- Lead investor Ryan Cohen has pitched his idea to evolve the struggling company into an Amazon competitor.

- NYSE:GME shot up nearly 30% on the news despite the broader markets falling.

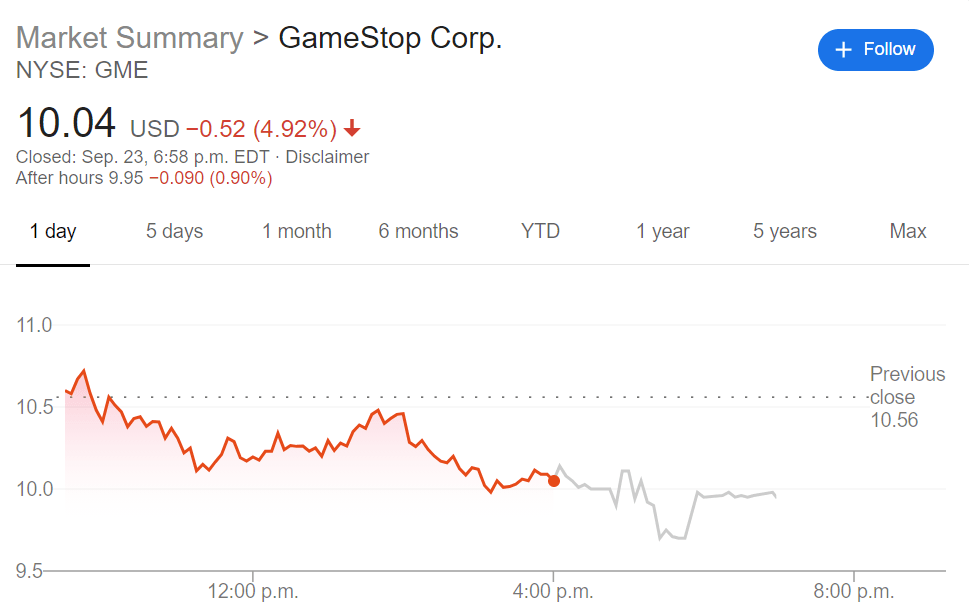

NYSE:GME has stirred for the first time in a while as there have been plans put forth by a lead investor for the beleaguered video game seller to evolve its scope. Shares catapulted up nearly 30%, reaching a new 52-week high of $11.17, which is the highest level the stock has seen in nearly 18 months. The stock pulled back by 4.92% on Wednesday, something understandable after a surge as large as the one exhibited earlier in the week.

The catalyst was a new vision for GameStop by top investor Ryan Cohen who heads RC Ventures LLC, an investment firm that now owns a 10% stake in the company. Cohen previously was founder and CEO of Chewy (NYSE:CHWY), the leading e-commerce site for pet food and supplies. With the massive success of Chewy, investors are optimistic that Cohen can transform GameStop back into a legitimate e-commerce business that could one day eat into the market share of Amazon (NASDAQ:AMZN). Presumably, GameStop would branch out from the video game and toy market to include other products that would make it more of a one-stop consumer shop.

GME stock dividend

If GameStop executives adopt Cohen’s lofty plans, they could have their work cutout for them. Amazon currently has a $1.5 trillion market cap and an unparalleled global supply chain and customer base so at this point, it should be considered impossible to dethrone this company as the king of e-commerce. With the introduction of completely digital game consoles with the upcoming release of the new Microsoft Xbox and Playstation 5, GameStop is in danger of being forced out of relevance in the same way that Blockbuster Video met its fate thanks to Netflix (NASDAQ:NFLX).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD looks bid ahead of RBA Minutes

Finally, AUD/USD managed to regain a small smile on Monday and retested the 0.6250 zone after six consecutive days of losses, all against the backdrop of a sharp pullback in the US Dollar and ahead of the release of the RBA Minutes.

USD/JPY weakens further after Trump threatened Japan over currency depreciation

USD/JPY drifts lower for the second straight day and moves closer to a multi-month low touched last week in reaction to Trump's threat to Japan regarding the weak JPY. Moreover, firming expectations that the BoJ will hike interest rates further and the risk-off impulse act as a tailwind for the safe-haven JPY.

Gold price consolidates below $2,900 mark amid tariff concerns

Gold price preserves the previous day's recovery gains from a three-week low amid concerns over Trump's tariff policies and global trade war fears. Moreover, geopolitical risks might continue to fuel safe-haven demand for the bullion.

Bitcoin drops under $90,000, are institutions truly long BTC?

Bitcoin (BTC) climbed to a high of $94,416 early on Monday before erasing newfound gains and dropping under $90,000 support.

Seven fundamentals for the week: Angst rises ahead of tariff deadline and full buildup to Nonfarm Payrolls Premium

A reality show in the White House – the world is still digesting the dressing down of Ukraine's President Volodymyr Zelenskyy in the White House, but markets have to focus on other actions of US President Donald Trump: tariffs. The dramas come in a week of top-tier data. It is time to fasten your seatbelts.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.