Gold back in trader's graces with tariffs set to kick in

- Gold props up over 0.50% at the start of the week despite tariffs being set to hit on Tuesday.

- Federal Reserve rate cut bets are still on the table for June.

- Gold price is slowely but surely making its way higher this Monday as President Trump remains silent on tariffs.

Gold’s price (XAU/USD) is set to revisit the high in the Asian session near $2,876 at the time of writing after a steady positive Monday thus far. Tariffs are still set to hit on Tuesday for Mexico and Canada and additional tariffs on China, they are not really triggering another flight into Gold. Traders will need to look for new headlines about tariffs, and there is still the chance that United States (US) President Donald Trump will change his mind.

Meanwhile, traders are still digesting Friday’s turn of events. The spat between Ukraine President Volodymyr Zelenskyy on one side and US President Trump and Vice-President J.D. Vance is still making headlines. The surprise move that took place afterward in London, with the United Kingdom extending several billions in loans to be covered with the frozen Russian assets in Europe, was actually something that President Trump was after. With no rare earth deal in place, the televised spat in the Oval Office, and now London reeling in the agreement on the frozen Russian assets, all bets could be off the table with even possibly the US withdrawing from NATO.

Daily digest market movers: No headlines yet

- Ghana’s new central bank chief, Johnson Asiama, has suspended the West African nation’s program of paying for Oil with Gold and said he expects the Ghana cedi (GHC) to stabilize after its volatility of last year, Bloomberg reports..

- The CME Fedwatch tool shows a 77.6% chance of a lower monetary policy rate for the Federal Reserve (Fed) in June, while the odds of keeping it unchanged are 22.4%.

- At 18:00 GMT, Federal Reserve Bank of Richmond President Thomas Barkin delivers a speech, "Inflation Then and Now", in Fayetteville Cumberland Economic Development.

- The US 10-year benchmark rate is currently trading around 4.23% on Monday, a touch higher from its fresh low at 4.19% on Friday.

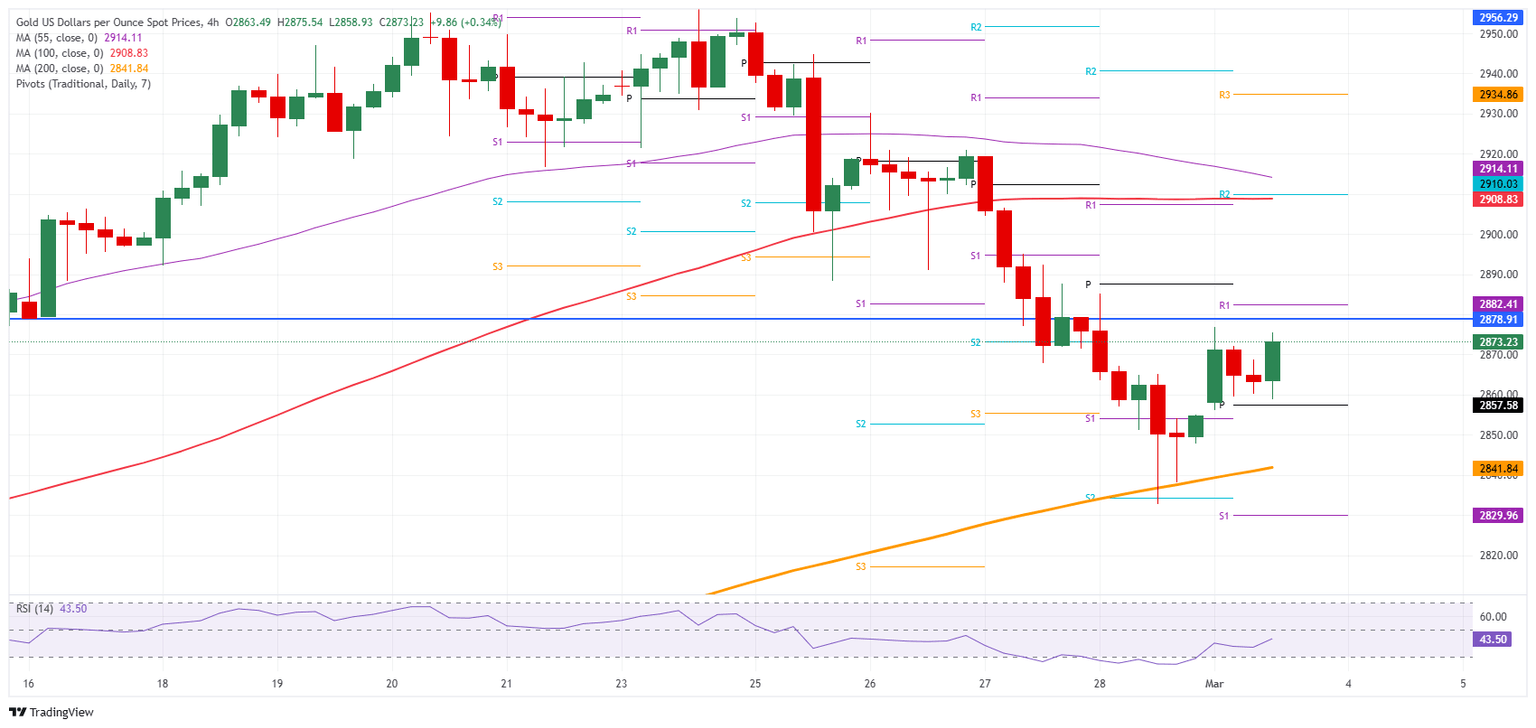

Technical Analysis: Heading into recovery

It looks like the cat is out of the bag for now. Last week, traders received all the information they needed, and the first new tariffs under the second term from US President Trump are set to kick in on Tuesday. For Bullion to be enabled to make a fresh all-time high, or at least move in that direction, new tariffs will be needed. Besides that, a continuous descent in yields would also help, where both drivers would be enough to see a steep rally in Gold prices again.

The daily Pivot Point at $2,857 is currently providing support to bounce off from and attempt to push Bullion higher. Further up, the daily R1 resistance at $2,882 is the first big level to watch out for and converges with February 14 and 17 lows. In case Gold has enough oomph to break through there, the daily R2 resistance at $2,910 will possibly be the final cap on Monday.

On the downside, the S1 support at $2,835 converges with Friday’s low. That will be vital support for Monday. If Bullion bulls want to avoid another leg lower, that level must hold. Further down, the dailyS2 support at $2,805 should be able to catch any additional downside pressure and will try to avoid a break below $2,800 and $2,790.

XAU/USD: 4H-Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.