Gold pushes higher as Middle East conflict rages on

- Gold continues its uptrend as the conflict in the Middle East remains unabated.

- The changing outlook for global interest rates, however, could put a limit on Gold’s upside.

- XAU/USD trends higher as a multi-time-frame uptrend extends.

Gold (XAU/USD) continues higher after the briefest of pullbacks to trade once more in the $2,730s on Tuesday. The yellow metal is rallying due to increased safe-haven demand because of the intensifying conflict in the Middle East, although it has slowed its pace as bonds sell off around the world due to a revision of the outlook for global interest rates.

From previously expecting interest rates to fall sharply, investors now see a gentler slope because unexpectedly strong US data eliminated the chances of another double-dose 50 basis point (bps) (0.50%) mega cut by the Federal Reserve (Fed). This, in turn, reduces Gold’s attractiveness as a non-interest-paying asset.

Gold could further shine as the members of the BRICS bloc meet for their annual summit in Russia. With de-dollarization on the agenda, a new Gold-backed currency for use by the BRICS is likely to at the top of list of options, leading to further likely upside for the precious metal, according to FXEmpire's James Hyerczyk.

Gold rises on safe-haven flows

Gold rallies as investor demand for safety increases due to the worsening conflict in the Middle East. Despite the eleventh visit to the region by US Secretary of State Anthony Blinken since the start of the conflict, a cease-fire deal seems as elusive as ever.

On Tuesday morning, Hezbollah announced that it had launched rockets at two bases near Tel Aviv and one near Haifa. This followed a series of Israeli airstrikes on southern Lebanon and Beirut. In one Israeli strike near Beirut’s Hariri Hospital, the death toll is said to have risen to 13, according to the Lebanon Ministry of Health, as per Reuters.

On Monday, Israel stepped up its bombardment of Beirut by destroying several economic targets in an attempt to wipe out the bank that provides Hezbollah with its funding.

An expected Israeli retaliatory attack on Iran is also back on the table after an Iranian drone penetrated Israeli air defense systems and exploded near Israeli Prime Minister Benjamin Netanyahu’s private residence over the weekend.

