Gold pushes to new highs as media revives debate over Fed rate cuts

- Gold is hitting record highs on Friday as markets debate anew whether the Fed will cut by 50 or 25 basis points in September.

- The revival of the possibility of a “jumbo” 0.50% cut fuels another rally in Gold.

- Gold’s broad uptrend resumes although momentum is flashing “overbought”.

Gold (XAU/USD) is exchanging hands in the $2,580s on Friday, trading about 0.90% higher on the day after posting new record highs on Thursday when it broke decisively out of a range it had been oscillating in since it peaked on August 20.

The initial catalyst for the breakout was the release of mixed “factory gate” price inflation data, or Producer Price Index (PPI) data out of the US for August. The figures showed a deeper-than-expected slowdown in headline PPI, and although core PPI remained sticky, the market reacted as if the data was disinflationary.

Gold extends rally after media reignites debate over 0.50% vs 0.25% Fed cut

Gold continued to rally during Friday’s Asian session due to the revival of the debate over whether the Federal Reserve (Fed) will cut interest rates by 0.50% or 0.25% at its meeting next Wednesday.

The release of still-high core consumer price inflation data, in the form of the Consumer Price Index (CPI) on Wednesday, had seemingly put to bed hopes of a “jumbo” 0.50% (50 pbs) cut. However, an article by a respected The Wall Street Journal (WSJ) Fed Watcher Nick Timiraos, as well as comments from former President of the New York Fed William Dudley, suggested a 0.50% should still be considered. This, in turn, led to a fall in US Treasury yields, a sell-off in the US Dollar (USD), and a rally in Gold’s price.

Lower interest rates are positive for Gold because it reduces the opportunity cost of holding the non-interest-bearing asset, making it more attractive to investors.

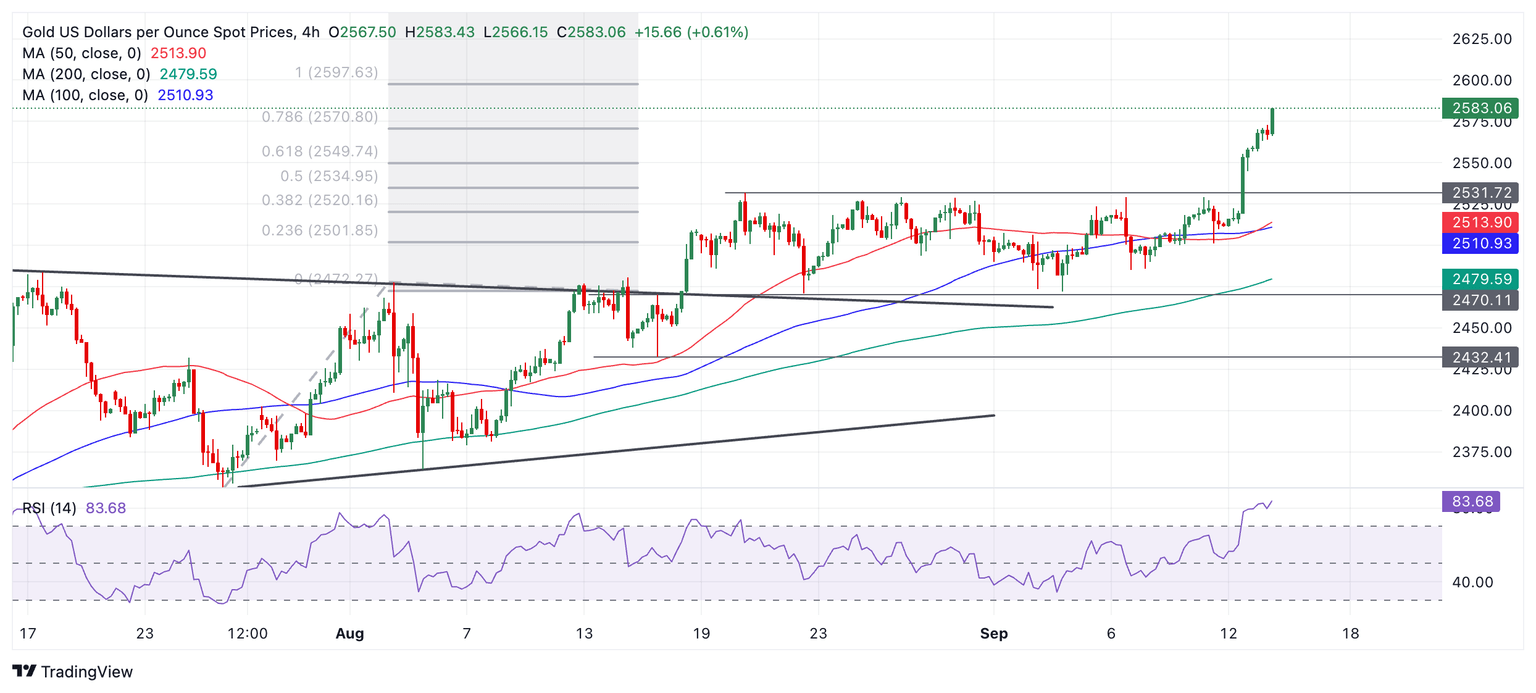

Technical Analysis: Gold pushes to record highs as broad uptrend resumes

Gold (XAU/USD) breaks out of its multi-week sideways range and surpasses the previous record highs of $2,531.

The longer-term trend for Gold is bullish, and according to technical analysis theory, since “the trend is your friend,” this favors a continuation of the uptrend.

XAU/USD 4-hour Chart

The precious metal has met its previous target at $2,550, generated after the original breakout from the July-August range on August 14, and now sets its sights on the next target at around $2,590.

Gold is overbought, however, according to the Relative Strength Index (RSI). This advises long holders not to add to their positions because of an increased risk of a pullback materializing.

If the RSI exits overbought, it will signal a correction is unfolding. If such a correction unfolds, it will likely find support either at the $2,550 prior target or firmer support lower at the $2,531 former high.

The trend on all timeframes remains bullish, however, suggesting any correction will eventually run out of steam and the broader uptrend will resume, pushing the yellow metal to new highs.

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Thu Sep 12, 2024 12:30

Frequency: Monthly

Actual: 1.7%

Consensus: 1.8%

Previous: 2.2%

Source: US Bureau of Labor Statistics

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.