Gold prices dip in face of strengthening US Dollar

- Gold slightly down in late trading, still up 0.40% for the week amid geopolitical tensions.

- Mixed US economic data; higher Housing Starts, lower Building Permits minimally impact Bullion.

- Fed Governor Waller's dovish comments suggest potential for early rate cuts.

Gold's price dropped late in the North American session, but it is set to finish the week with gains of over 0.40% as market players await the inauguration of US President-elect Donald Trump. Although the XAU/USD trades at $2,701, down 0.44%, investors continued to buy the golden metal due to political uncertainty.

The precious metal continues to be driven by geopolitics and politics in the United States (US). Although US Treasury bond yields in the belly of the curve remained unchanged, Bullion buyers failed to push prices higher to book additional gains ahead of the weekend.

The US economic schedule showed that Housing Starts jumped double digits, though Building Permits contracted in December. Gold barely reacted to the news, as most of the data revealed during the week, led by Retail Sales featured on Thursday, suggest the economy is solid.

The US Dollar Index (DXY), which tracks the USD's performance against a basket of six peers, surged 0.35% to 109.34.

Other data revealed during the Asian session showed that China’s economy hit a 5% Gross Domestic Product (GDP) growth rate in 2024, according to the National Bureau of Statistics.

On Thursday, Fed Governor Christopher Waller tilted dovish and commented that the US central bank could lower borrowing costs sooner and faster if the disinflation process evolves.

Market participants are pricing in near-even odds that the Fed will cut rates twice by the end of 2025 and see the first reduction in June.

Source: Prime Market Terminal

Next week, the US economic docket will feature the US Presidential Inauguration, the release of Initial Jobless Claims and Flash PMIs data.

Daily digest market movers: Gold price pressured ahead of the weekend

- Gold fell as real yields remained firm on Friday. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS) yield, was virtually unchanged at 2.18%.

- The US 10-year Treasury bond yield was unchanged at 4.618%, a headwind for the golden metal.

- US Housing Starts jumped from 1.294 million to 1.499 million in December, a jump of 15.8% MoM.

- Building Permits for the same period shrank as permits dipped from 1.493 million to 1.483 million, a 0.7% drop.

- The latest inflation data and Fed Waller’s comments pressured the US Dollar, as traders had grown confident the Fed would cut rates sooner rather than later. Waller didn’t rule out a cut in the March meeting as inflation “is getting close to what our 2% inflation target would be.”

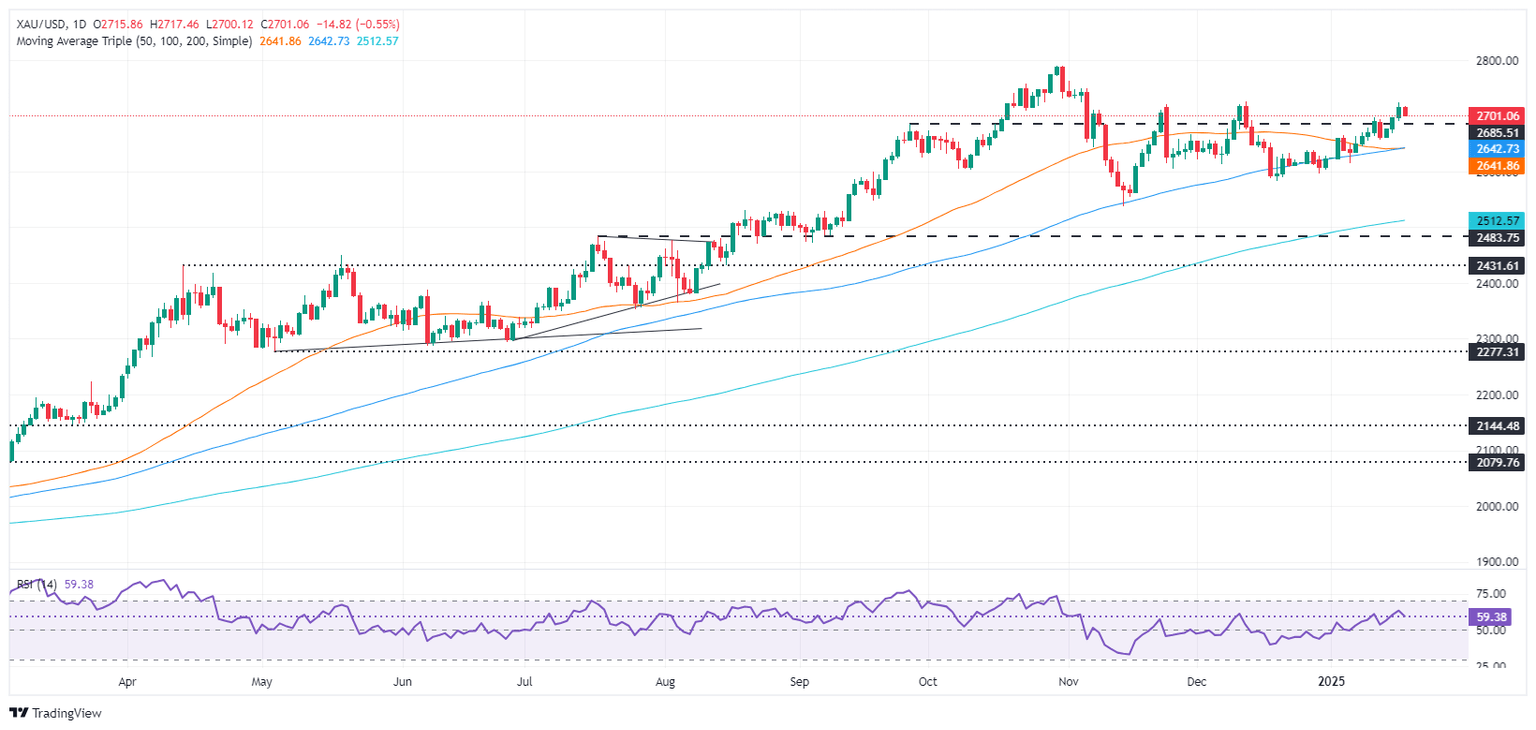

XAU/USD technical outlook: Gold hold firm near $2,700

Gold prices fell amid the lack of catalysts ahead of the weekend. Nonetheless, buyers must keep XAU/USD’s prices above $2,700, so they can remain hopeful of pushing the yellow metal toward the December 12 high of $2,726. Once surpassed, the next stop would be $2,750, followed by the all-time high at $2,790.

On the other hand, buyers’ failure to achieve the previously mentioned outcome could mean Gold might test the January 13 swing low of $2,656, followed by the confluence of the 50 and 100-day Simple Moving Averages (SMAs) at $2,639 - $2,642.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.