Gold touches record highs on expectations of global interest rate cuts

- Gold breaks to new record highs on Friday as central banks worldwide are expected to follow the Fed’s example.

- The precious metal shot to a new high after the Fed’s decision to slash borrowing costs by 0.50% on Wednesday.

- As traders say, the “trend is your friend,” and technically, Gold is in a strong uptrend in all time frames.

Gold (XAU/USD) breaks to a new record high in the $2,610s on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates. Lower interest rates are positive for Gold, as they reduce the opportunity cost of holding the non-interest-paying asset, making it more attractive to investors.

Following Wednesday’s Fed decision, the South African Reserve Bank (SARB) cut its key interest rate by 25 basis points (bps) on Thursday – the first cut since the Covid pandemic in 2020. The Central Bank of the Philippines cut interest rates by 250 bps to 7.0% at its meeting on Friday. The Reserve Bank of India (RBI) is now also widely expected to slash interest rates in sympathy with the Fed when it next meets.

Although the People’s Bank of China (PboC) kept its key lending rates unchanged at the September fixing on Friday, the one and five-year loan prime rates lie at record lows of 3.35% and 3.85%, respectively, after the bank made a surprise cut in July. The Bank of Japan (BoJ), meanwhile, left rates unchanged at its meeting on Friday, despite some speculation of a rate hike in the offing.

Gold breaks above previous record highs

Gold smashes above the previous record highs set on Wednesday of $2,600 following the Fed’s decision. At this meeting, the US central bank decided to cut interest rates by a double-dose of 50 pbs (0.50%).

The upside for the yellow metal was capped, however, by the Fed’s broadly positive outlook for US growth, which the central bank saw remaining stable at about 2.0% per year until the end of 2027. This suggested a “soft landing” profile for the economy, which is broadly positive for sentiment. However, this was probably negative for the safe-haven Gold. Thus, the precious metal quickly fell after peaking.

At the same time, increased geopolitical risk aversion might be generating supportive safe-haven flows. Israel’s use of exploding pagers and walkie-talkies to eliminate and injure Hezbollah agents in Lebanon has increased the risk of an escalation in the Middle East conflict, potentially supporting the precious metal.

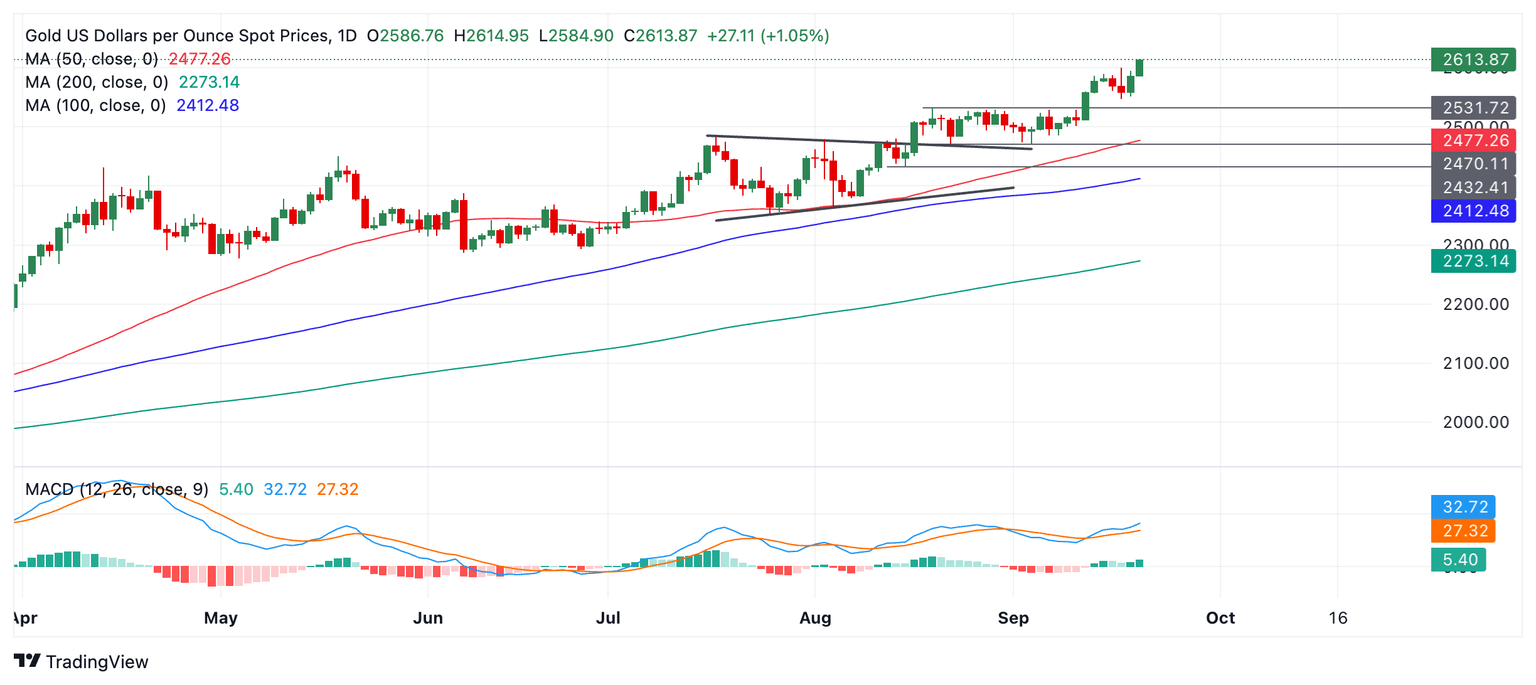

Technical Analysis: Gold makes new high as uptrend extends

Gold has broken through to new highs on Friday, above the previous record high of $2,600 set after the Fed meeting on Wednesday.

The technical analysis dictum says that “the trend is your friend,” which means the odds favor more upside for the yellow metal in line with the dominant long, medium, and short-term uptrends.

XAU/USD Daily Chart

The next targets to the upside are the round numbers: $2,650 first and then $2,700.

Gold is still not quite overbought, according to the Relative Strength Index (RSI) in the daily chart above, which also leaves room for more upside.

In the event that Gold’s RSI enters the overbought zone on a closing basis, however, it will advise traders not to add to their long positions.

If it enters and then exits overbought, it will be a sign to close longs and sell, as it would suggest a deeper correction is in the process of unfolding.

If a correction evolves, firm supports lies at $2,550, $2,544 (0.382 Fibonacci retracement of the September rally), and $2,530 (former range high).

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.