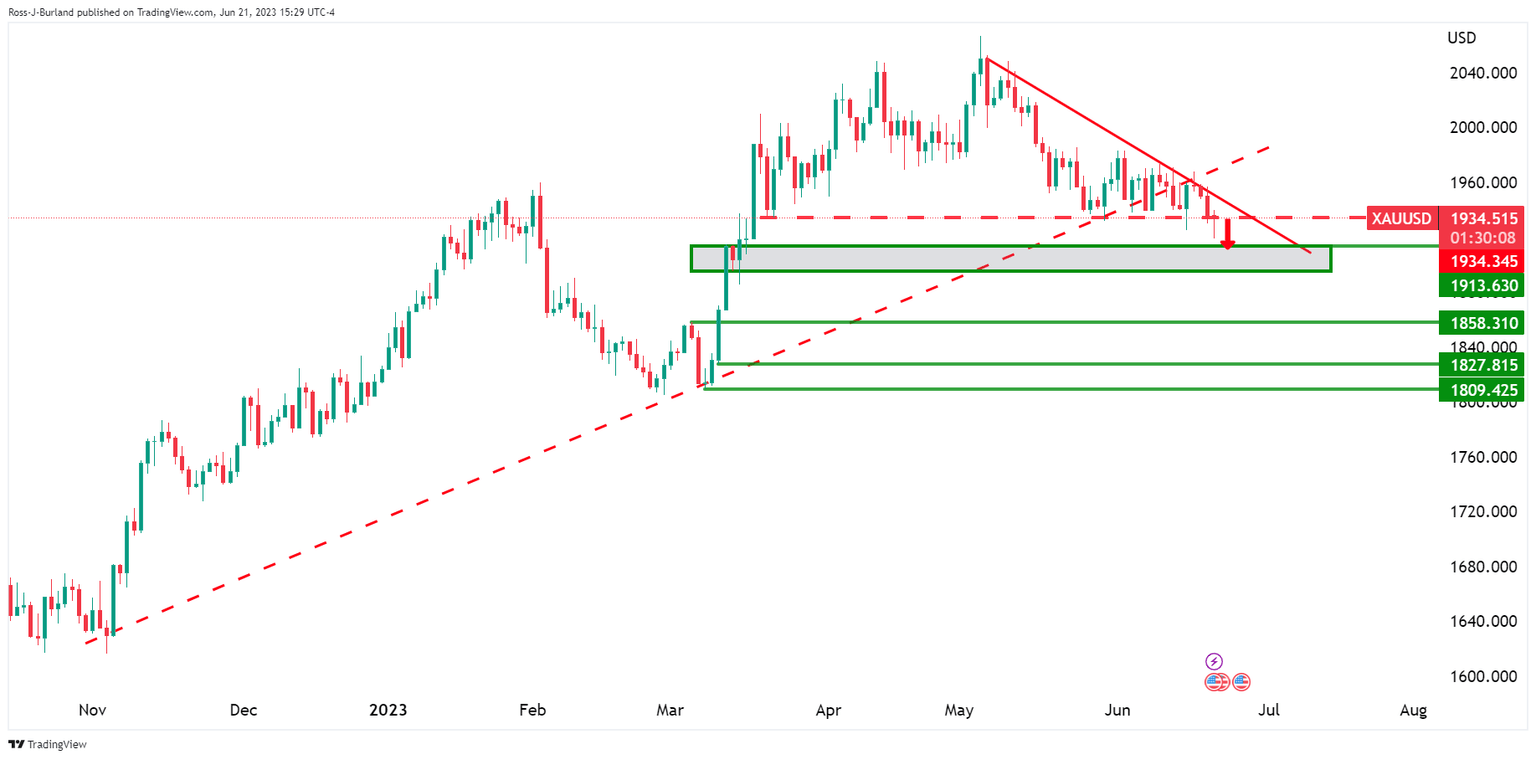

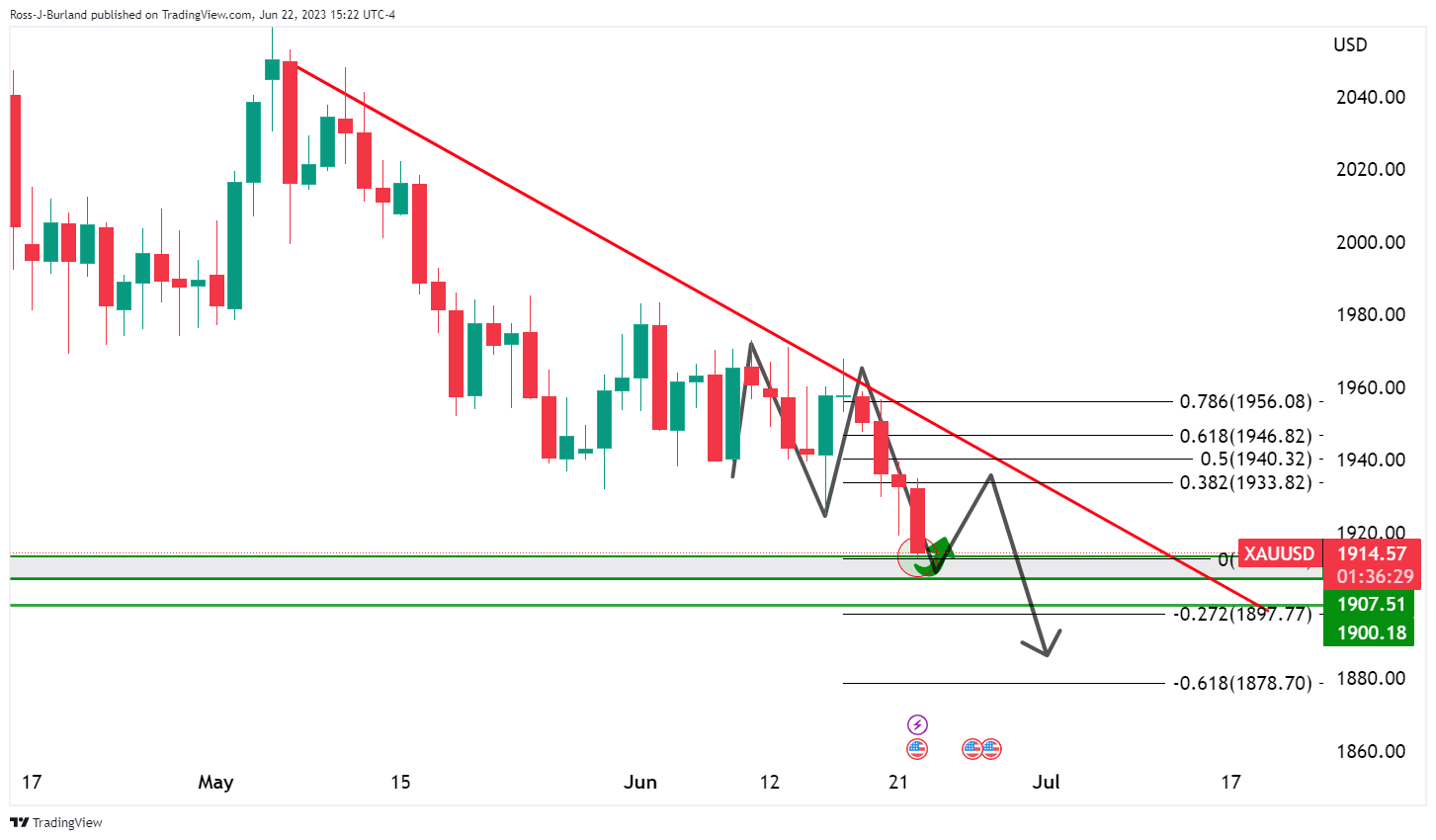

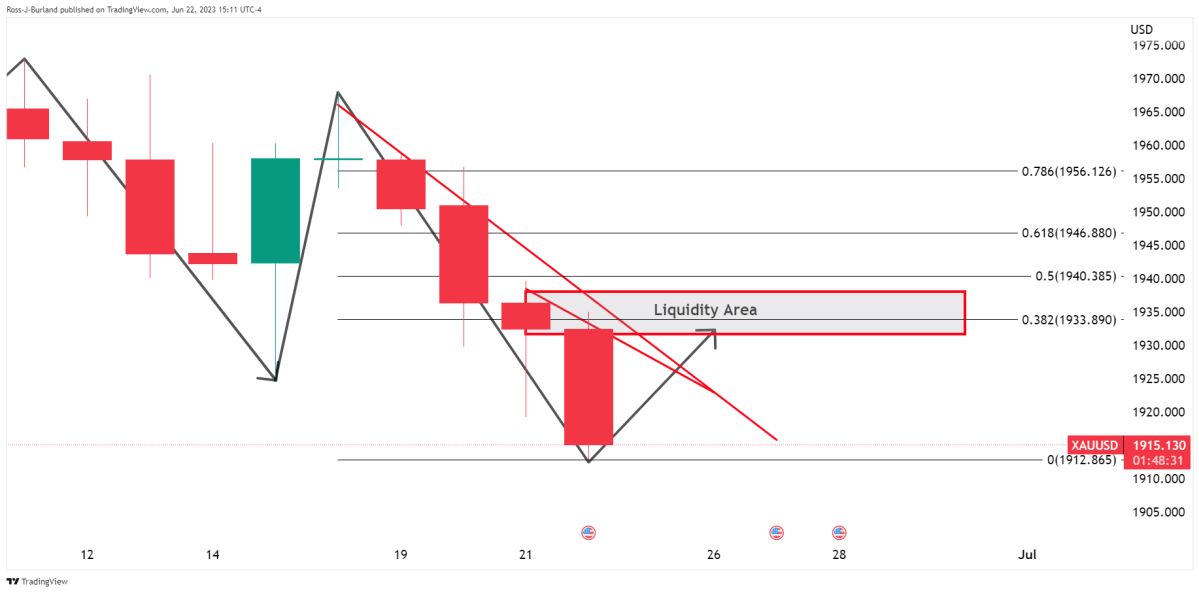

As per the prior day's analysis, Gold Price Forecast: XAU/USD bears eye a breakout, whereby the wick on the daily chart was noted and was expected to be filled in the coming session as a catalyst for a selling programme into support in and around $1,913, we have seen a low of $1,912.82.

