Gold and Silver prices retrace, analysts remain bullish

- Gold price peaked on Monday right above $2,000 before bulls took some profit.

- Silver is following the same trend, still far from its all-time highs.

- Precious metals have benefitted from the international banking crisis.

Precious metals are continuing the retracement initiated on Monday as the financial markets try to settle down from the huge stress seen over the last few days. Gold price (XAU/USD) has pulled back to trading below $1,970 at the time of writing, from a peak above $2,000 early on Monday, as the US Dollar has re-gained some footing. Silver price action (XAG/USD) has been a bit quieter, with a relative monthly high below $23 achieved on Monday and a 1% retracement since.

UBS agreement to buy Credit Suisse and coordinated central bank action to inject liquidity into the system are the actions that have somewhat relieved the extreme risk-off mood seen since the collapse of Silicon Valley Bank. US Treasury yields are re-gaining some lost ground, having collapsed from above 4% to below 3.5%, they are back above the latter level at the time of writing.

Gold price dip a buying opportunity ahead of FOMC?

Tensions are far from over, though, as the Federal Reserve interest rate decision on Wednesday is a crucial one to understand how the biggest central bank in the world understands the dilemma between combating relentless inflation and alleviating the stress the international banking system is suffering.

Last week, "Gold ETF holdings increased by more than 700koz to 92.52moz," according to the ING Global Economics Team, showing that market players are buying physical Gold to hedge against the current banking distrust.

Institutional market strategists believe that precious metals, particularly Gold, have more room to continue rallying, as any dovish hints in the FOMC statement and projections (also known as the dot plot) will provide a bullish impetus for the bright metal. ANZ Bank analysts write:

“Despite banking regulators rushing to shore up market confidence, the uncertain macro backdrop continues to entice buying.”

“All eyes now shift to the Fed’s two-day meeting. Any dovish commentary should help support the precious metals sector.”

Technically, bank analysts from Société Générale see the current Gold price retracement as just a minor pullback and project the uptrend to continue:

“Gold is expected to head gradually towards the upper part of its range since 2020 at $2,055/$2,075. This is a key resistance zone; overcoming it could mean the onset of a larger uptrend.”

Monica Kingsley, an Independent Analyst and FXStreet contributor, is firmly in the precious metals bull camp ahead of the Federal Reserve meeting. Kingsley deems Gold as the "star performer of 2023":

Precious metals do remain in vogue, and I‘m not looking for any kind of a powerful feedback. If we see 25bp tomorrow with some hawkish language on readiness, and not too much banking / deposits fights, gold followed by silver would keep thei own. Consider pullback below $1,950 a gift (may come before FOMC as almost usual) - this is the main star of 2023.

Gold price daily chart (Analysis by Monica Kingsley)

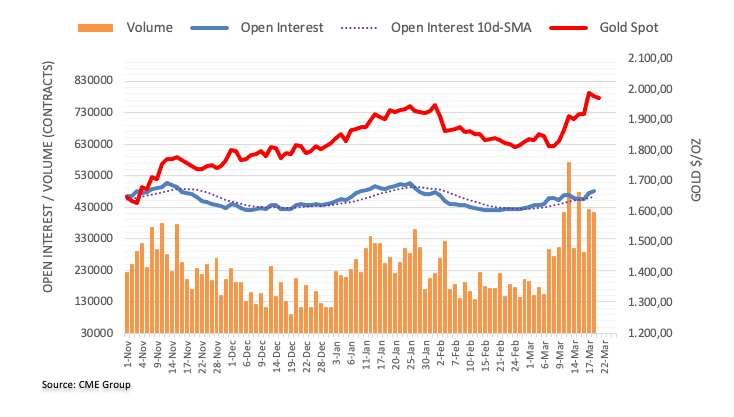

Gold trading volume on the rise

The huge rally (around 10% in the span of a week) seen in Gold price has been highlighted by surging open interest and volume in the futures markets. According to data from the CME Group, the volume of contracts negotiated rose from levels around 13K in the first week of March to an average above 40K in the past seven trading days.

Silver price technical outlook is also bullish

Silver price has not made the same headlines as its brightest counterpart in Gold, but the second-highest traded metal has also profited from the banking crisis. The technical scenario in XAG/USD remains with bullish potential intact despite the recent retracement. Haresh Menghani, Market Analyst at FXStreet, writes:

“The recent breakout through the $21.65-$21.70 confluence resistance was seen as a fresh trigger for bullish traders. Furthermore, a subsequent move and acceptance above the 50% Fibonacci retracement level of the recent sharp pullback from a multi-month peak further add credence to the constructive outlook. This, along with bullish oscillators on 4-hour and daily charts, suggests that the path of least resistance for the XAG/USD is to the upside.

Hence, any subsequent dip towards the overnight swing low, around the $22.20 area, which coincides with the 50$ Fibonacci level, could be seen as a buying opportunity.”

Author

FXStreet Team

FXStreet