Gold price closes in $2,000 round resistance, Silver price rallies past $23 as US Dollar rout continues

- Gold price bulls come back after Federal Reserve triggers dovish interest rate hike.

- Silver price makes seven-week highs as precious metals appreciate.

- US Treasury yields fall below 3.5%, sink US Dollar value.

Gold traders are again rejoicing after the Federal Reserve (Fed) confirmed expectations of a modest 25 basis points interest rate hike on Wednesday. The bright metal has re-gained the $1,980 mark, back on the uptrend after having retraced from year-to-date highs on Monday and Tuesday. Precious metals have all benefited from the super-important central banking decision, as Silver triggered a seven-week high, rallying past the $23 mark to continue with its uptrend.

Gold safe-haven narrative strengthened by US Treasury yield fall

The fall of the US Treasury bond yields, with the benchmark 10-year bond netting below 3.5% after the Fed decision, is behind this move, as the US Dollar, the measure of all commodity markets, including Gold and Silver, is highly correlated to it.

Kenny Polcari, a long-time equity trader and renowned Wall Street influencer, is quite clear on this safe-haven narrative being back in vogue for Gold on his daily blog post:

Gold – as I told you – rallied off the $1950 level yesterday on the back of the sell off – and ended the day up $33 at $1998/oz. I am not surprised and neither should you be….Gold is the ultimate safety trade – and yesterday’s action suggests investors want safety….so think US treasuries and GOLD. The more the markets remain unclear about the future, the better it is for gold….Capisce?

Gold price technicals suggest more gains to come for the bulls

Gold price still has some way to go before testing the levels above $2,000 seen on early Monday peak, a trend that is likely to continue according to market analysts.

Pablo Piovano, News Editor at FXStreet, deems another visit to the psychological round mark “on the cards”. Piovano analyzes open interest data from the CME Group in the Gold futures market to support that bullish thesis:

“The uptick in the precious metal was on the back of a small build in open interest, which remains supportive of the continuation of the upside momentum in the very near term.”

Anil Panchal, Technical Analyst at FXStreet, looks deep at the technicals of the XAU/USD price action, seeing room for a consistent rise as Gold price remains out of overbought territory despite the uptrend seen in recent weeks:

“Gold price extends bounce off the 50-bar Simple Moving Average (SMA), backed by the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator and upbeat Relative Strength Index (RSI) line, not overbought.”

Gold price technical analysis by Anil Panchal, News Editor at FXStreet

According to Panchal, the “two-month-old upward-sloping resistance line, near $2,015, acts as the last defense of the Gold bears”.

Slobodan Drvenica, Information and Analysis Manager at Windsor Brokers, also favors the bulls in his Gold price analysis, but gives more respect to the resistance levels ahead for the bright metal. Drvenica foresees a tough battle for buyers to break above the round $2,000 resistance again:

Overall bullish daily techs support the action, but evident weakening of bullish momentum warns possible headwinds at key $2000 resistance zone (psychological / 2023 high at $2009), which may keep the price in extended range. (...) Bullish scenario requires firm break of $2000/$2009 barriers to open way for retest of record highs at $2070/$2074 (Mar 2022 / Aug 2020 peaks, respectively).

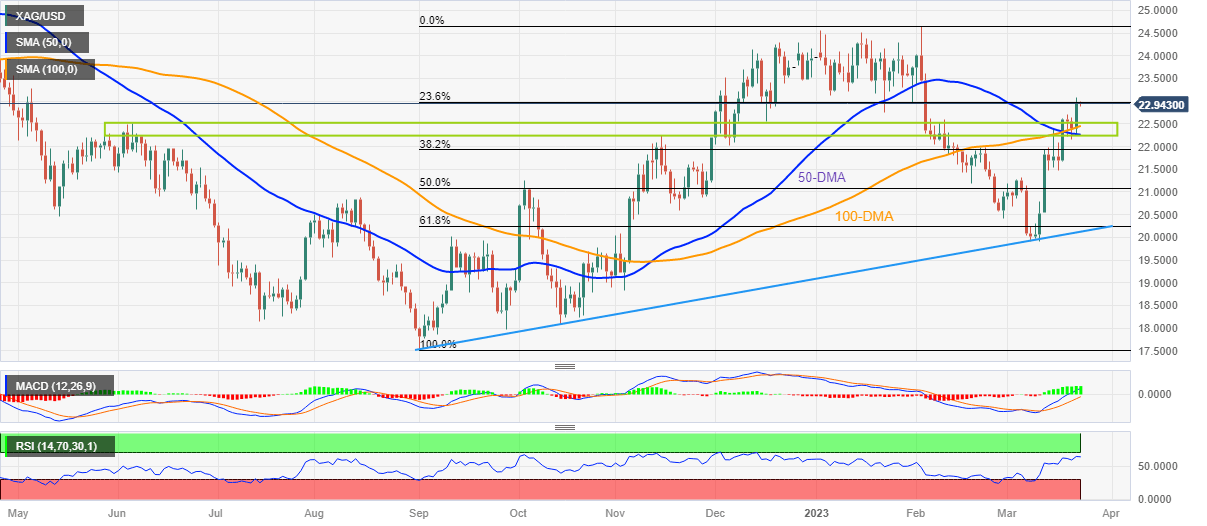

Silver price rises above $23, faces tough resistance levels ahead

The price of Silver has made even more strides than its shinier counterpart, as XAG/USD triggered a seven-week high on the back of the Federal Reserve meeting, breaching the $23 mark during Thursday's European trading session. Silver price had not rallied as abruptly last week, but it is now making more gains than Gold.

The upside of the precious metal number two is a bit more capped than Gold’s, though, as the year-to-date highs set in January are still away and remain a thick resistance cluster. According to Anil Panchal, it will not be easy for the Silver metal to make new year-to-date highs:

“Multiple hurdles marked during early 2023 guard the XAG/USD’s immediate upside near $23.30, $24.00 round figure and the $24.30 levels before challenging the Year-To-Date (YTD) high surrounding $24.65.

“Meanwhile, the aforementioned horizontal resistance-turned-support appears a tough nut to crack for the Silver bears as it comprises multiple levels marked since June 2022, as well as the 50-DMA and 100-DMA, while challenging the bears near $22.25-55.”

Silver price technical analysis by Anil Panchal, News Editor at FXStreet

Author

FXStreet Team

FXStreet