Gold clocks 7.0% decline so far in November

- Gold trades substantially lower due to pressure from US political factors.

- It has weakened nearly 7.0% in November so far as a result of Donald Trump and the Republican’s political gains.

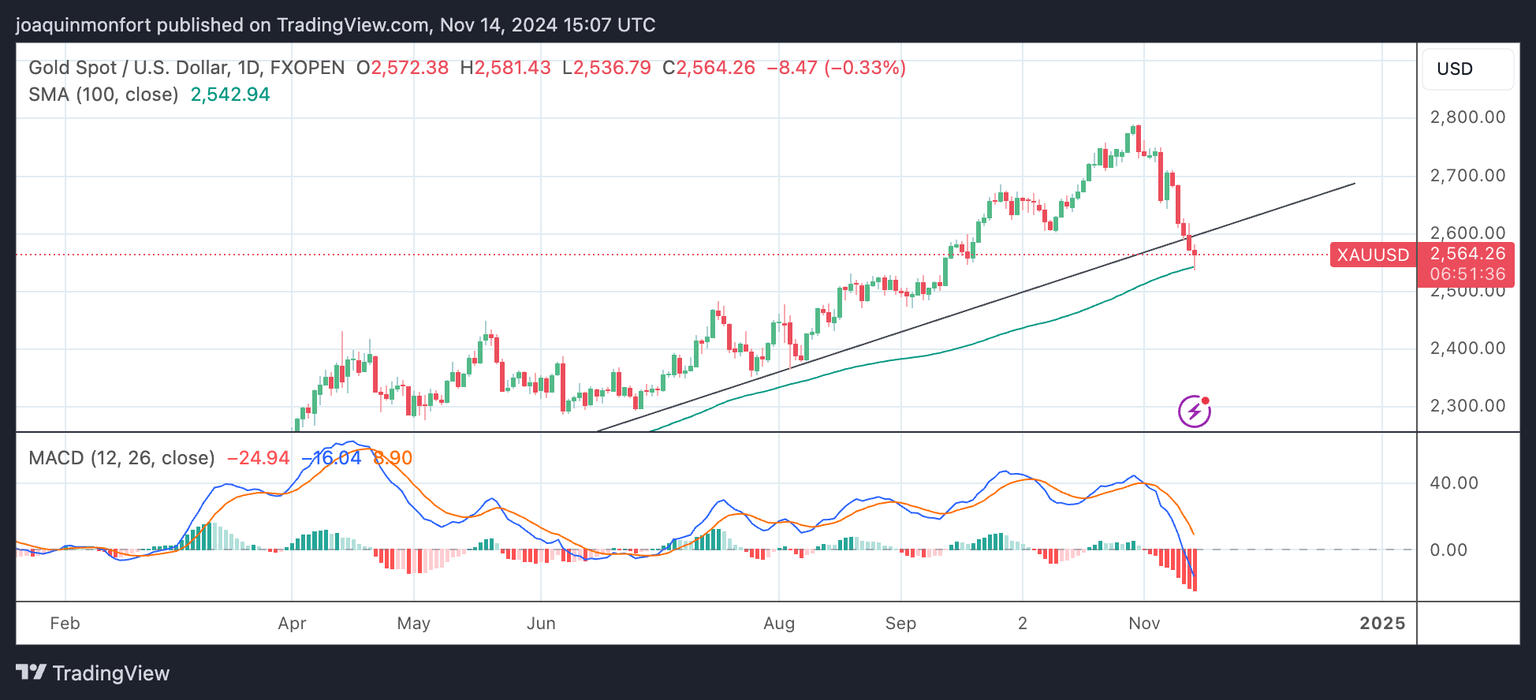

- XAU/USD breaks through a major trendline and declines to the 100-day SMA.

Gold (XAU/USD) is trading down almost 7.0% from its peak, so far in November as markets absorb the impact of the seismic shift in US politics that has occurred since the election of former President Donald Trump.

The precious metal further extends its decline on Thursday, breaking below a major trendline and reaching the $2,560s after the news that the Republican Party has won a majority in the US Congress, which means it now controls the White House, Senate and the House of Representatives.

Control of the legislature will enable Trump to push through economic policies that the market gauges as inflationary but also broadly positive for the US Dollar (USD). Gold is falling because a stronger US Dollar is negative for the precious metal, which is mainly priced and traded in USD.

The outlook for interest rates is offsetting this effect, particularly after the release of recent US inflation data. This helped reassure markets that the Federal Reserve (Fed) would push ahead with an expected 25 basis point (bps) (0.25%) interest rate cut at its December meeting. Lower interest rates are generally positive for non-interest paying Gold because they increase its attractiveness in the eyes of investors compared to other assets.

Gold declines as trend-followers exit and traders turn to other assets

Gold is also suffering due to outflows from Gold Exchange Traded Funds (ETFs), which allow investors to purchase “stocks” in Gold, enabling them to hold the commodity without actually purchasing physical Gold bullion. Gold ETFs shed around $809 million (12 tonnes) net in early November, driven by North American outflows and partially offset by Asian inflows, according to the World Gold Council (WGC) data.

Part of the reason for the outflow is likely major hedge funds exiting their huge long positions after riding the uptrend to the October record highs. Another could be competition from alternative assets such as Bitcoin (BTC), which is trading above $90,000, at new all-time highs, because of expectations the Trump administration will relax crypto regulation.

US stocks are also rising as investors anticipate lower corporation tax and looser regulations, boosting company profits, and this might also be diverting funds away from the precious metal.

Demand for Gold is also falling in China, the world’s largest consumer of the yellow metal, amid an economic slowdown that is expected to accelerate as the new US administration steps up its trade war with the country.

Gold generally rises as a result of investors seeking safety amid a rise in geopolitical risks. These may now wind down if Donald Trump can hold true to his promises to bring an end to conflicts around the globe. The news that South Korea has made a U-turn on promises to send lethal aid to Ukraine on Thursday, whilst far from reassuring to Ukraine, could be taken as a sign of tentative moves towards de-escalation.

In the Middle East, meanwhile, although the bombings continue, attempts are being made to agree to a US-led ceasefire in Lebanon before the Biden administration hands over control to Donald Trump’s government. The odds of success, however, remain slim, according to a Reuters report.

Trump’s appointment of Former Arkansas Governor Mike Huckabee as Ambassador to Israel could further inflame the conflict. Huckabee is a known Zionist and supporter of Israeli Prime Minister Benjamin Netanyahu. He has said he does not support a two-state solution to the Israeli-Palestinian problem and sees the West Bank as belonging to Israel. His appointment could embolden Israel to make more audacious attacks. If so, it could drive safe-haven flows to Gold.

Technical Analysis: XAU/USD breaks below major trendline and continues south

Gold breaks cleanly through a major trendline and extends its decline. According to technical analysis, the precious metal is now in a short and probably medium-term downtrend, and, given it is a principle of technical analysis that “the trend is your friend,” the odds favor a continuation lower.

XAU/USD Daily Chart

Gold has now fallen to the next support level and target at around $2,540 and the 100-day Simple Moving Average (SMA).

A decisive break below the 100 SMA would indicate yet more weakness to the next target at around $2,477 and the July and August highs.

The precious metal remains in an uptrend on a long-term basis, raising the risk of a reversal higher in line with its broader up cycle.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.