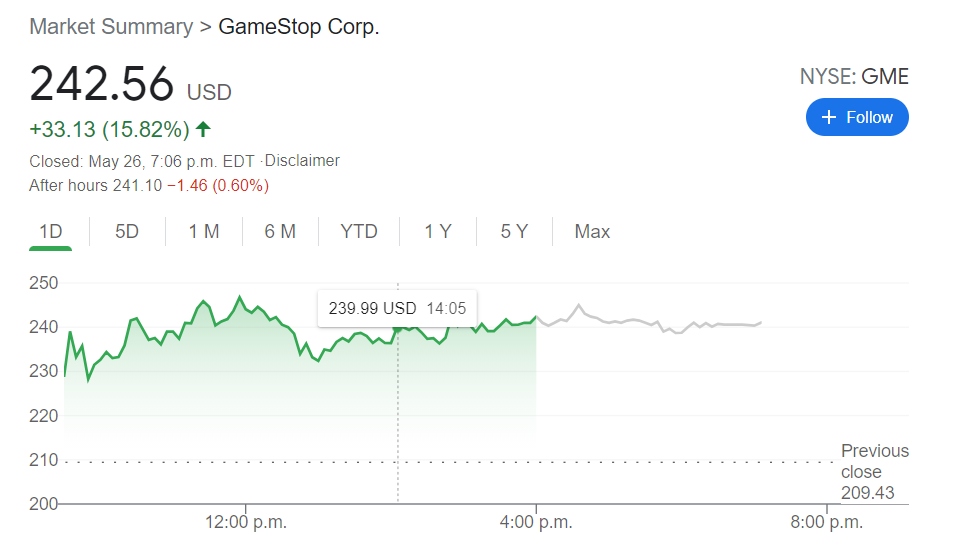

- NYSE:GME surges by 15.82% as the latest meme stock gamma squeeze continues.

- More details emerge about the new GameStop NFT site that surfaced on Tuesday.

- Fellow meme stocks rally alongside GameStop as short seller losses continue to pile up.

NYSE:GME has officially gone bananas, literally, as the Reddit Apes continue to pile into the stock in the latest coordinated short squeeze of hedge fund managers. On Wednesday, shares of GameStop skyrocketed gaining 15.82% to close the trading session at a staggering $242.56. Any sort of fundamental analysis has been thrown out the window with GameStop, and it is surprising that institutional investors continued to openly short the stock despite the ongoing attention it has received. The stock has gained an incredible 45% over the past five trading days.

Stay up to speed with hot stocks' news!

In an announcement that flew somewhat under the radar, GameStop announced that it was hiring for its new NFT or Non Fungible Token site. Not much is known about the site yet, except that it will operate on the Ethereum blockchain, and that GameStop is finally making its long awaited entry into the cryptocurrency sector. NFTs have been an incredibly popular way to digitally certify things like artwork, and so this could be an interesting revenue stream for GameStop as Ryan Cohen attempts to rebuild the franchise from the ground up.

GME stock forecast

Wednesday also saw other stocks like AMC (NYSE:AMC) and BlackBerry (NYSE:BB) surge as sympathy plays to GameStop. The rally also came alongside a rebound in the cryptocurrency markets, as Reddit investors continue to move back and forth between cryptos and meme stocks. It is estimated that the latest short squeeze cost hedge funds over $754 million on Tuesday alone, and there could be a lot more pain incoming as Redditors are refusing to let off the gas.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD tumbles to three-week lows near 1.0750

Fresh headlines mentioning the imminence of US tariffs on the European Union put EUR/USD under heavy pressure and send it to the area of multi-week lows around 1.0750 on Wednesday.

GBP/USD retests the 1.2870 zone, or two-week lows

The Greenback's upside impulse is now gathering extra steam and motivates GBP/USD to recede to the area of new two-week troughs around 1.2870.

Gold remains slightly offered just above $3,000

Gold is trading in a narrow range on Wednesday but continues to hold firm just above the $3,000 mark. The precious metal is drawing support from upbeat sentiment in the broader commodities space, buoyed by Copper’s surge to a fresh all-time high earlier in the day.

Bitcoin holds $87,000 as markets brace for volatility ahead of April 2 tariff announcements

Bitcoin (BTC) holds above $87,000 on Wednesday after its mild recovery so far this week. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as the market absorbs the tariff announcements.

Sticky UK services inflation shows signs of tax hike impact

There are tentative signs that the forthcoming rise in employer National Insurance is having an impact on service sector inflation, which came in a tad higher than expected in February. It should still fall back in the second quarter, though, keeping the Bank of England on track for three further rate cuts this year.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.