Technical Analysis: Gold rallies toward next upside target

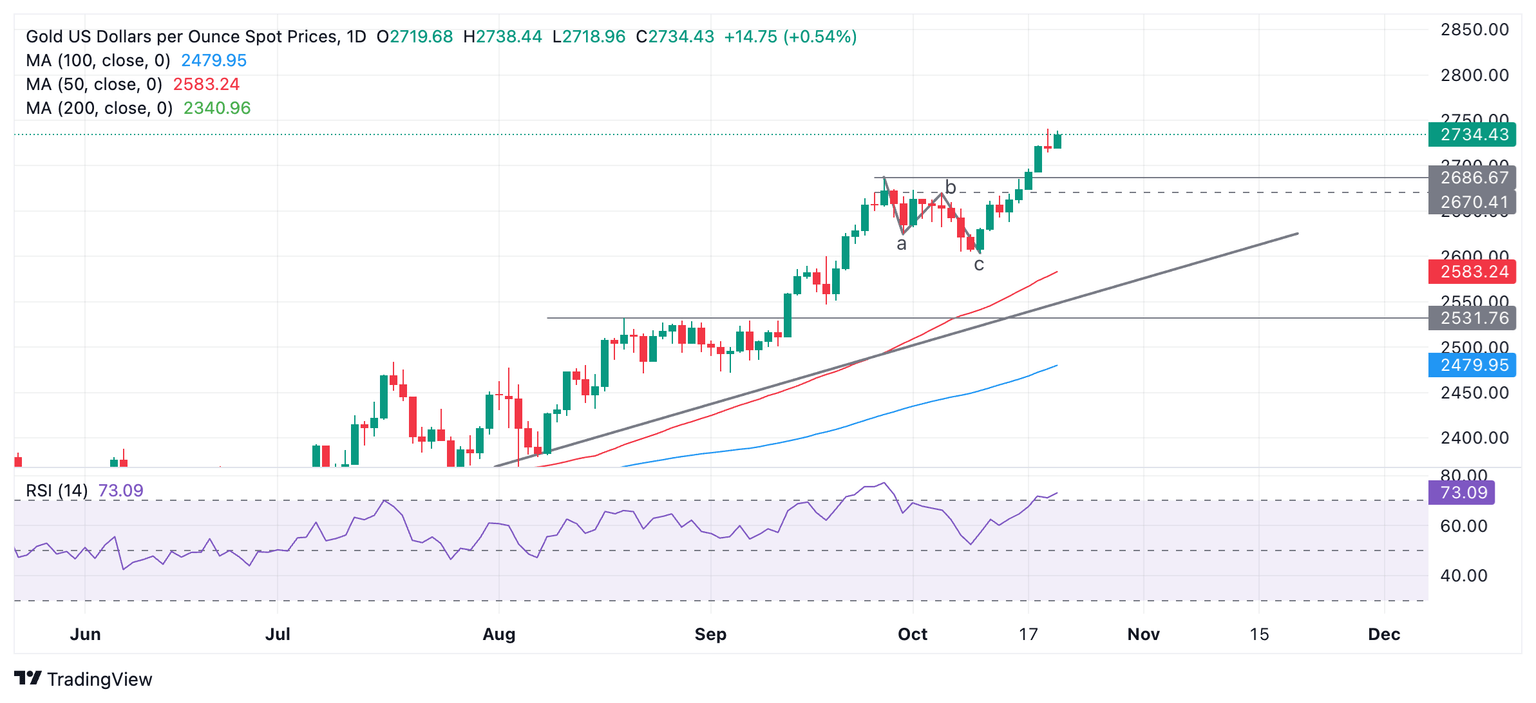

Gold continues rising in a steady uptrend on all time frames (short, medium and long) and, after breaching the $2,700 mark, it is now on its way to the next target at $2,750.

XAU/USD Daily Chart

The Relative Strength Index (RSI) is overbought, however, advising long-holders not to add to their positions because of an increased risk of a pullback. Should RSI close back in neutral territory, it will be a sign for long-holders to close their positions and open shorts as a deeper correction may evolve. Support lies at $2,700 (key level) and $2,685 (September high).

Gold’s overall strong uptrend, however, suggests that any corrections will likely be short-lived, and afterward, the broader bull trend will probably resume.

BRICS FAQs

The BRICS is the acronym denoting the grouping of Brazil, Russia, India, China and South Africa. The name was created by Goldman Sachs’ economist Jim O’Neill in 2001, years before the alliance between these countries was formally established, to refer to a group of developing economies that were predicted back then to lead the global economy by 2050. The bloc is seen as a counterweight to the G7, the group of developed economies formed by Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

The BRICS is a bloc which intends to give voice to the so-called “Global South”. The alliance tends to have similar views on geopolitical and diplomatic issues, but still lacks a clear economic integration as the governing systems and cultural divergence between its members is significant. Still, it holds yearly summits at the highest level, coordinates multilateral policies and has implemented initiatives such as the creation of a joint development bank. Egypt, Ethiopia, Iran and the United Arab Emirates joined the group in January 2024.

The five founding members of the BRICS alliance account for 32% of the global economy measured at purchasing power parity as of April 2023, according to data from the International Monetary Fund. This compares with the 30% of the G7 group.

There has been increasing speculation about the BRICS alliance creating a currency backed by some sort of commodity like Gold. The proposal is meant to reduce the use of the dominant US Dollar in cross-border economic exchanges. In the BRICS’ 2023 summit, the group stressed the importance of encouraging the use of local currencies in international trade and financial transactions between the members of the bloc as well as their trading partners. The group also tasked finance ministers and central bank governors “to consider the issue of local currencies, payment instruments and platforms” for this purpose. Even if the bloc’s de-dollarization strategy looks clear, the creation and implementation of a new currency seems to have a long way to go.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.