GME Stock News: Gamestop set to resume fall on Netflix chilling effect

- NYSE:GME dipped by 0.48% on Thursday, as the broader markets continued to show volatility.

- Netflix announces its entry into the videogame market.

- AMC outpaces the market as the meme stock bucks its recent trend.

Update July 19: Has Friday's recovery only been a correction? GameStop Corp (NYSE: GME) has ended the trading week with an upswing of 1.33% at $169.04. However, Monday's premarket data is pointing to a fresh decline, albeit a smaller one. Shares of the videogaming company – aka the "poster child of meme stocks" – has been under immense pressure from heavyweight Netflix. The streaming content giant is venturing into video games to expand its offering in the face of an "attention recession." The fading out of the pandemic has had a limited effect on gaming, GME's territory.

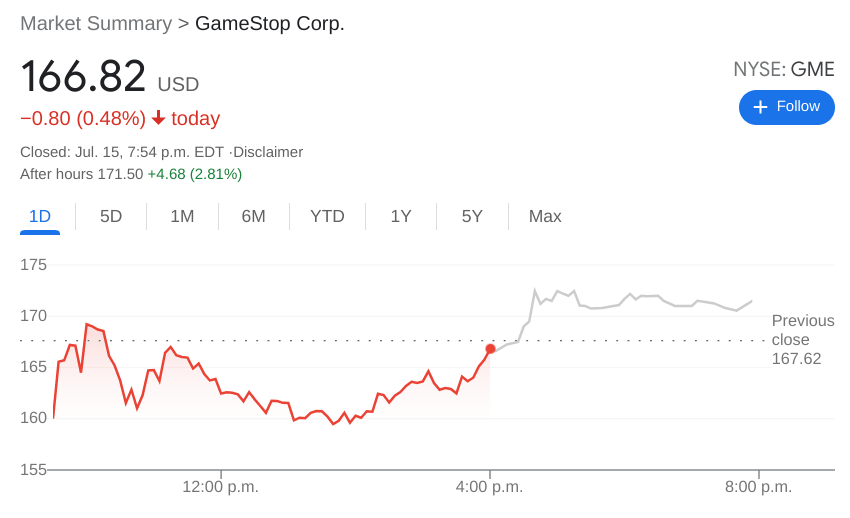

NYSE:GME extended its decline on Thursday as the stock has now fallen during every session this week. Shares of GameStop dropped 0.48% and closed the trading day at $166.82, after recovering some of its morning losses at the closing bell. GameStop has rebounded slightly in after hours trading with the stock up nearly 3% at the time of this writing. It has been a downward spiral for GameStop following the second short squeeze event in June, having now lost 27% over the past month.

Stay up to speed with hot stocks' news!

GameStop investors received some unwelcome news on Wednesday, as streaming giant Netflix (NASDAQ:NFLX) officially announced the hiring of a gaming industry veteran to head its upcoming venture into the videogame world. Mike Verdu will be the new vice president of gaming development for Netflix after previously holding related positions with Facebook (NASDAQ:FB) and Electronic Arts (NASDAQ:EA). Netflix plans on adding games to its platform within the next year and it is anticipated that it will be utilizing its vast library of intellectual property to create games based on shows like Stranger Things. Netflix shares surged on Wednesday but were trading lower on Thursday falling by 0.91% during the session.

GME stock forecast

Elsewhere in the meme stock world, AMC (NYSE:AMC) reversed its recent bearish decline and added 7.72% during the day and nearly 6% more in after hours trading. There was not any specific news from the company, so it could just be that the stock finally found some support after falling over 50% from its recent all-time highs.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet