Gold holds on to near 1% gain in safe-haven favoritism

- Investors flock into precious metals and push Gold to fresh all-time highs at $2,877 on Wednesday.

- Equities correct amid Asia reopening after Chinese New Year holidays.

- Gold sets forth rally and enters its fifth day of gains.

Gold’s price (XAU/USD) is rallying near 1% on Wednesday and is into its fifth consecutive day of gains, accounting for more than 2.5% of gains this week and hitting fresh all-time highs near $2,877 while investors pile into the precious metal commodity. Softer economic data from the United States (US), which further supports the case for another rate cut from the Federal Reserve (Fed), together with quickly fading tariff fears, is lifting Gold to higher levels day by day.

On the economic data front, the calendar could become an additional tailwind for Gold to stretch even higher. This Wednesday, US Purchasing Managers Index (PMI) data for January will be released. A softer PMI print could be enough to set off Gold again to a new all-time high.

Daily digest market movers: Stretching higher

- Investors and traders are parking their cash under Gold, away from tech stocks, whilst being safe from the fresh lows in US yields as inflation concerns abate, Bloomberg reports.

- At 14:45 GMT, S&P Global will release the January final reading for the Purchasing Managers Index. The ISM Services PMI is expected to stay stable at 52.8.

- At 15:00 GMT, the Institute for Supply Management (ISM) will also release its PMI data for the Services sector as a whole:

- The PMI is expected to tick up to 54.3 from 54.1 in December.

- The Prices Paid component was at 64.4 last time and has no forecast.

- The CME FedWatch tool shows an 83.5% chance of keeping interest rate unchanged in the March 19 meeting, compared to 16.5% for a 25 basis points rate cut.

Technical Analysis: Gold is the investor sweet spot

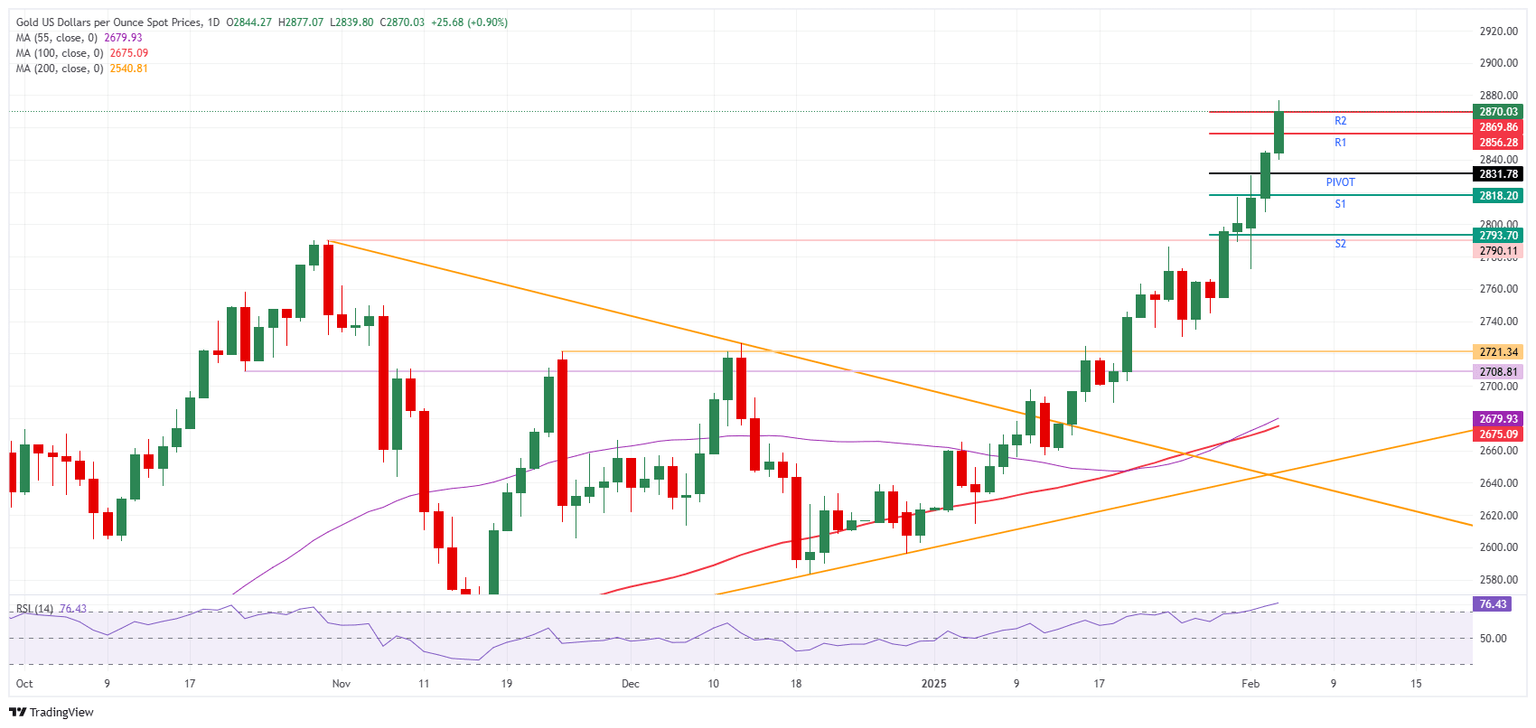

Gold is on a tear again, and with China heading back into markets after the Chinese New Year holidays, expect to see a catch-up move in assets. With the Bullion rally heading into its fifth day on Wednesday, expect Chinese traders to try to catch up with it, meaning that any brief dip or pullback will be bought with interest. Since there are no reference levels that bear historic value anymore, the intraday Pivot Point levels are becoming increasingly important.

The Pivot Point level for this Wednesday is the first nearby support at $2,831. From there, S1 support should come in at $2,818, though it does not look the best. Instead, look for S2 support at $2,793, which roughly coincides with$2,790 (the previous high of October 31, 2024) as a more significant level.

On the other side, R2 resistance at $2,869 is the next level to watch, followed by the logic big figures such as $2,880 and $2,900. Further up, some analysts and strategists have already called for $3,000.

XAU/USD: Daily Chart

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.