Gold Price Analysis: Attempted recovery might still be seen as selling opportunity

- Gold gains some traction on Monday and recovers further from one-month lows.

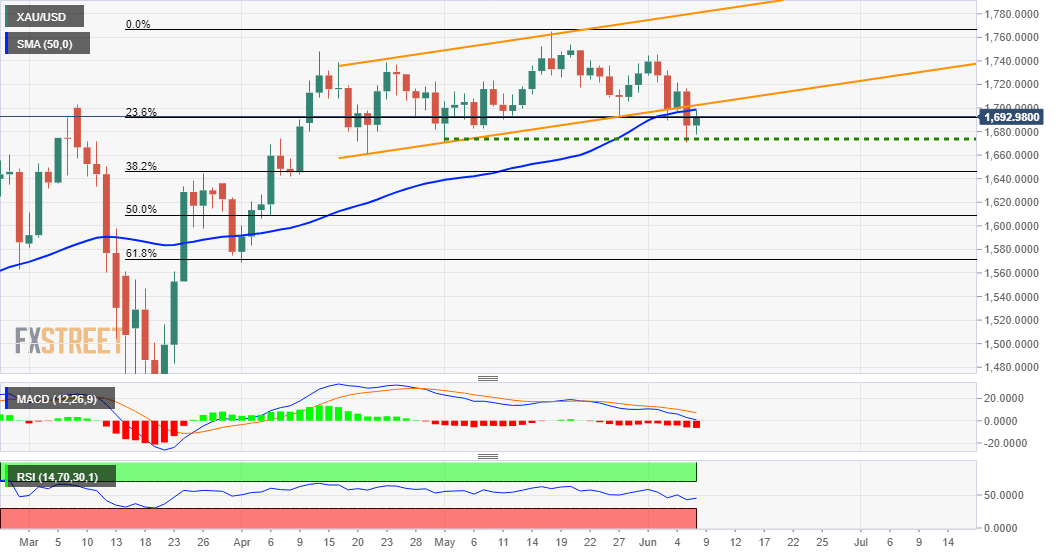

- The near-term technical set-up still seems tilted firmly in favour of bearish traders.

- Move beyond $1700 should remain capped near trend-channel support breakpoint.

Gold managed to close a modest weekly bearish gap of around $10 and was last seen trading near the top end of its daily trading range, just below the $1695 level. The uptick comes after Friday's late rebound from one-month lows, around the $1670 level and supports prospects for additional gains.

Meanwhile, the commodity last week's broke through a short-term ascending trend-channel. A subsequent acceptance below 50-day SMA confirmed a near-term bearish breakdown. This, in turn, warrants some caution before placing aggressive bullish bets or positioning for any further move up.

The negative outlook is further reinforced by the fact that technical indicators on the daily chart have just started drifting into the bearish territory. Hence, the uptick might still be seen as a selling opportunity near the $1700 mark and remain capped near the channel support breakpoint.

On the flip side, bears are likely to wait for some follow-through weakness below the $1670 level support, which if broken will set the stage for a slide towards the $1650 support. The downward momentum could further get extended towards the next major support near the $1635 region.

Gold daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.