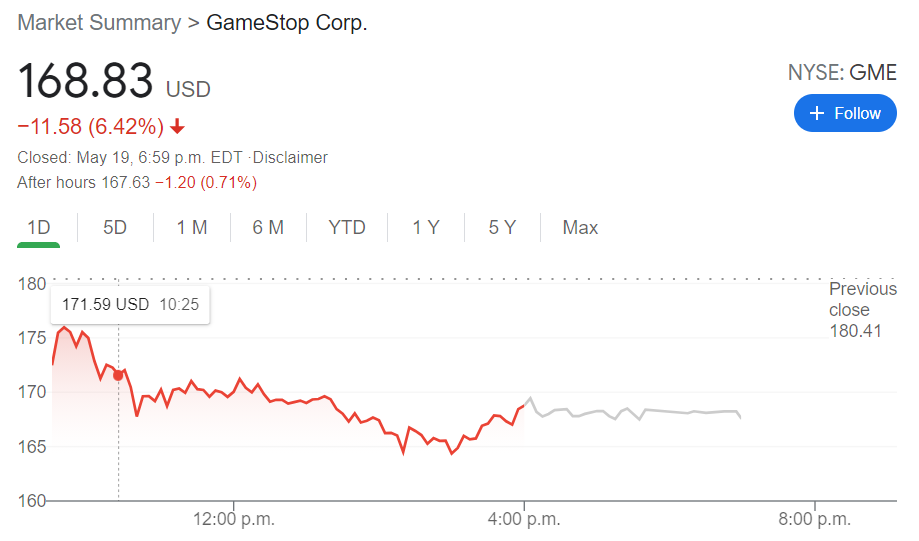

- NYSE:GME fell by 6.55% on Wednesday amidst a broader market sell off.

- GameStop and AMC fall short of the latest short squeeze attempt by retail investors.

- The recent crypto market crash has forced retail investors to show their paper hands.

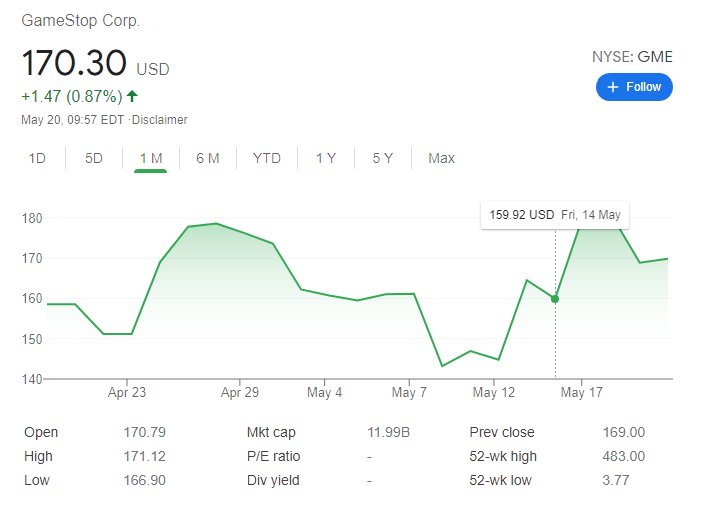

Update May 20: GameStop Corp (NYSE: GME) has kicked off Thursday's trading session with a moderate recovery, yet of psychological importance – a recapture of the round $170 level. As the chart shows, shares of the videogaming firm are holding above the $164.50 support line. To further increase momentum, the price would need to surpass the highest close this week, which stands at $180.67. The reasons for the latest moves are detailed below.

NYSE:GME investors may not quite have the diamond hands they all claim to be using as the meme stock saw its recent rally come to an end. On Wednesday, shares tumbled by 6.55% to close the trading session at $168.83. Shares fell after climbing steadily for the past couple of weeks, and GameStop will need to find support soon or risk falling back below its 50-day moving average price of $165.64.

Stay up to speed with hot stocks' news!

The impending short squeeze that has been brewing across social media for GameStop and AMC (NYSE:AMC) fizzled out on Wednesday after several days of escalating momentum. The latest attempt has been centered around AMC, but GameStop and other meme stocks have been surging as sympathy plays. Will there be another coordinated short squeeze on Wall Street? A report was released that revealed hedge funds with short positions in AMC and GameStop had already lost over $1 billion, and with the trading volume that AMC has been experiencing, these funds could be in for some more pain in the coming days.

GME stock forecast

There is another theory as to why the short squeeze was stalled on Wednesday, and it has to do with the current cryptocurrency market crash. The prices of popular coins like Bitcoin, Ethereum, and Dogecoin have all plummeted over the past few days, and a large percentage of retail investors have been forced to liquidate their positions that have mostly been made on margin. It seems that at the end of the day, even the hardest of diamond hands turn to paper hands when the margin calls arrive.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD gains traction toward 1.0850 after Eurozone data

EUR/USD picks up fresh bids and trades in positive territory near 1.0850 on Monday. The pair draws support from upbeat Eurozone Sentix Investor Confidence data for March, which improved to -2.9 from February's -12.7, lifting the sentiment around the Euro.

GBP/USD rises above 1.2900, struggles to gather bullish momentum

GBP/USD holds steady above 1.2900 after falling toward 1.2870 earlier in the day. The risk-averse market atmosphere amid the uncertainty surrounding US President Donald Trump's trade policies, however, caps the pair's upside.

Gold retreats to $2,900 area in choppy session

Gold struggles to hold its ground and trades in the red near $2,900 on Monday. In the absence of high-impact data releases, investors refrain from taking large positions and wait for fresh developments surrounding the Trump administration's tariff policy.

Five Fundamentals for the Week: Trade war, inflation and consumer confidence to shake markets Premium

Trade-war developments continue dominating headlines, with several levies set to come into force. US inflation figures are set to rock markets despite not fully reflecting tariffs. Consumer sentiment is of high interest after the plunge seen last time.

February CPI preview: The tariff winds start to blow

Consumer price inflation came out of the gate strong in 2025, but price growth looks to have cooled somewhat in February. We estimate headline CPI rose 0.25% and the core index advanced 0.27%. The moderation in the core index is likely to reflect some giveback in a handful of categories that soared in January.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.