Gold prior analysis

There were prospects of a downside continuation on the weekly chart.

Gold daily charts, prior analysis

it was stated, ''From a daily perspective, we are moving into testing the lows while on the front side of the bearish trend. The wick on the chart could've filled in the coming session and this could be the catalyst for a selling programme into support in and around $1,913.''

Gold update

As illustrated, the weekly and daily chart analysis played out.

Gold price outlook

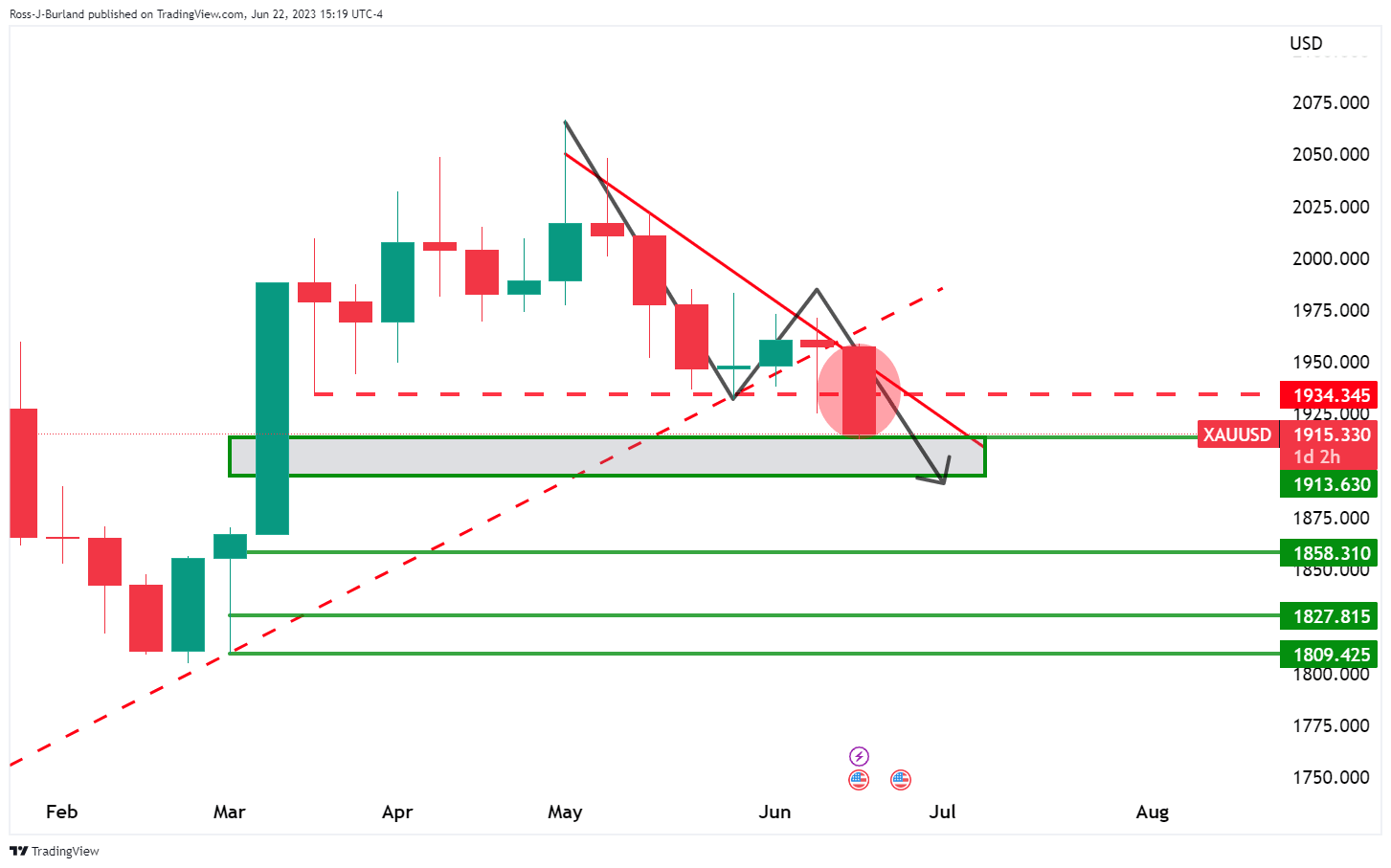

We might see a reversion at this point, into the M-formation's neckline.

On the other hand, should the bears sink in their teeth, the $1,880s will be vulnerable:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.